Discuss your challenges with our solutions experts

From grey and brown to green and blue: low-carbon hydrogen in refining

A cost effective way for refiners to reduce their carbon footprint

1 minute read

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant has over 15 years of experience with a strong focus on the refining, crude oil and chemicals industry.

Latest articles by Sushant

-

The Edge

Getting China back on track

-

The Edge

Refining’s perfect storm passes

-

Opinion

From grey and brown to green and blue: low-carbon hydrogen in refining

-

Opinion

Refinery emissions: implications of carbon tax and mitigation options

The refining industry is coming under ever more pressure to decarbonise, and refiners will have to find cost-effective ways of reducing their carbon footprint while remaining economically viable. Here, low-carbon (green or blue) hydrogen can play an important role in helping to meet net zero carbon emissions targets in many countries.

Oil refining is one of the largest markets for hydrogen, accounting for about 32 Mtpa of hydrogen demand. Hydrotreating to reduce the sulphur content of finished products accounts for about half of refiners’ hydrogen demand, while hydrocracking to increase the yield of transport fuels accounts for another 40%.

However, more than 65% of refineries’ hydrogen demand is met by hydrogen produced as a by-product of refinery processes, notably gasoline, aromatics and ethylene production. By-product hydrogen is less likely to be replaced by low-carbon hydrogen, as units producing hydrogen are an integral part of refining and chemical sites meeting fuel and chemicals demand.

In Low-carbon hydrogen in refining: options and economics, we explore the replacement options and economics of switching from fossil fuel-based hydrogen to low-carbon hydrogen in an attempt to decarbonise. You can buy the full report in our online store, but read on for a brief outline.

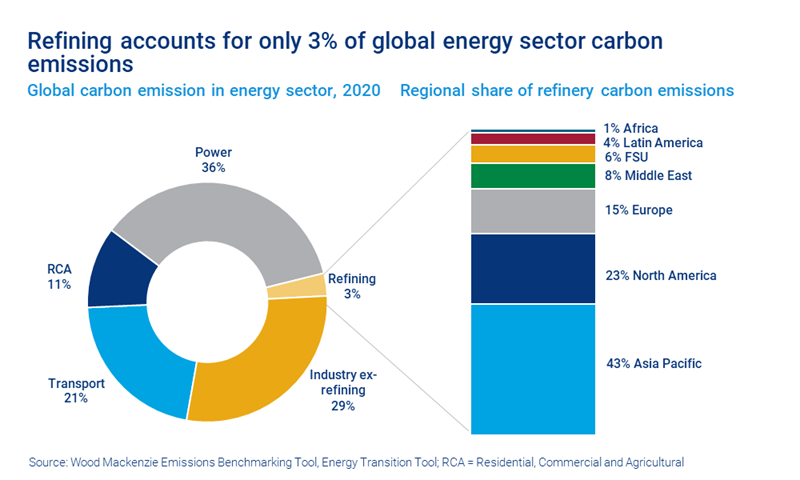

Asia Pacific the biggest refinery emitter

Refining accounts for just 3% of global energy-sector carbon emissions, with Asia Pacific the largest contributor. The region has 35% of global refinery capacity, but accounts for 43% of global refinery emissions. Fuel combustion, power and hydrogen are the major sources of refinery emissions.

Shortfalls in refinery hydrogen supply are currently met by on-purpose hydrogen production in refineries from natural gas and coal (grey and brown hydrogen, respectively), which equates to about 32% of refinery demand. On-purpose hydrogen accounts for about 10% of total refinery emissions. Asia Pacific – led by China – accounts for almost half of global carbon emissions from on-purpose hydrogen production.

Low-carbon hydrogen is only likely to replace on-purpose hydrogen if low-carbon hydrogen becomes cost competitive and policy support develops over time. The potential global market size for low-carbon hydrogen in this segment could be up to 10 Mtpa by 2050. Global refinery carbon emission could be reduced by up to 100 Mtpa, about 10% of overall scope 1 and 2 global refinery emissions.

Replacing fossil fuels in combustion applications to generate heat and steam could create a larger market for low-carbon hydrogen in refining. In this segment, the potential market for low-carbon hydrogen could be up to 40 Mtpa by 2050. Global refinery carbon emissions could be reduced by up to 300 Mtpa, or about 25% of overall scope 1 and 2 global refinery carbon emissions. Thus, the total potential demand for low-carbon hydrogen in refining could be up to 50 Mtpa by 2050.

Green hydrogen needs to be cheaper

Although combustion is a bigger market, green hydrogen needs to achieve a much lower cost to compete in combustion sector than that required to compete with on-purpose hydrogen. The cost of hydrogen is important to refiners, as it accounts for 10-25% of a refinery’s variable operating expenditure.

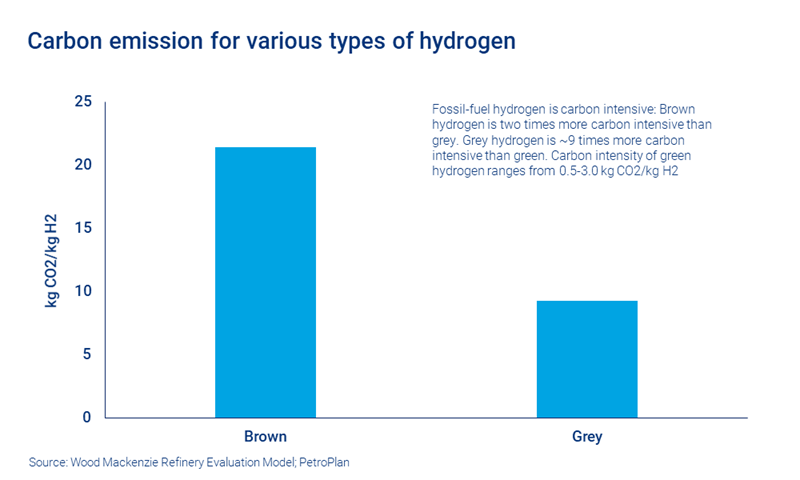

Alternatively (or in conjunction), a far higher carbon price would be required to make on-purpose hydrogen use less economical than green hydrogen. Fossil-fuel hydrogen is carbon intensive. Brown hydrogen is two times more carbon intensive than grey, while grey hydrogen is around nine times more carbon intensive than green. Higher carbon prices and emissions penalties could drive a shift to low-carbon hydrogen use as feedstock.

Volatility in the gas prices from events such as Russia’s war on Ukraine also brings considerable uncertainty to fossil fuel-based hydrogen costs. The shift to low-carbon hydrogen should grow as refiners reduce their dependency on the natural gas market to support energy security.

Support and incentives needed

In addition to the falling costs for low-carbon hydrogen and higher carbon prices, financial incentives and stronger policy support will be necessary to accelerate its production and stimulate demand in refining. Dedicated national hydrogen roadmaps will help grow low-carbon hydrogen’s penetration in many sectors.

From a cost and emissions perspective, a leap towards green hydrogen rather than blue is more likely in refining in the longer term. However, countries with low-cost gas resources and CO₂ sequestration capacity will have the opportunity to enter the blue hydrogen market.

Low-carbon hydrogen projects in refining are at very early stages of development. They only make up about 7% of the global hydrogen project pipeline. The replacement economics for low-carbon hydrogen rely heavily on coal, gas, carbon and renewable power prices, so are very refinery site and country specific.

To read our cost comparisons and delve into the detailed replacement economics of various types of hydrogen, buy the full report.