From ‘revenge spending’ to plunging exports, China’s path to economic recovery remains uncertain

China’s energy demand is growing again as the country emerges from lockdown, but export sector recovery still looks challenging

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

China’s consumers are back and ready to shop. Malls have now re-opened nationwide and are reporting rising trade. From high street chains to luxury brands, China’s retail therapy-deprived consumers are heading out and ‘revenge spending’ as they make up for months in lockdown.

This is no flippant observation. Long before the impact of coronavirus, China’s economy was already undertaking a massive realignment towards the service sector. In 2019, over 52% of China’s economic output came from services and this share is expected to continue to rise. China’s transition from a producer to a consumer will be one of the great economic transformations of the 21st century.

Services are also critical to the shape of China’s economic recovery from the coronavirus outbreak and to its near-term energy demand. Official Q1 growth contracted by 6.8%, though we still expect overall growth for 2020 to remain positive at 0.5%, with recovery beginning in the current quarter and strengthening through 2021. Services and construction will be critical to this and will drive the recovery in energy demand.

But not all sectors are performing as well. Figures released by the National Bureau of Statistics (NBS) last week indicate that the recovery is unbalanced. China’s export industries are being hit hard by the spread of coronavirus beyond China and the impending global recession. Exports account for almost a fifth of China’s GDP and drive a significant share of the country’s industrial energy demand. By implication, without a broader global recovery there can be no quick return to pre-crisis levels for many of China’s industrial manufacturers or their demand for energy.

Official data highlights the uneven pace of the recovery

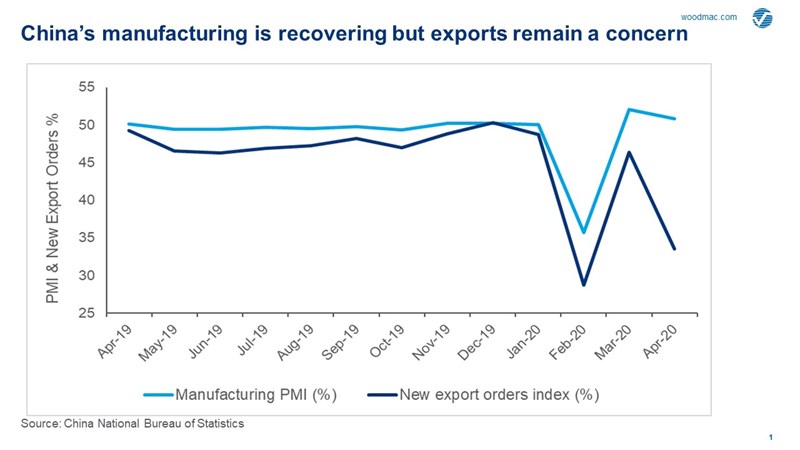

Looking for positives, the NBS’ purchasing managers’ index (PMI) for the manufacturing sector remained above 50 for the second month in a row in April, critical as anything above 50 indicates growth. But let’s not forget that PMI is only relative to the previous month, and with February numbers plunging, the recent recovery is relative. April’s reading in the low 50s also worries me that the bounceback may not be as strong as some think.

We also need to look beyond the headline PMI number. China’s recovery is uneven and being driven by the domestic consumption and hopes of government stimulus for sectors such as construction (which has been relatively limited to date as debt sustainability remains a critical issue in China). Meanwhile, data indicates a widening gap between investment to meet local demand versus that for the export sector.

In fact, China’s new export orders index fell dramatically in comparison to March, highlighting the reality of collapsing global economic growth as coronavirus has spread and strict lockdowns put in place worldwide. Virtually all of China’s major export markets are suffering, and we now expect the US and the Eurozone economies to contract by 4.9% and 6.7%, respectively, in 2020. For China’s export manufacturers, the worst of the downturn still lies ahead.

And an uneven impact on China’s energy demand

The initial signs of recovery in energy demand are positive. Power generation returned to normal levels in April, indicating that measures to stimulate the economy and the gradual end of lockdown are reviving demand. Nationwide, we expect that thermal coal demand will continue to see negative year-on-year growth through April and May, but the pace of contraction is slowing. Non-power demand for thermal coal remains soft, in part due to export weakness.

A clear beneficiary has been renewable generation, which has seen a significant uptrend with wind generation experiencing more than 10% growth year-on-year. We now expect higher and quicker renewable penetration through the remainder of 2020.

China’s oil demand is recovering from a shocking Q1, though our expectation of demand reaching 13 million b/d in Q2 still represents a 2.5% year-on-year decline. The end of lockdown has seen drivers returning to the roads with a vengeance (lots of congestion during the recent May Day holidays). This may be positive for gasoline and diesel but major restrictions on air travel and mandatory quarantine of international arrivals mean no real prospect of a recovery in jet fuel demand this year.

Domestic gas demand has held up remarkably well. Demand for March recovered to a similar level to 2019. And while total gas imports were flat year-on-year, March LNG imports rose by 4% over 2019 levels. With average landed LNG prices continuing to drop, China is on course to at least match April 2019 imports of 4.5 Mt. An extended heating season this year has helped, but as we move into summer the focus will shift to industrial demand strength.

The uptick in demand has helped reduce inventory levels at LNG terminals, supporting more spot purchasing as prices fall. We now expect China’s LNG imports to reach 14.2 Mt in Q2, up 6% over Q2 2019.

Focus will now shift from China to the global recovery

Closely watching China data is critical to understanding the global energy outlook. We now believe that the strength of domestic demand and government support for key sectors will allow China to return to growth from Q2 and into next year. But with the country emerging from an unprecedented quarterly economic shock in Q1, we also need to keep in mind how integrated China is with the global economy. It is unrealistic to expect China’s energy demand to achieve anything close to a full recovery while many of its key export markets remain in lockdown and, inevitably, recession.

APAC Energy Buzz is a blog by Wood Mackenzie Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.