Africa upstream oil and gas: one last hurrah?

Investors are looking afresh at Africa’s advantaged barrels – but old problems persist

3 minute read

Gail Anderson

Research Director, North Sea Upstream

Gail Anderson

Research Director, North Sea Upstream

Gail focuses on the North Sea Upstream industry and its gas and power sector.

Latest articles by Gail

-

Opinion

North Sea upstream: 5 things to look for in 2025

-

Opinion

Video | Shell and Equinor announce UK asset merger to create new JV

-

Opinion

End of an era looms as Chevron seeks UK exit

-

The Edge

Why the transition needs smart upstream taxes

-

Opinion

North Sea upstream: 5 things to look for in 2024

-

Opinion

The challenges and opportunities in Europe’s oil & gas, CCUS and hydrogen sectors

Martijn Murphy

Principal Analyst, North Africa Upstream

With energy security currently high on the agenda, Africa’s upstream sector looks set to enjoy a new lease of life. While challenges persist, cash-rich oil and gas companies are viewing the continent with fresh eyes – helped by African governments who are keen to exploit their upstream resources before it’s too late.

In a recent webinar we explained the appeal of Africa’s advantaged exploration opportunities and vast gas resources, and analysed the continent’s capex and production trends. Fill out the form to watch the replay, and read on for a brief introduction.

Africa upstream: deepwater and LNG lead the renaissance

Africa's upstream sector has gained increasing attention over the last 18 months. The need to replace lost Russian barrels has been key to this resurgence, but impressive exploration success and improved fiscal terms in some countries have also been important factors.

Upstream investment in countries like Angola, Nigeria, Egypt, Libya and Algeria has declined as fields mature and the risk-reward ratio becomes less compelling. In these countries, unit costs are increasing, as is emissions intensity.

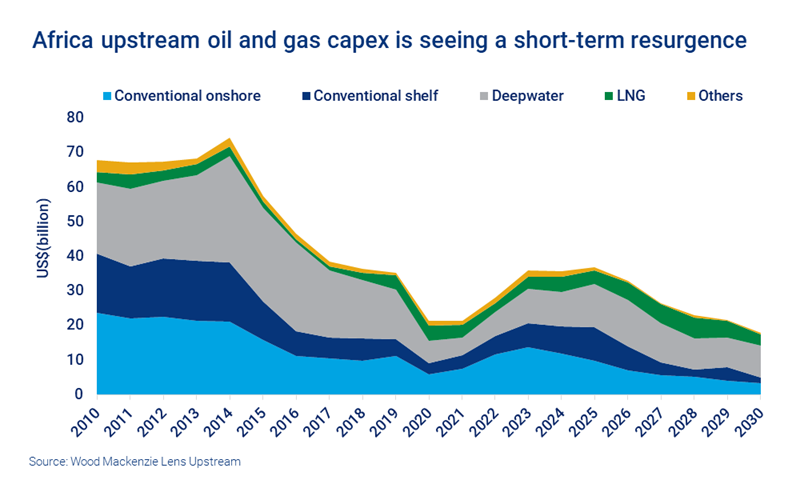

Despite this, overall upstream capex in Africa has rebounded to pre-pandemic levels and should remain steady in our view. Growth is being driven by all resource themes, with deepwater and LNG in particular spearheading the region’s recovery. Looking forward, we expect investment will effectively migrate south and east as new greenfield projects in Mozambique, Namibia, Uganda and South Africa get underway.

While there’s plenty to be positive about, it’s important to bear in mind that a lot of the old challenges persist; these include above-ground risk, project execution, long lead times, the dominance of national oil companies (NOCs) and the lack of well-established gas markets.

Africa’s advantaged barrels

With both unit costs and emissions intensity high, the Majors have increasingly divested their positions in mature fields to focus on more advantaged assets. Buyers have generally been NOCs, local companies and private equity.

Three stunning discoveries in Namibia have been the biggest recent event in the African upstream sector. While still being appraised and tested, we estimate these currently add up to over six billion barrels. The sheer scale of these fields will give them an advantage in terms of profitability, while fiscal terms are also generous in Namibia.

Given very low break-evens and high internal rates of return, these and other advantaged opportunities look set to thrive. In contrast, less advantaged assets may struggle without rescoping to reduce costs and/or better fiscal incentives. Governments will need to be proactive in managing their natural resources to maximise inward investment.

Gas and LNG potential in Sub-Saharan Africa

LNG in Sub-Saharan Africa has seen a resurgence in interest in the last 18 months. In fact, the region has become something of a floating LNG (FLNG) hotspot, with its share of global FLNG capacity set to rise to 50% once sanctioned projects come onstream.

We expect global demand for gas to be steadier than for oil in the long term. Under our base case, demand in 2050 will be higher than today, while even under our 1.5-degree global warming scenario it will only be 25% lower. Africa boasts nearly 700 trillion cubic feet of discovered gas resources, more than enough to satisfy domestic demand and maintain significant exports.

Plans to double African LNG supply over the coming decade will therefore be welcomed, particularly by European buyers. However, for this to happen, capex will need to increase significantly and infrastructure improved.

Get further insight into the Africa upstream opportunity

The webinar offers detailed analysis of these themes by region and energy type, illustrated by charts. Fill in the form at the top of the page to watch the replay.