Sign up today to get the best of our expert insight in your inbox.

China juggles four major economic changes in 2023

3 minute read

Yanting Zhou

Principal Economist, Asia Pacific

Yanting Zhou

Principal Economist, Asia Pacific

Yanting leads our in-house macroeconomic research for Asian economies.

Latest articles by Yanting

-

The Edge

Getting China back on track

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

China juggles four major economic changes in 2023

Change is afoot in China. Economic growth is slowing, while rising political tensions between China and the US, coupled with global supply chain restructuring, are disrupting its external markets. The new government has much to do to accelerate the recovery of the Chinese economy.

As it redirects its trade and investment away from the US to neighbouring Asian economies in a difficult global export market, China needs to boost domestic consumption by lowering saving rates and increasing real wages. The good news is that the government's recent steps to support private businesses and stabilise housing prices are already giving consumers a renewed sense of security.

In the latest edition of our China economic focus, we discussed strategies and policies for the new government as it deals with four major changes in the Chinese economy. Read on for an overview, or visit the store to read it in full.

1. A new government and new policies

China chose its new government at the March National People’s Congress, with Xi Jinping re-elected president and Li Qiang becoming the new premier. Although the top leader is unchanged and the long-term strategy of ‘dual circulation’ persists, we expect there to be changes to the government’s short- to medium-term policies to support the recovery of the Chinese economy.

2. Reopening of the economy

The government has set a lower-than-expected gross domestic product (GDP) growth target for this year, at around 5%. While we think this target is somewhat conservative, it could also mean that China will face more challenges in recovery and that government support will be below expectations.

Wood Mackenzie forecasts GDP growth of 5.5% this year. However, if China pushes to make up ground lost during the pandemic, 7% growth is not impossible. We examined the implications of a hotter economy for commodities and natural resources in the March edition of Horizons: The great reopening.

3. Changing external markets

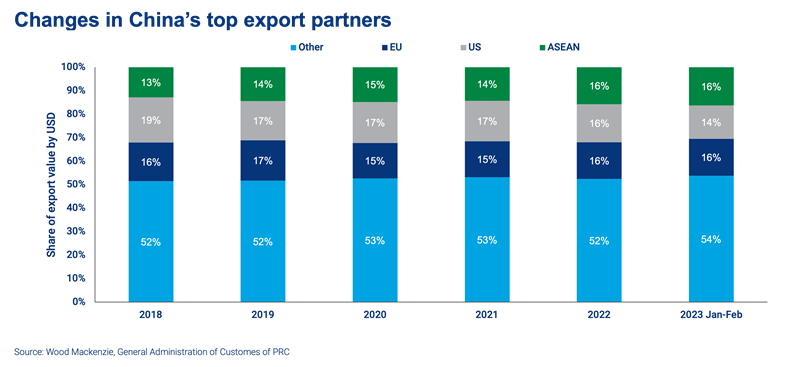

China’s exports are set to experience a downturn in 2023, driven by the global economic slowdown. Exports in the first two months of the year fell 6.8% from the same period in 2022. Moreover, the US-China relationship has deteriorated further over a series of recent events, including technology blockages and the Chinese balloon incident. The global supply chain is seeking diversification from China for cost, security and political reasons.

China is reacting by redirecting trade and investment to the Belt and Road countries. The country has been promoting the Regional Comprehensive Economic Partnership (RCEP), which came into effect on 1 January 2022. RCEP focuses on reducing tariffs between the 15 member countries across the Association of Southeast Asian Nations (ASEAN), eastern Asia and Oceania.

China has also been reducing import tariffs in line with RCEP requirements and its eight free trade agreements with countries across Latin America, Asia and Europe. The Peterson Institute for International Economics calculated that China’s import tariffs for rest of world had dropped from 8% in early 2018 to 6.5% by the end of 2022, while taxes for the US had increased from 8% to 21.2%.

However, beyond the short term, China’s competitiveness will be challenged. Its cost advantage, especially for middle- and low-end products, is already eroding.

Consequently, growing domestic demand has become more important ‒ and China has ground to recoup. At the end of 2022, the economy was 3% below where we expected it to be based on its pre-Covid trajectory.

4. Quantity to quality

China faces demographic headwinds. Its total population fell for the first time in 2022 and urbanisation is also slowing significantly. Premier Li highlighted that quality-driven growth would replace quantity-driven growth. To achieve this, however, the government needs a new set of policy tools to support consumption.

A systematic consumption revival plan is needed. Although boosting domestic consumption is a priority highlighted in the government work report of the Congress meeting, detailed stimulus measures are lacking. Some local governments are providing consumption incentives. Twelve provinces are offering subsidies for auto purchases and some cities are issuing coupons for home appliances. Such measures are the kind of typical government policy tools that merely bring forward future demand and rarely create additional demand.

The real challenge for the new government is to raise the population’s willingness to consume and reduce China’s ultra-high saving rates by providing more security to Chinese households.

To read more of our insights into China’s economy read The great reopening: what the end of China’s 'zero-Covid' strategy means for global energy and natural resources.