Discuss your challenges with our solutions experts

Choppy waters ahead for global olefins

2020 has been characterised by a pandemic-driven collapse in demand and turbulent feedstock prices. How will the industry navigate the challenge ahead?

1 minute read

With contributions from Alan Gelder, VP Refining, Chemicals & Oil Markets, Prachi Mehta, Senior Research Analyst, and Ashish Chitalia, Research Director, Head of Global Polyolefins.

The plastics industry was bright-eyed and optimistic at the start of 2020. The protracted trade war between the US and China was pointed towards resolution, concerns over the fallout of Brexit had abated and demand expectations had improved after a lacklustre 2019. But that optimism was quickly withdrawn as the coronavirus outbreak began to grip global economies.

Pressures abound from all sides: 2020 has been characterised by turbulent feedstock prices and a collapse in demand across all aspects of the value chain. And that’s compounded an already uncertain outlook for the olefin and polymer industries as they grapple with a cyclical downturn and headwinds from an increasing focus on sustainability.

How has the coronavirus crisis transformed the olefins industry? And can it navigate the challenging times ahead? Our team of energy, olefins and polymer experts discussed what to expect in an increasingly complex world at our recent Global Olefins Conference. In this article, we share a few key points from our presentations, including:

- The outlook for oil demand and the impact on refiners

- How the changing market affects liquid feedstocks

- The resilience of ethylene and propylene

- How the low oil price could support polyolefin markets in turbulent times.

Is an oil price recovery in sight?

The pandemic has taken a significant toll on the global economy. The recovery process will be slow, and we expect permanent scarring. Global GDP could be as much as 4.5% below what we forecast for 2025 in our pre-Covid economic outlook.

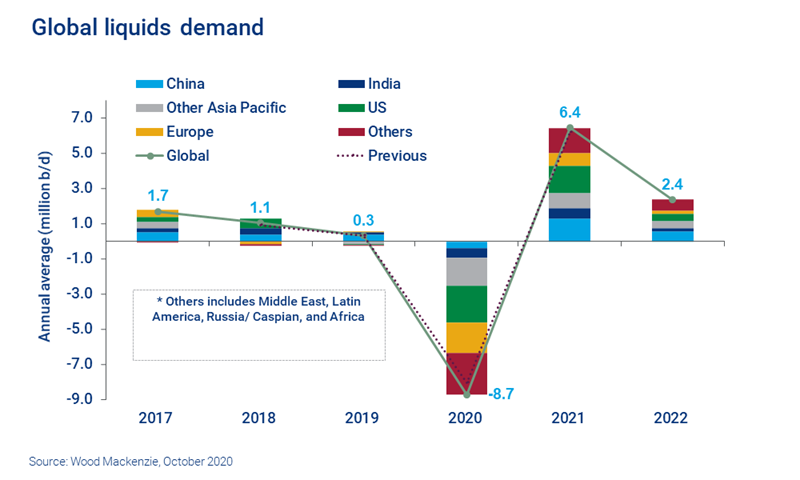

While oil demand was hit hard in April 2020 as coronavirus lockdown measures took hold across the globe, the outlook for 2021 looks brighter. We expect to see a 6.2 million b/d year-on-year rise in demand. However, it will take a few years to recover to pre-crisis levels.

Meanwhile, the steep drop in oil supply since April is re-balancing the market. Global supply will return to growth in 2021, but demand gains are expected to outpace it. That will have implications for the oil price’s recovery and a knock-on effect on feedstock prices in every part of the olefins value chain.

Refiners remian under pressure. Even before the coronavirus crisis removed at least two years of demand growth from the oil market, overcapacity was an impending threat to the refining industry. In response to the steep drop in oil demand, refining margins dropped to the lowest levels seen this century. While they should begin to recover over the next 18 months, margins will remain weak.