Connect four: key findings from the first four editions of Horizons

1 minute read

In January 2021, Wood Mackenzie launched Horizons, a series of monthly thought leadership articles designed to impart insights from our research analysts around the globe and inform discussion on key issues in the energy and commodity markets.

Four months in we thought it about time that we looked at some highlights.

January – Total eclipse: how falling costs will secure solar’s dominance in power

Over the next 20 years, we expect more than 4 terawatts (TW) of wind and solar power to come on stream globally, taking renewables’ share of the world’s power capacity to 30% from 10% today. Some 2.6 TW of this will be solar and it will get cheaper.

We expect solar costs to fall 15% to 25% over the next 10 years.

Based solely on technological improvements currently in the early to mid-stage commercial pipeline and assuming the likely phase-out of subsidies, we expect solar costs to fall 15% to 25% over the next 10 years. Silicon-based modules will remain the dominant technology, but become more efficient and gain higher power ratings. Trackers technology will continue to evolve, with new configurations and lower prices enabling greater energy capture. These cost reductions will be accompanied by the automation of the lifetime operation and maintenance of solar assets.

Solar already gives traditional forms of power generation a run for their money on the cost front. By 2030, we expect it to be the lowest-cost source of new generation right across the US, for instance.

What will this new level of cost competitiveness mean? Read Total eclipse: how falling costs will secure solar’s dominance in power in full.

February – Fast and furious: Europe’s race to slash emissions by 2030

If Europe is to cut its greenhouse gas (GHG) emissions to 55% below 1990 levels by 2030, dramatic changes need to be made this decade. The EU needs more renewable generation and a shift from internal combustion engines to electric vehicles. It also needs to step up the phase-out of coal and find ways to encourage energy efficiency and accelerate the electrification of buildings.

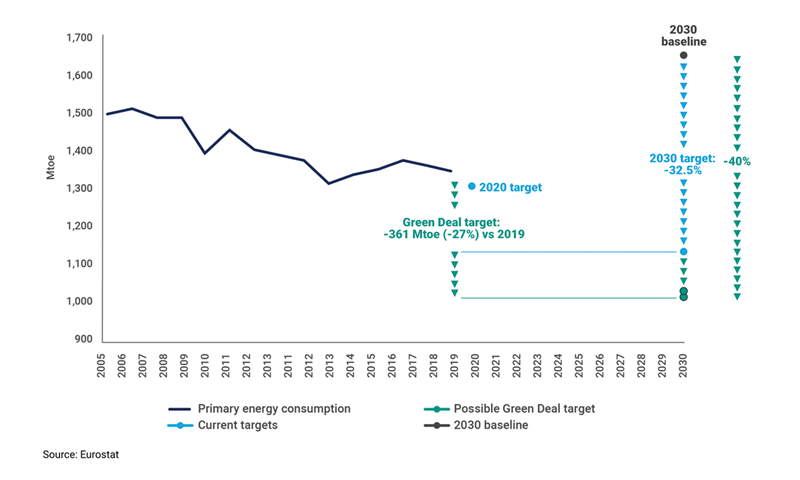

Europe has a mixed record in delivering energy savings and needs a rapid shift in trajectory

EU-27 primary energy consumption and energy efficiency targets.

Reforming the carbon market will be critical, especially for the hard-to-decarbonise industrial sectors, such as cement and steel. Though the EU Emissions Trading System (ETS) covers sectors that generate half of the bloc’s emissions – power, industry and aviation – they will only deliver a third of the cuts needed. Policymakers must provide the energy industry with more certainty on the future cost of carbon and the sectors that will be affected. What’s more, reform must come soon to spur investment in technologies such as carbon capture and storage (CCS) and low-carbon hydrogen.

All this means that there is an ever-growing list of investable opportunities. What are they? Read Fast and furious: Europe’s race to slash emissions by 2030 in full.

March – Tectonic shift: China’s world-changing push for energy independence

As with most developed economies, China is increasingly dependent on the rest of the world for its energy (other than coal) and metals. It is remedying that situation, however.

China’s goal of carbon neutrality by 2060 heralds the complete transformation of its economy and how it produces, transports and consumes energy. By winning the clean-energy race, China can cast off the shackles of external reliance and dominate the resources and technologies the world needs to decarbonise.

China’s pathway to carbon neutrality and impact on hydrocarbon demand

Read the full Horizons article for more on these scenarios.

Decisive government and private-sector efforts have put it well ahead of the game in virtually all clean-energy supply chains and technologies. Electrification is hitting its stride, underpinned by colossal investment in renewable generation. China dominates the supply and processing of most of the raw materials needed for batteries and other zero-carbon technologies. Three-quarters of global lithium-ion batteries, half of the world’s electric vehicles (EVs) and almost 70% of solar panels are made in China.

This is a major headache for much of the developed world. Why? Read Tectonic shift: China’s world-changing push for energy independence in full.

April – Reversal of fortune: oil and gas prices in a 2-degree world

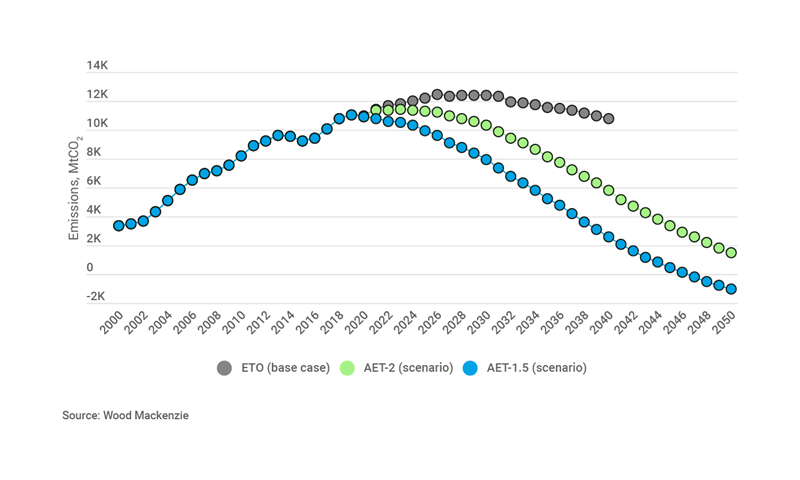

If the world cranks up its efforts to limit global warming to 2 °C, the consequences for the oil and gas industry will be severe. Under our accelerated energy transition, two-degree scenario (AET-2) to 2050, the energy market would be progressively electrified and the most polluting hydrocarbons squeezed out. Prices would come under pressure as demand fell and, in a ‘Copernican revolution’, the traditional relationship between oil and gas prices would be turned upside down.

To be clear, our AET-2 scenario is just that – a scenario – and not our base-case forecast. It envisions how one interpretation of the Paris Agreement could be achieved, based on our fundamental analysis across the natural resource sectors. Even so, the oil and gas industry cannot afford to be complacent. The risks associated with robust climate-change policy and rapidly changing technology are simply too great and the implications of a scenario akin to our 2 °C model are profound.

To find out more, read Reversal of fortune: oil and gas prices in a 2-degree world in full.

Don't miss out on the next edition

Horizons is a regular feature in The Inside Track, a weekly round-up of all the latest news and views from Wood Mackenzie's global experts. Fill in the form at the top of the page to sign up.