Sign up today to get the best of our expert insight in your inbox.

Refining’s perfect storm passes

Sharply weaker margins reflect stronger supply

4 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant Gupta

Research Director, Asia Pacific Refining and Oils

Sushant has over 15 years of experience with a strong focus on the refining, crude oil and chemicals industry.

Latest articles by Sushant

-

The Edge

Getting China back on track

-

The Edge

Refining’s perfect storm passes

-

Opinion

From grey and brown to green and blue: low-carbon hydrogen in refining

-

Opinion

Refinery emissions: implications of carbon tax and mitigation options

For consumers of oil products, lulled into a false sense of security by moderate fuel prices over much of the last decade, 2022 came as a shock. The war in Ukraine exposed the fragility of the global oil value chain, downstream in particular, with prices at the pump catapulted to record highs. Thankfully, the heat is now coming out of the market much as our global oil refining team – Alan Gelder and Sushant Gupta – had predicted. They shared their thoughts on how the market has adapted and the immediate outlook for refining margins and product prices.

Why did product prices spike?

Russia’s invasion of Ukraine sparked the perfect storm. A lack of investment in new refineries and the closure of older units during the pandemic had left the refining sector vulnerable to a supply shock. That threat became very real on the outbreak of the war. Self-sanctioning by companies that traded with Russia compounded the widespread fear in the market that Russian crude and product exports would be lost.

How high did prices get?

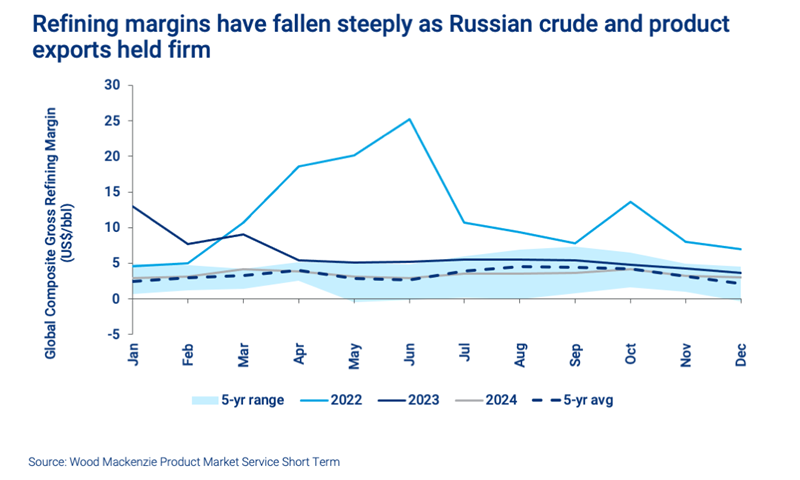

Refining margins rose to almost 10 times the five-year average. Wood Mackenzie’s global composite refining margin touched US$25/bbl in June 2022, another layer for consumers to absorb on top of the price of crude oil almost doubling.

There were significant regional variations around this core theme depending on inventories, access to crude feedstocks, products and refinery configurations. In Northwest Europe, diesel/gas oil traded at nearly US$60/bbl over Brent crude compared with a ‘normal’ US$16/bbl, while US monthly gasoline prices averaged almost US$40/bbl over Brent in the summer of 2022 compared with US$11/bbl before the crisis.

Who were the winners and losers?

US refiners were “money-printing machines’’ in 2022, refining contributing handsomely to record downstream earnings for independents and integrated corporates. Traders also made a killing in these exceptionally volatile markets. In contrast, soaring prices hit consumers’ pockets hard and added to governments’ growing concern about inflation.

What’s happened this year?

It’s all unwinding, with fuels markets tumbling back towards pre-war levels. Our global composite refining margin for April 2023 fell to the upper end of the five-year range, down 70% compared to the peaks of 2022, even dipping below the five-year historical average at times – a first since the invasion. The current downward pressure on margins may prompt refiners with simpler refining configurations in Asia and Europe to cut utilisation rates in the coming months.

Why have product prices fallen so far so quickly?

First, concerns in many quarters that Russian supply would dry up have not materialised. As we predicted in early 2022, Russia’s oil exports have managed to find alternative buyers, the biggest among them Turkey, India and China, which have seized the opportunity to import heavily discounted Russian crude. Russian products have similarly found their way into North Africa, Turkey, the Middle East and Latin America. Overall, Russian export volumes have remained steady despite the imposition of sanctions and bans.

Second, crude prices have fallen, with Brent trading just below US$80/bbl, well down from the US$123/bbl monthly peak of last June. A mild northern hemisphere winter led to lower-than-expected demand for heating fuels. The stuttering global economy and concerns around the US banking sector, US debt ceiling and China’s perceived slower-than-expected bounce-back from lockdown have all combined to weigh on market sentiment over the last few months.

Third, new refineries have been commissioned in the Middle East and China, which have increased refined product supply, particularly of diesel.

Is the squeeze in fuels prices over?

We think the extreme prices and volatility of mid-2022 are now in the past. The market has adapted well to new trade flows of crude and products. Importantly, the fundamentals have improved for consumers. Over 800 kb/d of new refining capacity came online late last year, and another 1.5 million b/d is scheduled to start up this year, including Nigeria’s giant Dangote refinery, commissioned this week. As a result, the market is much less vulnerable to any new supply shocks.

While there is always uncertainty as to the timing and ramp-up of new refineries, available capacity over the next 18 months should broadly balance against expected demand growth. That should mean refining margins stabilise in their historical range, though perhaps trending to below average into 2024. Refining profitability will be much lower in coming quarters, reflecting the fall in product cracks. High Middle East official selling prices will compound the margin squeeze for buyers of medium/sour crudes.

Global refining’s perfect storm in 2022 was short-lived and didn’t reflect a structural change in the market. The return of refining margins to historical norms this year is a story of Russia’s export resilience and global supply growth.

Of course, some of the calm in the markets could be ruffled by the robust growth in oil demand we are forecasting for H2 2023, something which many others are currently dismissing.