Discuss your challenges with our solutions experts

1 minute read

Ian Thom

Research Director, Upstream

Ian Thom

Research Director, Upstream

Ian brings 18 years of experience to his role as head of regional analysis for Europe, Russian, Caspian and Africa

Latest articles by Ian

-

Opinion

Video | Lens Emissions: Africa’s oil – legacy fields vs low-carbon future

-

Opinion

Namibia faces setback as Shell downgrades oil discoveries

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Global upstream: the biggest topics

-

Opinion

Africa’s Energy Hotspots – three trends that will shape the next decade of African energy

Deepwater has emerged from the downturn much stronger and is ready for the next phase of investment.

Ian Thom

Research Director, Upstream

Ian brings 18 years of experience to his role as head of regional analysis for Europe, Russian, Caspian and Africa

Latest articles by Ian

-

Opinion

Video | Lens Emissions: Africa’s oil – legacy fields vs low-carbon future

-

Opinion

Namibia faces setback as Shell downgrades oil discoveries

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

ADNOC acquires stake in Rovuma LNG from Galp

-

Opinion

Global upstream: the biggest topics

-

Opinion

Africa’s Energy Hotspots – three trends that will shape the next decade of African energy

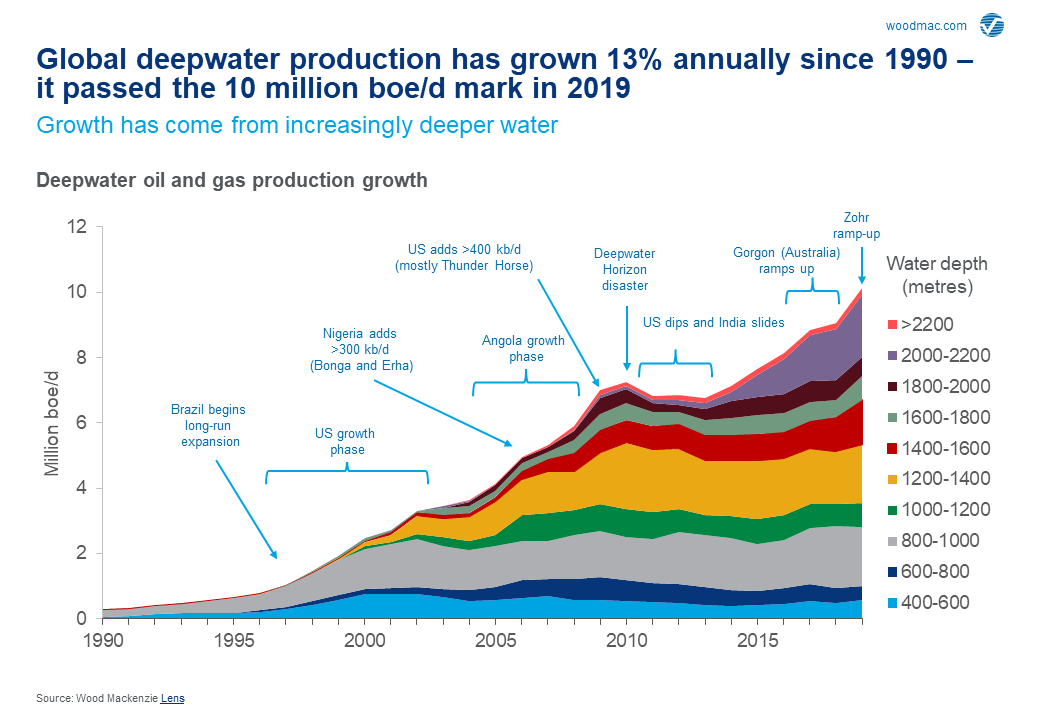

The global deepwater industry reached a milestone in 2019 – this was the first year it surpassed the 10 million boe/d mark. Source: Wood Mackenzie Lens®

The global deepwater industry is set to continue to grow: output is expected to reach 14.5 million boe/d by 2025, with strong growth in both oil and gas.

A challenging few years during the downturn forced deepwater to reinvent itself by cutting costs, cycle times and breakevens. It has emerged much stronger and is ready for the next phase of investment – much of which will be in deeper waters and in new plays and new countries. Brazil will continue to lead on investment and production in its prolific Santos Basin, but major discoveries over the past decade have been transformational for Mozambique, Israel, Egypt and Guyana. And while the type and quality of projects have changed, deepwater is here to stay.

So, what do we expect for the next decade in deepwater? I sat down with the upstream team to catch up on the key trends to watch.

For an in-depth discussion of global deepwater exploration, development and production trends, purchase the full 37-page report in store: Global deepwater: the state of the industry

Deepwater investments boast high returns. Could this change?

Deepwater is one of the great growth themes of the oil and gas industry. It’s often associated with large, expensive and complex long-cycle projects, but can be highly rewarding for those willing to take on the risks.

Typically, deepwater investment returns average 23%. But there is a wide variation: for one in five assets, the number is below 15%.

The best returns come from smaller oil projects with quick tie-backs to host facilities, whereas gas has systematically lower returns in comparison to oil.

Over the past 10 years, gas has made up 58% of volumes discovered, and it is set to become more prominent. Less than half of that is currently commercial: many major gas discoveries remain undeveloped due to market constraints and high costs.

Despite its successes, mistakes in the deepwater are costly. A run of dry holes or a project delay can destroy economics – with operators unable to ramp up or down activity as easily as for onshore resources.

How does deepwater compare to tight oil? Learn more:

Is ultra-deepwater here to stay?

Over the past 30 years, water depth has been steadily increasing.

A typical deepwater project in 2000 would have been in the 600 to 800-metre depth range. Now, growth from ultra-deepwater projects – those at water depths of more than 1,500 metres – is outpacing shelf projects.

By 2023, ultra-deepwater should account for more than half of overall deepwater production – with much of this growth coming from quality oil assets in Brazil, Guyana and the US.

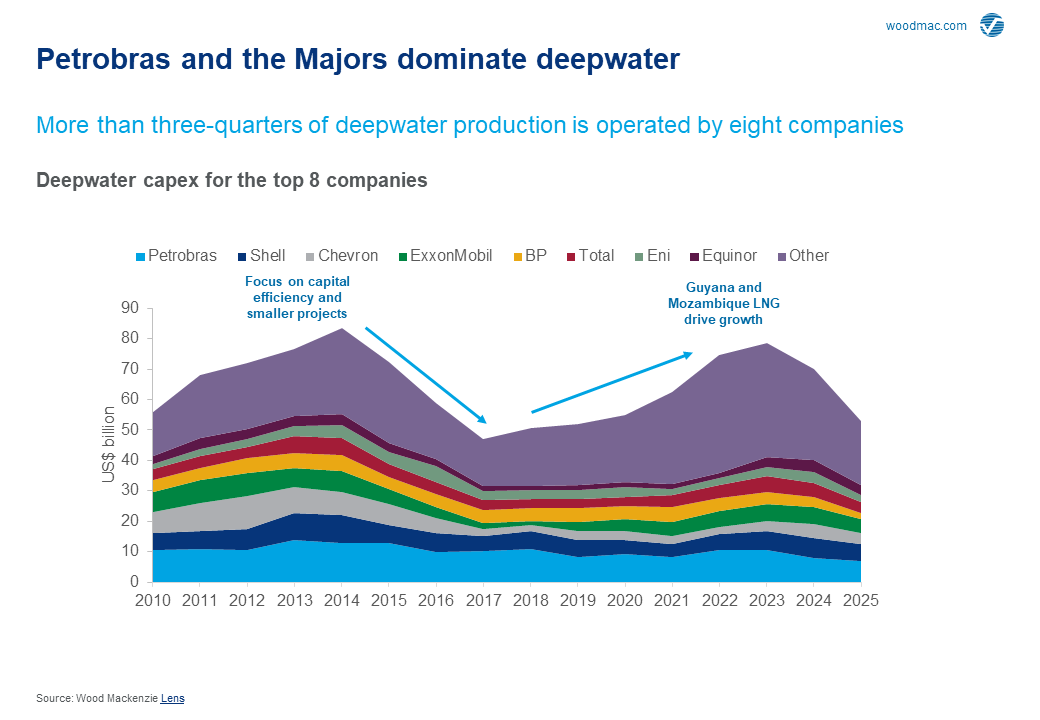

Deep pockets required

As fields get deeper and increasingly technically challenging, deepwater will remain an industry for those with deep pockets.

Companies in this space need the scale and capability to take on huge projects, matched by an appetite for the necessary risk. More than three-quarters of deepwater production is operated by eight companies: the Majors and Petrobras. Collectively, they operate 23 of the top 25 deepwater assets.

Where are the deepwater hotspots?

Brazil and the US dominate; Nigeria, Angola and Australia also feature. Cumulatively, Guyana, Mozambique and Brazil will add 3.7 million boe/d of growth between 2018 and 2025.

The upstream team picks some highlights:

Brazil and Guyana stand out, with huge ongoing investment in oil developments. The Santos basin in Brazil and the Stabroek block in Guyana will add over 2.5 million b/d of oil production by 2025.

Luiz Hayum, upstream analyst, Latin America

The US deepwater Gulf of Mexico created a distinct buzz in the first half of 2019, with a strong uptick in leasing, exploration, project sanctions and M&A activity. And deeper, more complex reservoirs are expected to drive investment and production growth in the next decade.

Mfon Usoro, upstream analyst, Gulf of Mexico

West Africa is struggling with more marginal fields, tough fiscal terms and few remaining quality opportunities. Production could decline by more than 400 kboe/d by 2025.

Adam Pollard, upstream analyst, West Africa