Get Ed Crooks' Energy Pulse in your inbox every week

1 minute read

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Tech companies accelerate nuclear deployment

-

Opinion

Why is it so hard to find a charger for your electric vehicle?

-

Opinion

What carbon capture needs to meet climate goals

-

Opinion

Threats to oil supplies show the limits of US production growth

-

Opinion

Climate Week NYC special:The key takeaways from NY Climate Week, with Climate Group CEO Helen Clarkson

-

Opinion

How AI is reviving the nuclear industry

The 2020 presidential election will be momentous for US energy.

Ed Crooks

Senior Vice President, Thought Leadership Executive, Americas

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

Tech companies accelerate nuclear deployment

-

Opinion

Why is it so hard to find a charger for your electric vehicle?

-

Opinion

What carbon capture needs to meet climate goals

-

Opinion

Threats to oil supplies show the limits of US production growth

-

Opinion

Climate Week NYC special:The key takeaways from NY Climate Week, with Climate Group CEO Helen Clarkson

-

Opinion

How AI is reviving the nuclear industry

So this is Christmas, as John Lennon sang: another year over, and a new one just begun. It is the time of year for taking stock and looking to the future, and in that spirit, I have collected a selection of predictions for 2020 from 10 WoodMac experts.

A slowdown in US Lower 48 oil production growth will help OPEC

We are forecasting persistent global oversupply to continue in 2020, with non-OPEC production to increase 2.3 million barrels per day (b/d) year-on-year. For the first time in four years, though, the US will contribute less than half of that non-OPEC gain, as new producers such as Guyana ramp up and US shale growth slows.

Wood Mackenzie forecasts total US liquids production to rise by 1 million b/d in 2020, less than half the increase in 2018, when output rose by an astounding 2.4 million b/d. As the industry moves beyond the sweetest spots for drilling, and investors choke back the flow of capital to E&Ps, US Lower 48 onshore crude and condensate production is expected to gain just 0.5 million b/d in 2020. Having put pressure on other oil-producing countries for years, US investors will indirectly help them in 2020, supporting the OPEC+ group’s attempt to tackle global oversupply by restraining its output. With OPEC+ production restraint and stable demand growth, additional downward pressure on crude prices can be avoided in 2020.

Ann-Louise Hittle, Head of Macro Oils

Investors will reward US E&Ps who sharpen their focus on dividends and debt reduction

The immense pressure tight oil players are under to generate free cash will not go away in 2020, and could well persist into 2021 and 2022. Dropping rigs is one of the fastest ways to generate cash, but since the commodity downturn of 2009, very few shale E&Ps have pursued a successful “shrink to grow” strategy. Now may be the time to revisit that. Some Marcellus producers have tested the waters before releasing firm 2020 budgets, and their messages have been well received. If tight oil E&Ps are brave enough to tell investors they’ll forfeit any production growth to concentrate on delivering cash flow and raising dividends instead, we believe this market is likely to reward them.

Robert Clarke, Research Director Lower 48 Upstream

Company share prices will begin to reflect differences in perceived climate risk

Pressure on companies to disclose climate-related risks, including emissions metrics and the potential impacts to their businesses under a 2°C scenario, will increase. In 2020 they will release the first round of annual results since the EU’s guidelines on reporting climate-related information were published in July 2019, and the EU Regulation on Disclosures relating to sustainable investments and sustainability risks came into force. That EU regulation makes it mandatory for financial market participants to disclose how they incorporate sustainability risks into their investment decisions and products, and how they measure alignment with sustainability targets. To provide those disclosures, financial market participants will require greater disclosure around sustainability risks, including climate risk, from companies in their portfolios. In the US, companies will also face increased scrutiny as the issue rises up the political agenda, as a result of the presidential election and debates over the proposed Climate Risk Disclosure Act, introduced in the Senate by Elizabeth Warren.

Amy Bowe, Director of Upstream Consulting

Sustainability will permeate all business segments

Building resilience in the face of energy transition across all business segments will be one of 2020’s key themes. Shifting portfolios to the lower end of the cost curve, capital discipline and shareholder returns will remain high on the list of strategic priorities. Value will be favoured over volume. Digitalisation and technology will dominate the resource renewal discussion, making explorers even more uncomfortable. Eyes will be on Repsol, as it reveals what it means to align its exploration portfolio with the Paris climate goals. The EU’s Green Deal will prompt a few strategic reviews across the sector, with BP the one to watch.

Valentina Kretzschmar, Director of Corporate Research

International oil companies will keep selling assets

The process of re-engineering upstream portfolios for resilience will continue in 2020. Portfolio rationalisation will be a key tool, fuelled by a supermajor sell-off. But don’t expect a big rebound in upstream M&A from 2019’s lows. The supply of assets will outstrip demand. Sellers will need to accept discounted prices to shift low-margin, carbon-intensive assets from their portfolios.

Tom Ellacott, Senior Vice-President, Corporate Research

Solar power will continue to prosper in major markets in spite of subsidy cuts, while new markets will emerge

2020 will mark the beginning of reduced investment tax credits in the US, while China, the world’s largest solar market, moves toward a subsidy-free solar market structure. It will be the first time in a long time that the number one and two solar markets will have embarked on major policy shifts. Even so, we expect 126 gigawatts (GW) of capacity to be installed in 2020, beating the current record of 105 GW achieved in 2019. India, the third-largest market, will continue to see more low-priced utility-scale projects come online, even as the longer-term view remains tepid due to excessively competitive solar tenders. The long tail of solar markets will also grow at a faster clip, with 22 country markets having at least 500 megawatts of annual installations, up from 17 in 2019 and 16 the year before. For the longer term, there could be several bright spots, including the new solar homes mandate in California that goes into effect on January 1, and the initiation of China’s 14th Five-Year Plan.

Ravi Manghani, Head of Solar

All eyes will be on China as uncertainties mount

It’s difficult to recall heading into a new year with quite so much uncertainty over China’s economy. With stimulus options much more restricted than in the past, the country’s economic planners have just called for a “contingency plan” to deal with slowing growth. Last week’s phase one trade agreement with the US may have garnered headlines, but delivered very little of substance. All of this matters. China is the biggest market for seaborne commodities, and economic uncertainty coupled with Beijing’s double down on raising domestic coal, oil and gas output in 2020 will have major implications for commodity price volatility over the coming 12 months.

Gavin Thompson, Vice-Chair Asia-Pacific

Commodity prices will converge in Asia

Energy transition drives inter-fuel substitution. Japan’s gas-fired capacity is under-utilised because gas prices have traditionally been higher than coal, so coal-to-gas switching didn’t generally make sense. But things are changing. Japanese utilities are looking to curb emissions and keen to increase gas plant utilisation to help them integrate renewable power supplies and reduce local air pollution. Meanwhile, liquefied natural gas (LNG) suppliers are looking to secure demand with innovative pricing models in an oversupplied market. In April 2019, Tokyo Gas announced a 10-year agreement with Shell Eastern Trading for supply of 0.5 million tonnes per annum of LNG from 2020. The contract price is said to include coal indexation. We understand this is the first such LNG contract for supply to Japan. The new pricing mechanism improves LNG competitiveness in the power sector, and the trend is set to pick up in Asia next year.

Prakash Sharma, Head of Markets & Transitions, Asia-Pacific

Companies and investors will wake up to the fact that energy transition starts and ends with metals

Much is being made of the energy transition and how companies and countries are adapting their strategies to be at the forefront of the shift to a lower-carbon world. The missing piece of the jigsaw is the fact that energy transition cannot and will not happen without the appropriate and timely development of the supply of metals. In 2020, the penny will drop that it isn’t just about lithium and cobalt needed to feed the electric vehicle revolution, but it’s more about the aluminium, copper, lead, zinc and nickel that will be needed to generate, transmit and store low- or zero-carbon power. 2020 is set to be the “back to the future” year, with energy companies looking at opportunities to invest in the raw material supply chain to ensure security of supply. Without appropriate support from either government agencies or deep-pocketed energy companies, metals may become the disabler of the energy transition as a lack of investment will limit the ability of the world to decarbonise. As the philosopher George Santayana said: “Those who cannot remember the past are condemned to repeat it.”

Julian Kettle, Vice-Chairman, Metals & Mining

Global carbon emissions are likely to rise again

Global greenhouse gas emissions continue to rise. To stay on track for limiting the rise in global temperatures to 2°C, emissions need to shift into a lower gear – contracting in some markets, fuels, and sectors – within the next 12 months. The problem is well understood, but responses are not: just look at the range of opinion post-COP 25 in Madrid. The shift to zero-carbon technologies – in terms of corporate strategy, capital investment, and human capital deployment – has progressed at a fast clip in 2019.This pace of change will not slow down in the year ahead. But global carbon emissions are still thought to have risen this year. How quickly society can respond to the global climate challenge will be reflected in 2020 emission data; the bellwether for progress.

David Brown, Head of Markets & Transitions, Americas

And finally, one from me:

The 2020 presidential election will be momentous for US energy

President Donald Trump’s election victory in 2016 has arguably not had a particularly large impact on the US energy industry.

Trends in oil and gas production that developed while Barack Obama was in office have continued, and the Trump administration has made little progress on his signature pledge to “put the miners back to work” in the coal industry.

The 2020 election may be different. A second Trump term will mean continuity, with further deregulation for the oil, gas and coal industries, and possibly another attempt to prop up economically challenged coal-fired power plants.

A Democratic president is likely to attempt to be more interventionist than Obama in pursuit of climate goals. Elizabeth Warren and Bernie Sanders have said they would “ban fracking”. Sanders has repeatedly said that “fossil fuel executives should be criminally prosecuted for the destruction they have knowingly caused”. Michael Bloomberg, a late entrant into the race to be the Democratic candidate, has set out a climate policy that includes a plan to close every coal-fired power plant in the US by 2030. Joe Biden, currently leading in the polls for the nomination, wants $500 billion a year invested in clean energy and environmental improvements, one-third of that from federal spending.

The reality is likely to fall short of the rhetoric, especially if a Democratic president faces a Republican-controlled Senate, but the campaign pledges point clearly to the direction of travel. A change of administration in 2021 would usher in one of the most significant shifts in energy strategy in US history.

Ed Crooks, Vice-Chair, Americas

How to get Energy Pulse

Energy Pulse is Ed Crooks' weekly column, published by Wood Mackenzie every Friday. Here's how to get Energy Pulse:

- Follow us on social media @WoodMackenzie on Twitter or Wood Mackenzie on LinkedIn

- Fill in the form at the top of this page and we'll send you an email when the latest issue goes live

- Bookmark this page to have access to the full archive of Energy Pulse

Quote of the year

“I am disappointed with the results of #COP25. The international community lost an important opportunity to show increased ambition on mitigation, adaptation and finance to tackle the climate crisis. But we must not give up, and I will not give up.” — António Guterres, secretary-general of the UN, reflected on the failure of the COP25 climate talks in Madrid, which ended on Sunday. The lack of progress at the meeting puts even more pressure on COP26, which will be held next November in Glasgow.

Chart of the year

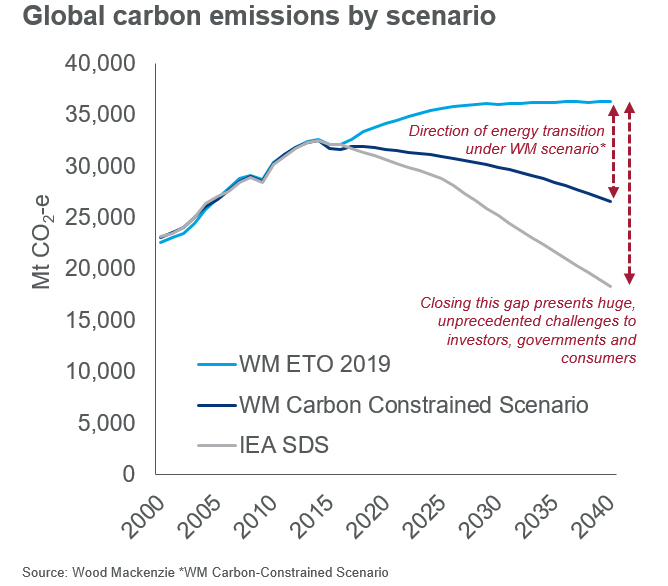

This is a version of a picture that I and WoodMac colleagues have been showing a lot this year. Its purpose is to emphasise the scale of the challenge involved in achieving the Paris climate agreement’s goal of keeping the rise in global temperatures to “well below” 2°C.

The highest line is the expected trajectory for global greenhouse gas emissions in our base-case forecast, with a plateau in the late 2020s. The second line down is the carbon constrained scenario, also known as the accelerated energy transition scenario. This essentially shows climate policies being pushed as far and as fast as is technically and politically possible. It shows a clear decline in emissions to 2040, but not enough to put the world on course for the Paris goal.

To do that, the path of emissions would have to be bent down to something like the lower line, which tracks the IEA’s sustainable development scenario. The gaps between the top and bottom lines are a measure of how much additional effort would be needed to put us on track for a 2°C world. It is a daunting prospect.

Coming next

This is the last Energy Pulse of 2019. Have a great holiday, everyone, and I will be back with you in the new year, for what promises to be an eventful 2020.