How do Western sanctions on Russia impact the global metals, mining and coal markets?

We explore how Russia's economy is adapting to Western sanctions by pivoting to new markets in Asia, and what this shift means for global trade and economic stability

6 minute read

Daniel Carvalho

Director, Metals & Mining Consulting

Daniel Carvalho

Director, Metals & Mining Consulting

Daniel brings over 18 years of experience as a global operations, process and technology leader.

Latest articles by Daniel

-

Featured

Metals & mining 2025 outlook

-

Opinion

Four key takeaways from LME 2024

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

What’s next for green steel technologies?

-

Featured

Metals and mining 2024 outlook

Yanting Zhou

Principal Economist, Asia Pacific

Yanting Zhou

Principal Economist, Asia Pacific

Yanting leads our in-house macroeconomic research for Asian economies.

Latest articles by Yanting

-

The Edge

Getting China back on track

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

The Edge

Can China’s recovery turn the oil market around?

-

Opinion

China juggles four major economic changes in 2023

Uday Patel

Senior Research Manager, Global Aluminium Markets

Uday Patel

Senior Research Manager, Global Aluminium Markets

Uday has over 30 years of experience in the metals & mining sector and is focused on global aluminium markets.

Latest articles by Uday

-

Opinion

Can America smelt again?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Aluminium: things to look for in 2024

-

Featured

Aluminium vs plastic: who’ll win the water bottle war?

Duman Baimbetov

Senior Research Analyst, Bulks Assets

Duman Baimbetov

Senior Research Analyst, Bulks Assets

Duman has a primary focus on coverage of coal, iron ore and steel assets in the CIS region.

Latest articles by Duman

View Duman Baimbetov's full profileChris Bandmann

Senior Research Analyst, Steel & Raw Materials Markets

Chris Bandmann

Senior Research Analyst, Steel & Raw Materials Markets

Latest articles by Chris

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Metallurgical coal: 5 things to look for in 2024

Robin Griffin

Vice President, Metals and Mining Research

Robin Griffin

Vice President, Metals and Mining Research

An integral part of the research team since 2007, Robin leads our analysis across metals and mining markets.

Latest articles by Robin

-

Opinion

Metals and mining tariff scenarios: potential impacts of new US tariffs on metals markets

-

Opinion

Where next for metals markets in 2025?

-

Opinion

eBook | Understanding the metals and mining landscape in 2025

-

Featured

Metals & mining 2025 outlook

-

Opinion

Challenges and opportunities for the steel value chain

-

Opinion

The future of coal in the global energy sector

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony is the global head of our thermal coal markets research for the Metals and Mining group.

Latest articles by Anthony

-

Opinion

Harris v Trump: A fork in the road for US energy

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Decarbonising metals and mining: three key strategies to win the emissions battle

-

The Edge

Resource nationalism and energy transition metals

-

Opinion

Golden opportunities to drive down mining and metals carbon emissions

-

Opinion

Battery raw materials: tracking key market dynamics

Charvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi Trivedi

Senior Research Analyst, Steel and Raw Materials

Charvi is responsible for analysing and tracking the steel industry performance and demand-supply forecasting.

Latest articles by Charvi

-

Opinion

Grey area: can steel really go green?

-

Opinion

How do Western sanctions on Russia impact the global metals, mining and coal markets?

-

Opinion

Green steel: challenging the status quo

-

Opinion

Steel: 5 things to look for in 2024

The geopolitical landscape for Russia, as a major supplier of various commodities, has undergone a dramatic transformation since the invasion of Ukraine. The EU, US, UK, and G7 have imposed complex sanctions aimed at weakening Russia's economy by restricting access to markets, finance, and technology, thereby hindering its war efforts in Ukraine.

However, not all countries have joined these sanctions. India and China have emerged as crucial markets for Russia, which has countered Western sanctions with its own measures. And despite the West's attempts at economic isolation, Russia has shown resilience by pivoting towards these Asian markets, significantly influencing global commodity markets.

Recently, our team presented a webinar on how Western sanctions on Russia are impacting the global metals, mining and coal markets. We discussed how, since the invasion of Ukraine, Russia's role as a major commodities supplier has faced significant upheaval, and how the country is adapting.

Fill out the form at the top of the page to download the full slide deck from our recent webinar on the impacts Western sanctions have had on Russia’s markets, or read on for a short summary of some of the key takeaways:

1. Metals and mining sanctions: impacts and implications

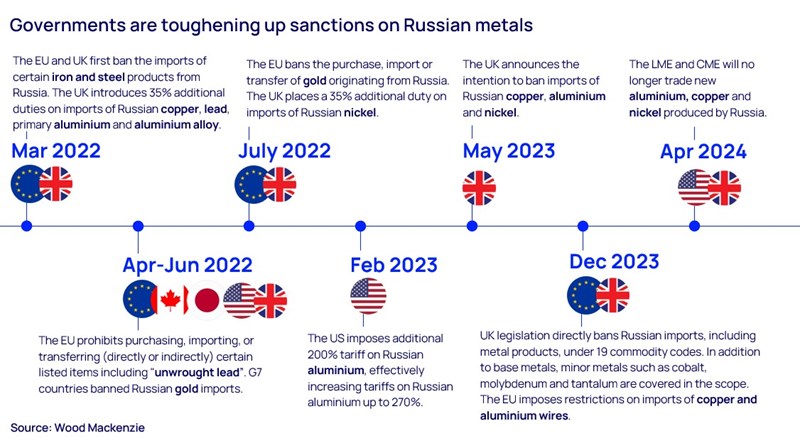

Western sanctions have significantly targeted the metal and mining sectors, with the US, EU, UK, and G7 implementing a series of restrictive measures since February 2022. These sanctions have introduced various trade barriers, from additional tariffs to outright bans on importing and trading Russian metal products, including aluminium, copper, nickel, and steel.

The scope of sanctions expanded dramatically in December 2023 when the UK Government enacted an embargo under 19 commodity codes, significantly broadening the spectrum of affected products to include both base and minor metals such as tungsten, cobalt, and tantalum.

2. Battery raw materials: uneven impacts and market stability amid sanctions

Russia's role in supplying critical battery raw materials has been compromised by the sanctions, and impacts so far have been felt unevenly across these markets. Copper, aluminium, and nickel have experienced more price volatility and tighter RoW market balances amid tightening sanctions on Russian material.

Despite this, Russia's internal production of synthetic graphite—consumed mainly by its domestic steel industry—has seen minimal impact from EU sanctions. Moreover, the global markets for cobalt and lithium have remained stable, as Russia contributes a trivial share to these specific materials.

3. Aluminium trade shifts: Europe’s dependence and China’s emerging role in Russian markets

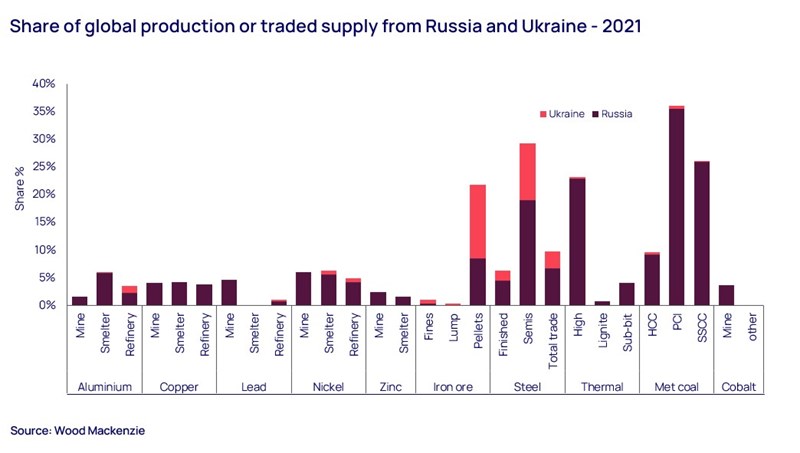

Russian primary aluminium is an essential part of the global supply chain, accounting for 6% of total supply and an even more significant 14% excluding China. This contribution is especially critical in low-carbon aluminium, where Russia provides 27% of the global low-carbon supply outside China as of 2023. Historically, sanctions such as those imposed by the US Treasury in April 2018 threatened significant disruption, including the potential complete shutdown of Russian aluminium and alumina production.

However, these were ultimately rolled back by year-end. The most recent sanctions since Q2 2022, including an LME ban on Russian aluminium produced after 13 April, limit the profitability of selling Russian metal and dissuade consumers from buying outside China. Russian aluminium finds markets despite these challenges, notably entering Western markets at discounts to global benchmark premia.

The European Union is pressured to implement a complete ban, which would necessitate increased imports from other regions such as India, the GCC, and Malaysia—potentially at higher carbon costs.

4. Gold: sanctions uplift traditional export routes, yet long-term production remains strong

Russia remains a significant player in global gold markets, contributing around 9% of worldwide production in 2023. The sanctions aimed at limiting Russia's income from gold to restrict its military actions have had a limited impact on production, which remains robust due to the country's vast gold ore reserves, long-established mine lives, and traditionally low operational costs.

The resilience of the gold sector is evident as production levels rebounded in 2023 following the impact of the initial sanctions. However, the traditional gold export routes have faced major disruptions; notably, the LBMA suspended accreditation for six Russian gold refineries in March 2022, significantly affecting Russia's access to the London market.

The G7's ban in July 2022 on the purchase, import and transfer of gold from Russia forced a significant pivot in trade routes, with Russia increasingly turning to markets in Asia, particularly China and India.

5. Coal: Russian coal expansion into Asian markets

In 2022, export sales were affected by the ban on Russian coal imports into the EU and UK, after which coal producers needed to divert their European exports to the Asia Pacific markets. This massive redirection created extreme congestion on Russia’s eastbound rail lines. However, despite infrastructure limitations, Russian coal producers increased coal exports to the key Asian markets (China, South Korea, and India) by more than 80% in 2023 compared to 2021.

We model that the newly announced US sanctions against SUEK, Mechel and Sibanthracite will impact around 8 to 10 % of Russian coal exports soon. The sanctions will reduce the demand for Russian coal in 2024 and tighten the high CV thermal and metallurgical coal market. We estimate that non-Russian producers will meet the demand, and it will support prices in the short term.

6. Steel sanctions: US cuts off, while EU increases Russian pig iron imports

The Russian steel industry experienced a mitigated impact from sanctions imposed by Western countries, particularly the EU and the US, which previously imported substantial quantities of Russian steel and metallics. Initial sanctions in early 2022 caused a sharp 71% drop in imports of Russian-finished steel, replaced by increased exports from Asia.

Additional bans on semi-finished products were announced in 2023, with a billet import ban starting in April 2024 and a slab ban in October 2024. However, lobbying by some companies has affected the pace and severity of these sanctions, leading to the EU's 12th sanctions package in December 2023, which extended import grace periods for certain products.

While the US eliminated Russian steel imports by 2023, the EU increased pig iron imports, reflecting variances in the impact of sanctions. Overall, we believe that significant changes in trade flows for metallics and semi-finished steel are unlikely before 2026 and 2028, respectively.

7. Iron ore: lesser sanctions, significant impacts

Despite broad sanctions elsewhere, actions against Russian iron ore have been less severe, reflecting the EU's need to balance sanctions with the demands of its domestic steel industry. There are no explicit bans on Russian iron ore, though targeted sanctions hinder transactions with specific Russian mining companies.

The primary reduction in imports has been through self-sanctioning by EU importers, leading to a significant concentration of Russian iron ore exports. By 2024, the Chinese market’s share of Russian exports has surged from 38% to 90%, indicating a high dependency on China and an increased vulnerability to any protectionist measures that might arise.

Final thoughts

Overall, our webinar highlighted the resilience of Russian commodity markets despite international sanctions, revealing the complex effects on global trade, pricing, and market strategies. Notably, the selective approach to sanctions, particularly excluding Platinum Group Metals like palladium (of which Russia controls 40% of global production), underscores the pragmatic balance between political objectives and economic interests.

Sanctions on critical materials such as PGMs, iron ore and slabs have been limited to avoid disrupting essential industries like European steel, demonstrating the intricate calibration of sanctions to manage economic interdependencies. This strategy illustrates how sanctions function as both political tools and economic levers, employed where costs are manageable for sanctioning nations.

Market concerns have mainly focused on bulk commodities, with significant disruptions in Russian high-energy thermal coal, PCI/SSCC, steel semi-finished products, and iron ore pellets. While aluminium and nickel have also been affected, the broader impact has involved trade flow adjustments rather than immediate market disruptions.

Learn more

To access more key takeaways, detailed insights and graphs, please fill out the form at the top of the page to download the full presentation from our recent webinar.