Western Europe will drive 46% of the continent’s solar in the next ten years

The region is poised to unlock 270 GW of solar capacity over the next decade

4 minute read

Juan Monge

Principal Analyst, Distributed Solar, Europe

Juan Monge

Principal Analyst, Distributed Solar, Europe

Juan covers distributed solar market developments across Europe.

Latest articles by Juan

-

Opinion

Global solar PV installed capacity will more than triple in the next ten years

-

Opinion

Global solar forecast gets an upgrade

-

Opinion

Chinese state-owned enterprises are the largest owners of solar assets

-

Opinion

Western Europe will drive 46% of the continent’s solar in the next ten years

-

Opinion

Global solar capacity to increase 32% compared to 2022

-

Opinion

Record solar buildout expected in all regions this year

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

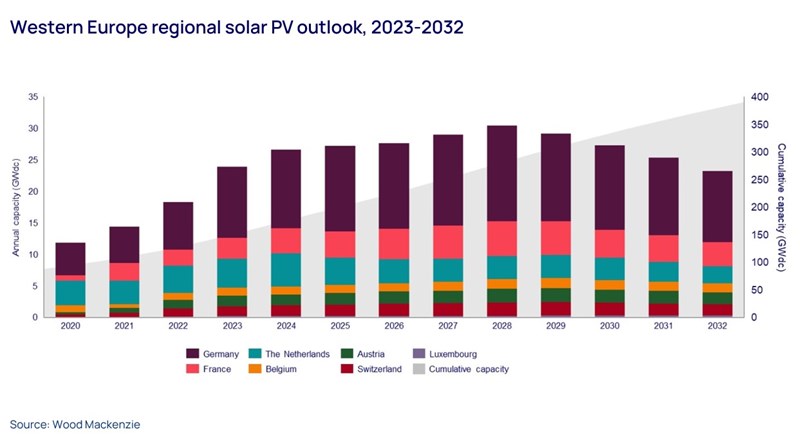

Our forecasts show that Western Europe will drive 46% of solar deployment in the European continent over the coming decade. Installations in Western Europe have soared as solar buildout becomes imperative to both reduce reliance on Russian gas and accelerate decarbonisation. Indeed, 2023 is set to be another record-breaking year, establishing a new benchmark for solar development across Europe.

Our recently published Western Europe solar PV outlook, available via our Global Solar Markets Service, explores the evolution of solar policy, retail rates, demand dynamics and other key market trends that inform our forecasts for the region.

Fill out the form on the top right of this page for a complimentary extract and read on for some key highlights.

Western Europe’s solar PV annual installed capacity will surpass 20 GW in the 2020s

Average annual installations in Western Europe will be 27 GW across the decade, this is unparalleled in the region. With annual installation records to be repeatedly broken throughout the outlook period. This magnitude of installed capacity expansions is fuelled by energy security concerns, electricity demand growth and the implementation of favourable policy frameworks across the region.

That said, equipment cost inflation, grid bottlenecks and land availability cast a shadow over market potential in the region. In select markets, these constraints have already begun to stifle solar development.

Rooftop mandates and sales tax exemptions are propelling distributed solar PV in the region

Germany will remain the top distributed solar PV market in Western Europe through 2032. The residential segment will experience the most growth, with cumulative installed capacity expected to grow fivefold in the next decade. After a record-shattering 2022, residential installations have seen additional growth so far this year. This is fuelled by the introduction of a sales tax exemption (which has effectively reduced installation costs by 20%) and regional residential rooftop mandates for new buildings in German states. On the C&I solar PV front, the impact of REPowerEU and regional commercial rooftop mandates will more than double total installed capacity through 2032.

As recent quarterly installation records in France are starting to show, the French residential solar market will finally flourish over the next decade. We expect cumulative totals for home solar in France to quadruple by 2032.

This scale of growth in the first half of the decade will be sparked by the need for protection from retail electricity price volatility and the fact that households will benefit from more generous feed-in-tariffs than in other comparable European countries.

Once retail rates stabilise and feed-in-tariffs look less beneficial, the REPowerEU residential rooftop mandate will become the main growth driver towards the tail end of the 2020s.

The C&I market has historically been a stronger sector for distributed solar PV in France. We expect the sector to peak in 2028, driven by REPowerEU rooftop mandates for new and existing commercial buildings, as well as the obligation to install panels on parking lots larger than 1,500 square meters. This regulation has been implemented this year, but there is a 5-year window to comply.

The Netherlands is the last major European distributed solar PV market benefitting from net metering. But the Dutch parliament made the decision to transition away from this compensation regime by 2025. This will press the breaks on the scale of growth both residential and C&I solar have seen in the last three years and continue into the mid-2020s, making annual deployments peak in 2024 for both sectors. Sustained declines in retail electricity rates in the next few years, along with grid capacity constraints and only moderate demand growth through the decade are other barriers to more robust growth for Dutch distributed solar PV.

Nevertheless, policy will be a key tool in ensuring significant annual capacity additions through 2032: as in the other key Western European markets, REPowerEU home solar and commercial rooftop mandates will be a fundamental catalyst for growth.

Auctions and growing demand for PPAs will remain key drivers for utility-scale solar

The current surge in utility-scale installations in the region can be attributed to the high capacity allocated in previous auction rounds, particularly in markets like Germany, France, and the Netherlands. The unprecedented volumes anticipated in upcoming rounds are also expected to unlock gigawatt-scale development. In Germany alone, ground-mounted large-scale solar auctions will support 62 GW of capacity between 2023-2029.

National governments will play an instrumental role in maintaining a competitive bidding landscape and ensuring favourable subscription rates at future auction rounds. This will be essential to unlocking our utility forecast.

Moreover, the recent surge in solar PPAs across Western Europe has also been instrumental in driving the record growth in utility installations. Structurally higher retail energy rates and steadfast industry emission targets will sustain the demand for corporate PPAs within the region.

Learn more

To find out more, fill out the form at the top of the page to download your complimentary extract of our recently published Western Europe solar PV outlook.