Colombia upstream: digging into multi-level intelligence

In a year of significant change and new challenges, granular, asset level valuation data is more important than ever

5 minute read

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius Moraes

Research Analyst, Latin America Upstream

Vinicius specialises in coverage of Argentina, Brazil, Colombia and Trinidad & Tobago.

Latest articles by Vinicius

-

Opinion

Can Colombia navigate the energy transition?

-

Opinion

Can Colombia’s gas sustain it through the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

What do Colombia’s ambitious fiscal reforms mean for oil and gas?

-

Opinion

Colombia upstream: digging into multi-level intelligence

Colombia’s upstream sector is always dynamic. That’s proving to be especially true in 2022. What are the changes and challenges to watch in this upstream hot spot? And how do we drill into the data to get a clearer view on valuations?

This insight draws on unique, actionable intelligence from Lens Upstream. Fill in the form for a demo.

Offshore frontier exploration: a move into deepwater in the Colombian Caribbean

Offshore exploration of the Colombian Caribbean has delivered in 2022. Shell and Petrobras started drilling exploration wells in early 2022, the Gorgon-2 and Uchuva-1, both with Ecopetrol as a non-operating partner. Both wells resulted in natural gas discoveries, with what we estimate could be three trillion cubic feet (tcf) of combined recoverable resource.

The new offshore wells in the Caribbean represent technological breakthroughs in Colombia, with a move into deeper waters in the search for resources. However, this will translate to higher costs, especially in Colombia, where no offshore infrastructure exists. Our global tracking shows deepwater gas projects can take 12 years from discovery to first production.

If Colombia is to rely on offshore gas projects to sustain demand growth, it will require a fast-paced project with favourable economics or expensive LNG imports to buffer an interim period. Nonetheless, two successful deepwater results is good news for the sector.

Unprecedented political changes: tax reform ahead

Gustavo Petro won Colombia’s presidential election in June, marking the beginning of the first left-wing government in a historically conservative nation. Petro’s campaign alarmed some upstream investors by suggesting stopping new exploration contracts and banning unconventional projects.

A few weeks into the new government‘s tenure, extensive tax reform has already been proposed. This includes a national carbon tax, eliminating royalty deductions on income tax and higher fees on foreign dividends. There is a degree of uncertainty over what will become effective, and when.

Energy security: Colombia’s gas demand could overtake supply by 2025

Colombia’s gas-proven reserves have decreased over the past decade. We estimate that current reserves equate to eight years at the latest consumption rates. If no significant discoveries are commercialised in the short term, gas demand will overcome supply by 2024-25.

There are large expectations of offshore and non-conventional resources, but both are under political scrutiny. Banning unconventionals would fulfil Petro’s campaign promises, while the latest tax reform proposal eliminates special deductions from free trade zones. This would have a significant impact on offshore development. Servicing the country’s gas and energy demand without paying for expensive LNG imports will be a growing challenge.

Corporate leadership in the energy transition

Ecopetrol has shown strong leadership in its energy transition efforts. The national oil company (NOC) is moving faster on transition strategies than many regional peers. It has announced a plan to increase gas production to about 40% of total hydrocarbon production, and is investing in renewables and integrating its ISA acquisition.

Colombia is a vital resource base for many companies. Ecopetrol plays a big role, and other NOCs also have stakes. And it is the primary value driver behind many independents, including Frontera, Parex, Gran Tiera, GeoPark and Canacol Energy. Given the scale and impact of evolving news in the region, access to granular, asset-level valuations can be vital.

So, how do we deliver this detail?

Colombia: asset-level insight

Colombia’s mix of data sources make it an ideal candidate for implementing innovative solutions and workflows with validations at different data source levels.

Corporate disclosures and field-level information from the Colombian regulator, ANH, are high quality and provided monthly. However, unlike some other American regimes, analysts do not have data sources at the granular individual well level. This makes Colombia an interesting case study to triage various data sources and test out statistical methods to derive well-level intelligence.

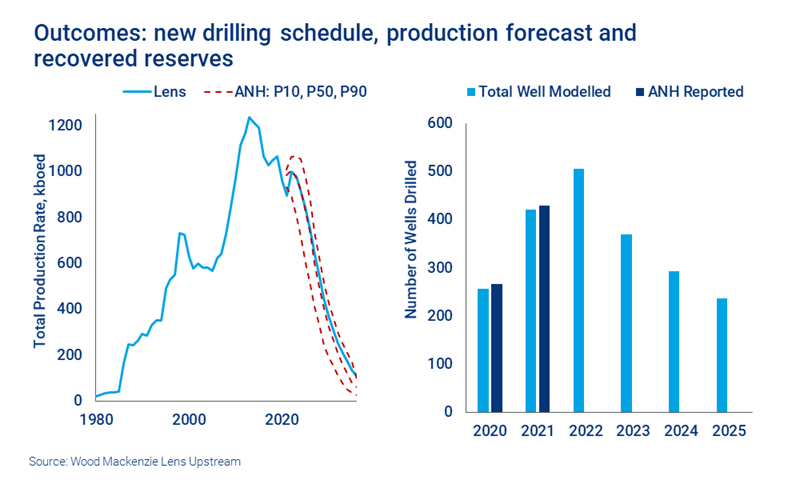

We have completed a full update of our Colombia coverage with robust quality checks for historical production, drilling schedules, reserves, and investment commitments at the field, company and country levels. This update includes a detailed review of each asset’s production profile and well activity.

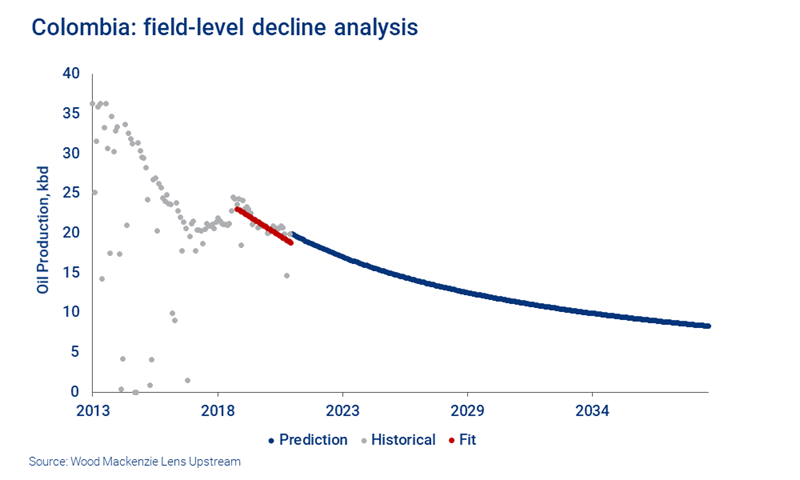

Analysing Colombian field level decline trends

We modelled 671 fields, aligned historical productions to the latest official production figures reported by ANH and analysed the latest field level decline trends.

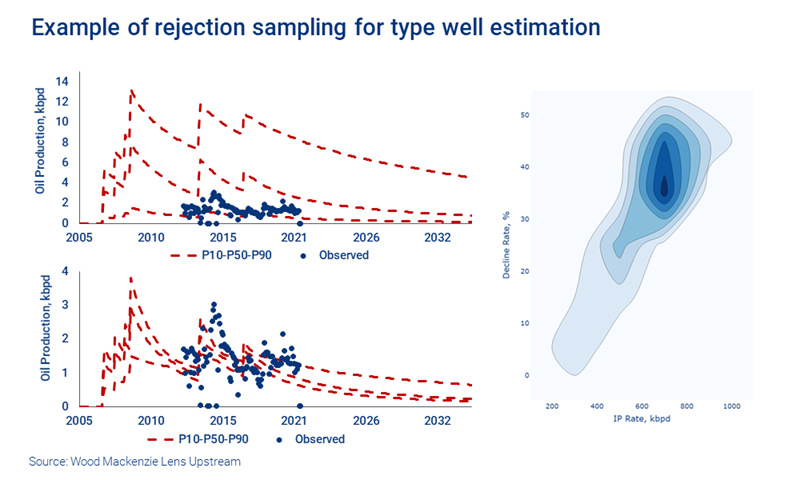

Colombia only has field level production data available. However, we can combine this with official historical drilling schedules to apply methods, such as rejection sampling, to infer the most probable average well-type in a given field.

We then sample an unbiased distribution of initial production (IP) and decline rate parameters (prior) and simulate field production at field level given the historical well schedule. We ‘reject’ results that are outside an error margin from the observed production data.

Finally, we update our parameter distributions (posterior). These allow us to generate a parameter probability map, given the observed field level data and drilling schedule. And we find creative ways to extract the most value out of data, beyond its face value.

Diving deep into company reports and multi-company reconciliations

Our approach includes an holistic integration of information reported by operators and partners. This includes different scopes of information, such as production figures, 1P and 2P reserves, field redevelopment, upsides, new drilling schedules, capital investments and lifting costs.

Company guidance reconciliation

Field-specific parameters, such as transportation and lifting costs, reflect the latest information reported by operators.

The same process is applied to capital investments. We have analysed planned disbursement at the asset micro and company macro level. Reported planned expenditure for individual fields has been considered, including drilling schedule, enhanced oil recovery (EOR), facilities and more. To validate our capex forecast, we aggregated each company’s working interests in the individual assets to match the total capex investment planned at the corporate level.

At the country level, our models align with the ANH's reserves and forecast estimations (2P), giving greater validity to our approach.

Colombia upstream: track the latest changes

Our country coverage continues to evolve at pace. Get the latest analysis for Colombia – and for other regions around the world – with Lens Upstream. Fill in the form at the top of the page for a demo.

Wood Mackenzie Lens Upstream

Build resilient and sustainable portfolios with Lens Upstream

Learn more