Find out how our Consulting team can help you and your organisation

The energy transition in the upstream oil & gas sector: a reality check?

Geopolitical, financial and technical headwinds have slowed energy transition progress, but ever-tighter climate regulation continues to drive change

7 minute read

Valentina Kretzschmar

Vice President Consulting, Climate Risk and Strategy

Valentina Kretzschmar

Vice President Consulting, Climate Risk and Strategy

Dr Valentina Kretzschmar has over 25 years of experience in the energy sector.

View Valentina Kretzschmar's full profileLast year was a pivotal one for climate disclosures. The International Sustainability Standards Board’s (ISSB) new standards and the EU’s Corporate Sustainability Reporting Directive (CSRD) climate disclosures have been adopted across dozens of jurisdictions around the world. While the mandatory climate regulation will increase the pressure on oil and gas companies to improve their reporting and ramp up their decarbonisation efforts, the question remains whether it will, or indeed should, have any impact on their traditional business models.

Geopolitical volatility and the recent focus on the security of energy supply have given the oil and gas sector some breathing space. There’s been general recognition that the transition is not going as smoothly as envisaged and that the world will continue to rely on hydrocarbons for the foreseeable future. In turn, this has reduced the twin pressures on oil and gas companies to embrace clean energy diversification and comply with climate disclosure requirements.

The decarbonisation challenge hasn’t gone away

The ESG bubble has been punctured, with increasing backlash against green policies and climate disclosures in both Europe and the US. The pushback against the Security and Exchange Commission (SEC) Climate Disclosures – more specifically, scope 3 disclosures in the US – illustrates the unwillingness of many US companies to take responsibility for their customers’ emissions, or the emissions arising from their supply chain. This sentiment is widely shared among oil and gas companies outside the US.

Oil and gas companies cannot afford to drop the ball when it comes to climate risk mitigation and energy transition strategies.

Valentina Kretzschmar

Vice President Consulting, Climate Risk and Strategy

Dr Valentina Kretzschmar has over 25 years of experience in the energy sector.

View Valentina Kretzschmar's full profileHowever, the ESG reprieve is likely to be temporary. The oil and gas sector remains unloved in the West, particularly in Europe, and the regulatory pressures will continue to ramp up. This means that oil and gas companies cannot afford to drop the ball when it comes to climate risk mitigation and energy transition strategies.

Creating pragmatic, viable pathways for decarbonising their scope 1 and 2 emissions, and transparent reporting on climate-related disclosures are fundamental steps all oil and gas companies must embrace. This will go a long way toward ensuring they remain investible, can attract the capital and talent they need and retain their social licence to operate.

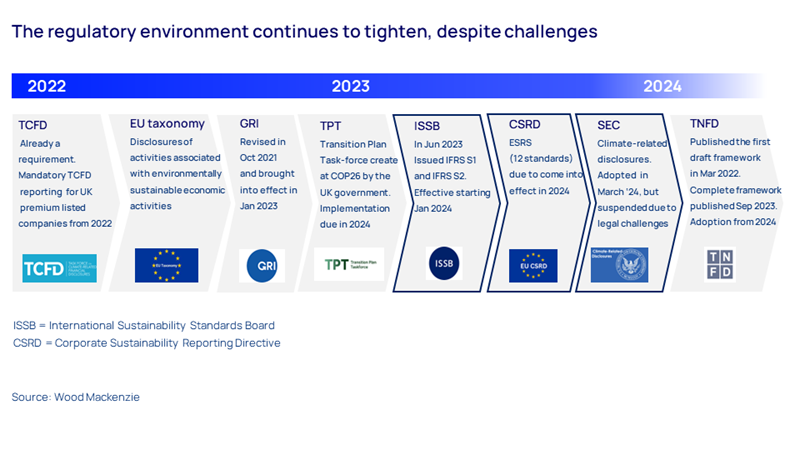

The regulatory environment tightens as mandatory climate disclosures are adopted

Climate regulation evolved rapidly in the wake of the Paris Climate Agreement, signed in December 2015, as the need to hold companies accountable for the impacts of climate change grew. The Taskforce for Climate-related Financial Disclosures (TCFD), introduced in 2017, provided an interim framework, which helped organisations prepare for mandatory climate disclosures.

The recent adoption of new, mandatory climate standards, including the ISSB’s IFRS S1 and IFRS S2 standards and the EU’s CSRD, will have a significant impact on companies’ reporting practices from January 2024. Auditors will become much more rigorous in the assessment of climate disclosures.

- IFRS S1 and IFRS S2 standards: published in June 2023 and endorsed by the International Organization of Securities Commissions shortly thereafter, the standards aim to provide a global baseline for climate reporting. The UK, Canada, Australia, Singapore, Japan and Nigeria were among the first countries to adopt these standards.

IFRS S2 standard will be the first one implemented. This climate standard is based on the TCFD framework, although it demands more depth on most required disclosures. However, companies that have already embraced TCFD reporting should not need to worry too much about transitioning into IFRS S2, as most of the ground will have been covered already.

- CSRD: defined by 12 ESRS standards, these represent a whole new level of climate reporting. CSRD was adopted by the European Commission (EC) in July 2023. The EC promised it would ‘gold-plate’ sustainability reporting, and it delivered. The CSRD reporting will not only affect EU-registered companies but also EU subsidiaries of non-EU parent companies. The CSRD aims to make non-financial reporting as important as traditional financial reporting, and of the same quality.

- SEC Climate Disclosures: based on the TCFD framework and the Greenhouse Gas Protocol, these were originally proposed in March 2022 and finally adopted in March 2024, only to be almost immediately paused, due to legal challenges. The backlash against the rules, especially among Republicans, makes it very difficult to predict if and when the SEC Climate Disclosures will be implemented, pending the US elections in November.

Geopolitical, financial and technical headwinds are slowing the energy transition

The increasing climate-related regulatory pressures are happening in the context of an extremely volatile global geopolitical environment, in which the security of energy supply and affordability are being prioritised. A combination of geopolitical tensions, macroeconomic pressures and technological challenges are making climate goals look increasingly unattainable.

Governments are beginning to recognise the shift away from hydrocarbons will take longer than they previously envisaged. No major country is on track to meet the Paris-aligned commitments. Solving the energy trilemma is now the main priority of governments, as they try to balance the security of supply, affordability and sustainability.

Worldwide, there are stark differences in opinion between the Western perspective on the energy transition and that of developing nations. This is especially true of countries with yet-to-be-exploited oil and gas reserves that are increasingly insisting on their right to develop these resources. That said, many developing countries in the Global South have already signed up to climate disclosures, including Brazil and Nigeria, which have adopted IFRS S1 and S2 standards.

Political and social polarisation also exists in those countries leading the climate initiative. No country illustrates this challenge better than the US, where climate has become a partisan issue. On the one hand, many Republican states are openly rebelling against financial institutions focused on ESG investing.

Furthermore, any future Republican administration is less likely to push for the adoption of the SCE Climate Disclosures. On the other hand, California has implemented some of the strictest climate-related standards in the world. (The May edition of Horizons explores the prospect of a delayed energy transition scenario in the US.)

Meanwhile, the IPCC estimates that global warming is now expected to reach 1.5 °C by 2034 if the world stays on its current trajectory. This timing is 11 years earlier than was estimated in December 2015, when the Paris Climate Agreement was first signed. This worrying outlook is driving the urgency for action by governments and regulators.

A dual-track approach is needed, with the old and new systems working together to achieve an orderly energy transition.

Valentina Kretzschmar

Vice President Consulting, Climate Risk and Strategy

Dr Valentina Kretzschmar has over 25 years of experience in the energy sector.

View Valentina Kretzschmar's full profileFor the development of new energy systems to be accelerated, further policy support, akin to the US Inflation Reduction Act, will be required to incentivise private investment in clean technologies. But the old hydrocarbon-based systems cannot be switched off, as long as we depend on them for energy security and economic growth. The decarbonisation of the old systems must be pursued in parallel with the development of clean technologies.

A dual-track approach is needed, with the old and new systems working together to achieve an orderly energy transition.

The ESG bubble is punctured, but sustainability is still deeply embedded

The backlash against the ESG agenda itself is intensifying, as the pushback against green policies and climate disclosures increases on both sides of the Atlantic.

‘Peak ESG’ was arguably 2021, when Covid and the ensuing crash in oil and gas prices fuelled the narrative around the shift to a low-carbon future. Then the energy crisis, triggered by the Russian invasion of Ukraine in February 2022, once again prioritised traditional energy systems. Skyrocketing oil and gas prices also meant that traditional energy companies outperformed in the stock market, as renewables’ performance suffered from cost inflation and high interest rates. The compounding effect of all these factors has punctured the ESG bubble.

Despite this, climate-related regulation, already embedded in many countries, has continued the push for the green transition. There is a strong consensus among key stakeholders in the energy business that, despite the energy transition hitting a bump in the road, it remains a megatrend, one that will continue to grow and accelerate once the global geopolitical situation steadies.

What does this mean for oil and gas companies?

Geopolitical volatility, including elections in more than 60 countries worldwide in 2024, is expected to continue disrupting the energy transition. The uncertainty around the pace of change in sustainability will persist until the global geopolitical and macroeconomic landscapes stabilise.

However, climate-related regulatory requirements will continue to drive change in the corporate sector, including oil and gas. Oil and gas companies, especially publicly-listed ones, will be under increased pressure to prioritise climate risk mitigation.

This does not necessarily mean that their business models need to change. Doing things better, rather than differently, will ensure companies remain on the right track for now.

Responsible stewardship of oil and gas resources must underpin the companies’ growth strategies.

Valentina Kretzschmar

Vice President Consulting, Climate Risk and Strategy

Dr Valentina Kretzschmar has over 25 years of experience in the energy sector.

View Valentina Kretzschmar's full profileOil and gas companies must develop practical and effective approaches to reduce their scope 1 and 2 emissions, while being transparent in climate-related disclosures. Responsible stewardship of oil and gas resources must underpin the companies’ growth strategies. However, will this be enough to continue attracting investors and talent, while maintaining their social license to operate?

Diversification into clean technologies could be a lever for oil and gas companies, but only if it makes commercial and strategic sense. Shareholders are unlikely to support broad-based diversification that significantly dilutes return.

Got questions about how the energy transition affects your business?

Our Consulting team provides bespoke, independent advice that helps our clients navigate critical challenges. Find out more about how we can help you make decisions with confidence, or contact us via the form at the top of the page.