Can Colombia’s gas sustain it through the energy transition?

The country’s decision to halt new exploration puts uncertainty into Colombia’s long-term energy security

2 minute read

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius specialises in coverage of Argentina, Brazil, Colombia and Trinidad & Tobago.

Latest articles by Vinicius

-

Opinion

Can Colombia navigate the energy transition?

-

Opinion

Can Colombia’s gas sustain it through the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

What do Colombia’s ambitious fiscal reforms mean for oil and gas?

-

Opinion

Colombia upstream: digging into multi-level intelligence

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean Harrison

Senior Research Analyst, Gas & LNG

Sean specialises in North America LNG research, focusing on assets analysis, project economics and LNG contracting.

Latest articles by Sean

-

Opinion

Video | Lens Gas & LNG: Golar and partners' FID set to revive Argentina's LNG export ambitions

-

Opinion

Shining a light on the “coal versus LNG emissions” debate

-

Opinion

Video | Lens Gas & LNG: What is Venture Global's LNG strategy?

-

Opinion

Woodside acquires Tellurian and the Driftwood LNG project

-

Opinion

The LNG Majors' strategies in five key charts

-

Opinion

Why is Ruwais LNG an attractive position for the selected partners?

At this year’s World Economic Forum in Davos, Colombia confirmed its commitment to moving away from fossil fuels by announcing an end to new oil and gas exploration contracts. The Colombian government believes existing domestic discoveries can make it self-sufficient in gas as it focuses on the energy transition, but could that decision prove premature?

In the third of our four-part Upstream Colombia research series, we present the results of in-depth analysis into whether the country’s existing upstream discoveries are enough to meet future domestic demand. Fill out the form to download a complimentary extract from the report, or read on for a brief overview.

What prompted Colombia’s halt on new oil and gas exploration?

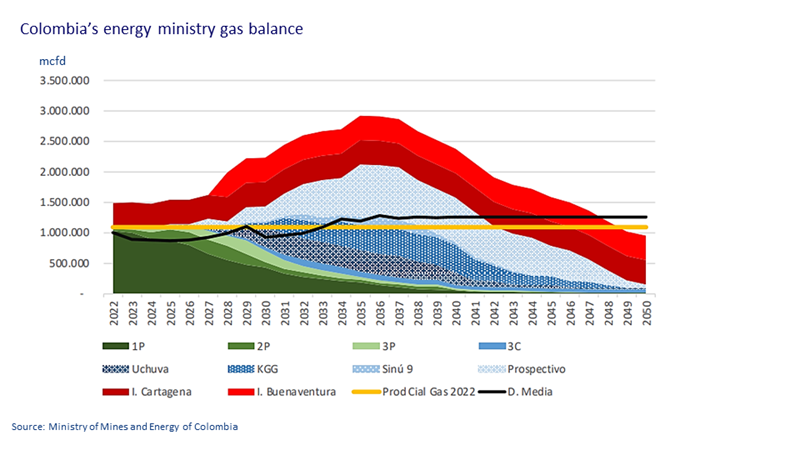

In December 2022, the Colombian Ministry of Mines and Energy published a report affirming that the country could meet its own future gas needs. Encouraged by the potential of recently discovered offshore gas reserves to bolster supply, they claimed Colombia could meet demand through domestic production until 2042, by which point the country’s energy transition would be well advanced. In the wake of the report, the Colombian government announced a halt to all new contracts for upstream oil and gas exploration.

What’s the outlook for Colombia’s gas supply based on current projects?

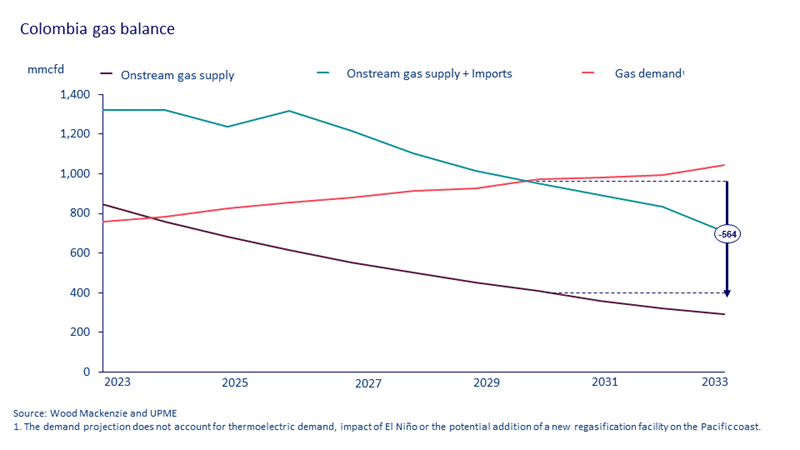

The decision to end exploration was controversial since Colombia’s domestic gas production is in steady decline. Without importing gas, we estimate that Colombia will experience a shortfall of 560 million cubic feet per day (mmcfd) by 2030 (see chart below). In fact, based on current commercial contracts, the country will face an overall gas supply shortage before the end of the decade even once import capacity is taken into account.

Colombia’s only regasification facility, SPEC LNG in Cartagena, can currently import around 400 mmcfd. Majority shareholder Promigas has plans for an additional 130 mmcfd by the second half of 2026, with 50 mmcfd of this capacity planned to come online in 2024.

However, plans for a second 400 mmcfd import facility (dubbed Pacific LNG) are currently in disarray, after UPME disqualified the sole consortium that had put forward a bid for the US$900 million project. Without additional domestic supply, that leaves a serious shortfall.

What domestic upside supply potential exists?

Many in Colombia see a large upside potential of three offshore discoveries – Gorgon, Uchuva and Orca. If developed, they would become Colombia’s first deepwater developments. But these discoveries are still at the evaluation stage, so there is considerable uncertainty regarding potential production volumes, project timelines and costs.

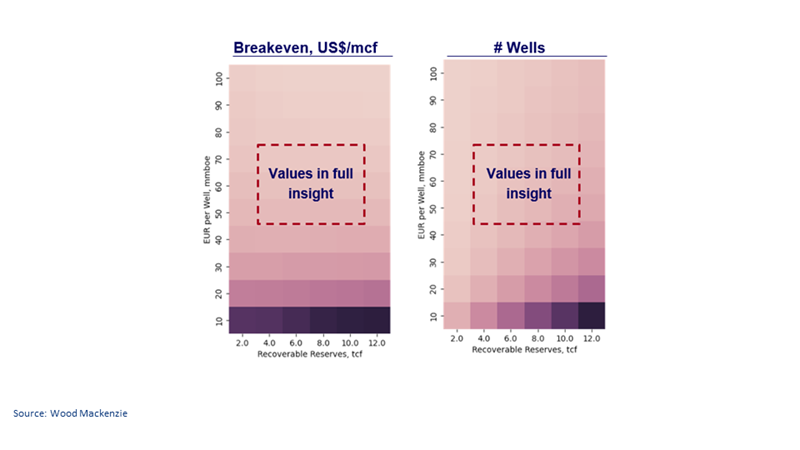

We leveraged our supply chain cost intelligence and valuation methodology to carry out comprehensive analysis of 60 possible scenarios, varying recoverable resources and well productivity to assess the potential breakeven range for projects.

To meet these benchmarks, offshore ventures will need to be both highly productive and cost-effective. Logistics may also increase project investment costs, given the distance of some fields from existing infrastructure and the limited capacity to move gas from the coast to Colombia’s interior.

Don’t forget to fill in the form at the top of the page to download your complimentary extract from the report. This includes breakeven figures for potential Colombian offshore projects along with a breakdown of production, drilling and cost assumptions for our analysis.

In the final part of our Upstream Colombia series, we focus on the country’s approach to the energy transition. The Colombian government has set aggressive net-zero targets, but is the country’s net-zero pathway feasible at an economic and practical level, and what are the specific challenges it must overcome?