China’s zonal gas transmission tariff: changes and implications

Simplified tariffs will facilitate supply optimisation and gas-on-gas competition

3 minute read

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai Dong

Principal Consultant, APAC Gas & LNG Research

Kai focuses on China's gas market, covering market fundamentals, gas supply/demand balance and regional market analysis

Latest articles by Kai

-

Opinion

How Asia will drive global gas and LNG investment to 2050

-

Opinion

Video | Lens Gas & LNG: Exploring key trends in Asia Pacific’s gas and LNG market

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

Opinion

The potential and opportunities in Guangdong LNG market

-

Opinion

China’s zonal gas transmission tariff: changes and implications

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru Huang

Research Director, Asia Pacific Gas and LNG

Miaoru leads our Northeast Asia gas research.

Latest articles by Miaoru

-

Opinion

How Asia will drive global gas and LNG investment to 2050

-

Opinion

Asia Pacific gas & LNG: 5 things to look for in 2025

-

Opinion

Gas & LNG in Asia: the next 10 years

-

The Edge

Getting China back on track

-

Opinion

The potential and opportunities in Guangdong LNG market

-

Opinion

China’s zonal gas transmission tariff: changes and implications

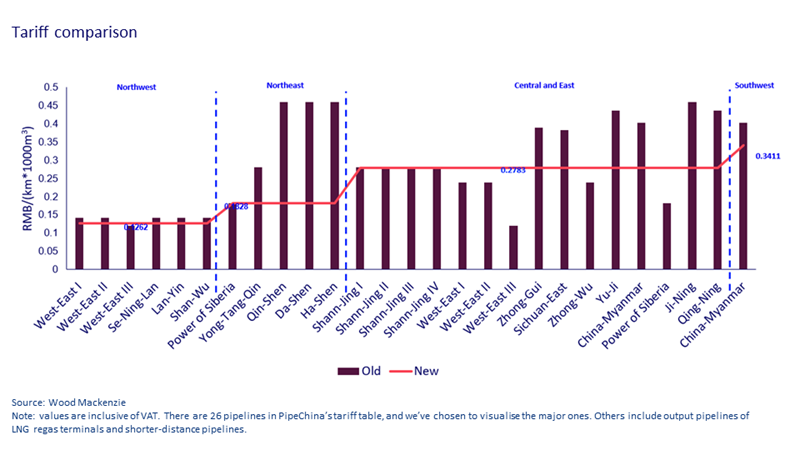

China has streamlined its pipeline tariff system, with the first of the new prices now in place. Released in December 2023, the new tariff system applies to the inter-provincial natural gas transmission pipelines operated by PipeChina. There are four new pricing zones: Northwest, Northeast, Southwest, Central and East.

A single network

China’s oil and gas industry has been undergoing major reforms, and the new system follows a period of regulatory turbulence. It overturns the 2016 ruling requiring companies operating pipelines to set their own tariffs. Each operator had a unique tariff for all pipelines they owned, and the regulation proved challenging and impracticable.

In 2019, PipeChina was established with the goal of providing neutral access to the country’s pipeline infrastructure. By 2021, the central government had the basis for zonal tariff, and the National Development and Reform Commission (NDRC) rubber-stamped the plans in December 2023. The new system supports China’s “One Network” ambitions and represents a significant step towards a streamlined gas sector.

Three cities serve the new zones: Zhongwei in the Northwest, Yongqing in the Northeast, and Guiyang in the Southwest. With each zone allocated a unique and uniform tariff to cover its inter-provincial pipelines, the total number of tariffs has been reduced from 15 to just four. The tariffs have been calculated on the basis of costs – for example, asset depreciation – plus reasonable profit. The income estimate is based on last year’s income, factoring in operating costs, future investment needs and local economic changes.

Each zone’s tariff is calculated according to its unique income prediction, resulting in significant differences between areas. The Northwest, Northeast and Southwest zones have seen reductions in their previous costs, while Central and East zone may have a slight increase.

Big reform - big market changes

The new guidelines have generally resulted in reduced tariffs. The Northwest, Northeast and Southwest zones supplied over 43% of China’s piped gas but accounted for just 14% of total domestic demand in 2023. These areas function as transit zones, diverting surplus gas from each transmission city.

The Central and East zone accounted for the majority of domestic demand in 2023, at 86%. This area consumed its own supply, as well as diverting gas and we believe demand here will increase by 217 bcm by 2050. The surplus from transit zones should cover this increase; we expect supply to build in time, as production ramps up in the Tarim basin and new cross-border pipelines are developed.

Our estimates suggest a slight decrease in transmission cost overall across China, however the Central and East zone will see a slight increase. Asset investment is of course part of the equation when determining tariffs, and we suspect that the increased cost in the Central and East zone will be used to fund the future pipeline construction.

Transport expenses will naturally affect the cost of gas, too. Take Shanghai, for example. We expect the cost of transportation through the Sichuan-East pipeline to be reduced by 27%, resulting in an 11% total cost decline for Sichuan gas. By contrast, the cost of transporting gas through Power of Siberia will rise by 21% for the Yongqing-Taizhou section, potentially resulting in a 6% total cost increase for Russian gas.

Conclusion: improved efficiency and reduced costs

The new zonal tariff system should result in overall improvements to efficiency. National oil companies and regional gas suppliers will have to adapt, and their responses will have a market impact.

China’s most important gas wholesalers are the NOCs; they dominate interprovincial pipelines. Their wholesale units will bear the cost of the changed tariffs, and regional subsidiaries will have to optimise gas sales to manage the changes.

End-users may choose alternative gas suppliers. This will stimulate competition between the units, ultimately leading to reduced upstream costs in China’s oil and gas sector.

In summary, we believe the tariff change will improve market dynamics. A uniform tariff in each zone should mean that gas swaps among distributors and buyers will become easier. The changes will require PipeChina to operate more effectively, however. With higher demand for route optimisation, the corporation needs to build more connecting pipelines and facilitate provincial pipeline integration for “One Network”.