The Inflation Reduction Act one year on

What has changed since the landmark US policy was passed and what does it mean for the energy transition?

4 minute read

Ryan Sweezey

Director, North America Power & Renewables

Ryan Sweezey

Director, North America Power & Renewables

Ryan focuses on coverage of North America power markets, producing forecasts of power, capacity and REC prices.

Latest articles by Ryan

-

Opinion

2025 global power market outlook: divergent paths in a transforming energy landscape

-

Opinion

The 2025 US power market outlook

-

Opinion

The global power market outlook: can global power generation keep up with the energy transition?

-

Opinion

North American power markets: navigating a trickier path to decarbonisation

-

Opinion

The Inflation Reduction Act and its impact so far

-

Opinion

The Inflation Reduction Act one year on

Robert Whaley

Director, North America Power

Robert Whaley

Director, North America Power

Latest articles by Robert

-

Opinion

Harris v Trump: A fork in the road for US energy

-

Opinion

North American power markets: navigating a trickier path to decarbonisation

-

Opinion

The Inflation Reduction Act one year on

On 16th August 2022, the US Federal Government passed its Inflation Reduction Act (IRA): a flagship policy with huge potential to reshape the sector.

One of the largest US energy public investment proposals in history, it was designed to provide structured incentives and a stable environment after three decades characterised by short-term clean energy policy.

Post its introduction, we forecast that it would usher in a boom era for US renewables manufacturers. There’s no doubt the unprecedented policy certainty has provided a shot in the arm for an ailing sector, with as much as US$1.2 trillion set to be invested in the US and Canada over the next decade, increasing to US$3.2 trillion by 2050.

One year since the IRA came into law, we hosted a webinar to assess the policy’s effect on America’s power market, reflect on potential roadblocks to progress and weigh up what it all means for the energy transition.

Fill in the form at the top of the page for access to the full discussion – and read on for some highlights, including:

- Why the IRA will shape the market for decades to come

- The impact of interconnection and transmission challenges

- How extreme weather could accelerate market reform

IRA tax credits are here to stay

A common misconception about the IRA is that it’s a ten-year law – that the technology-neutral renewable tax credits that the legislation provides extend for the next ten years only.

However, our view is that tax credits will be on offer for far longer; perhaps even for the next 30 to 40 years. While the IRA states that the central tax credits will be available until 2032 – which is why it is commonly thought of as a ten-year law – there is another aspect to it: that those tax credits will apply until the US electricity sector reaches 25% of 2022 CO2 emissions. And that’s the clincher. In our base case, the US only achieves the 25% emissions threshold in the late 2040s.

Rather than being a ten-year law, it’s far more likely that the tax credits on offer will be available for decades to come, creating massive investment opportunities for renewable technologies such as solar, wind and storage.

Traditional tax equity market could increase five-fold

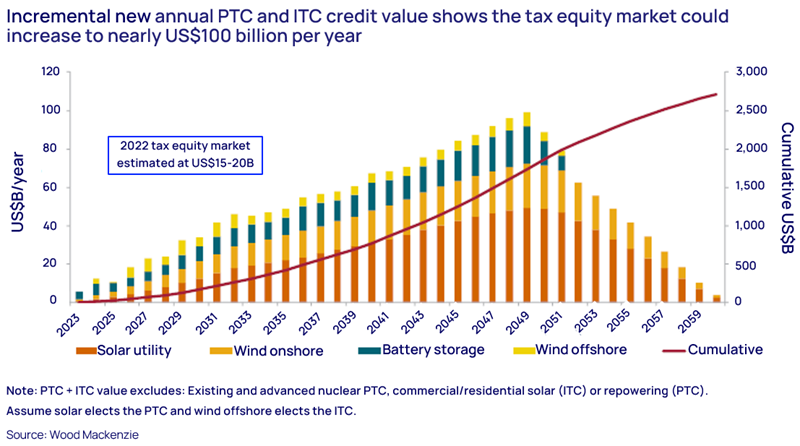

Traditionally, the US tax equity market sits at roughly US$15 billion to US$20 billion per year. But under the IRA, the supply of tax equity could increase to as much as US$100 billion in any given year in the late 2040s.

The total cumulative cost of the subsidies offered under the IRA could be upwards of US$2.7 trillion to US$2.8 trillion. That’s an order of magnitude larger than what the legislation is currently understood to cost in the public domain.

That level of demand cannot be met by the market as it is currently structured. Two things will need to happen: firstly, the transferability market needs to scale up in a big way. Recently released regulations have initiated the market, although it remains in its infancy. And secondly, new players will have to come on the scene, beyond the big names that traditionally operate in the renewables space.

Interconnection costs, transmission and the development of storage will be the fundamental drivers of how fast the energy transition materialises, and of what can ultimately be realised by the foundations that have been laid in the Inflation Reduction Act.

The IRA does little to address significant bottlenecks

Two of the biggest hurdles for expanding renewables capacity successfully – interconnection and transmission – aren’t addressed by the IRA.

The number of new interconnection queue requests have increased by an order of six on an annual basis since 2012. Processes need to be streamlined and the transmission network needs to be expanded to facilitate increases in capacity.

Although the IRA provides a pathway to achieve around 85% clean energy by generation share in the long term, it doesn’t address the need for transmission reforms, which will be crucial to allow the grid to be made available for the increased adoption of renewables.

We’ve seen some improvements this year, but will they be enough for what the market needs?

Some grid operators (and the FERC) have tackled the red tape associated with supply chain constraints and interconnection issues. They have worked to streamline processes, with reforms aiming to expedite processes and alleviate roadblocks that have limited new supply over the last few years. However, interconnection reforms need to be developed hand-in-hand with changes to transmission if they are to be effective.

Will the IRA accelerate the US’s path to net zero?

The IRA will create a clear boom in decarbonisation technologies to set the US firmly on its energy transition pathway. But how fast the energy transition materialises will be tempered not only by interconnection and transmission issues, but also by whether storage capacity can keep pace with developments.

Storage will be crucial for solar in particular – and has a key role to play in how aggressively renewables can be adopted. Longer-duration storage will also be important. By the end of the decade, we will need batteries to last for much longer than the traditional 2-4 hours. Doubling and tripling battery life is currently being explored, but significant progress needs to be made toward making longer-lasting storage a reality in order to support the ramp up of renewables and accelerate the path towards the energy transition.

Learn more about the upside and downside risks of the IRA for America’s energy transition journey by filling out the form at the top of the page. You’ll also get access to our charts tracking key metrics such as interconnection costs, interconnection queue requests and US zero-carbon electricity generation against carbon emissions.