Green metals: the journey to decarbonisation

What does the path to becoming greener look like for steel and aluminium, two carbon intensive industries?

1 minute read

By Edgardo Gelsomino, Head of Aluminium Research and Alex Griffiths, Principal Analyst Steel and Iron Ore.

The metals industry faces a dilemma: producers are under pressure to decarbonise. But at the same time, demand for commodities is rising.

If the goals of the 2015 Paris Agreement are to be met, the world needs more wind, solar, zero tail emissions electric vehicles, stationary storage and distribution. And each of those technologies relies on metals. At the same time, direct carbon emissions from metals producers must halve over the next 20 years to meet the 2°C limit set in Paris.

All carbon-intensive industries are firmly in the crosshairs. With the steel industry responsible for close to 10% of global emissions, and aluminium the second-highest of all the metals at 2%, both industries must make changes.

What does the journey to becoming greener look like?

We discussed this topic in a recent webinar: ‘What is the true carbon footprint of the metals we produce?’ Got 30 minutes? Fill in the form for a complimentary replay, and a copy of the presentation slides and charts. Got five minutes? Read on for a summary of the the journey to decarbonisation.

Cost of carbon a significant incentive

Until recently, CO2 emissions associated with iron and steelmaking have been cheap. Only steelmakers in Europe have felt the impact of carbon taxes. But now, environmental, social and governance – ESG – is higher up the investor priority list, and the cost of CO2 is rising.

The steel industry must eliminate 1.7 Bt of direct Scope 1 and indirect Scope 2 emissions over the next 20 years – or face a cost of US$191 billion each year in carbon taxes. That’s around a quarter of annual global steel revenues of US$800 billion in a good year.

Does aluminium earn its title as ‘the green metal’?

In reality, no metal can claim to be truly green.

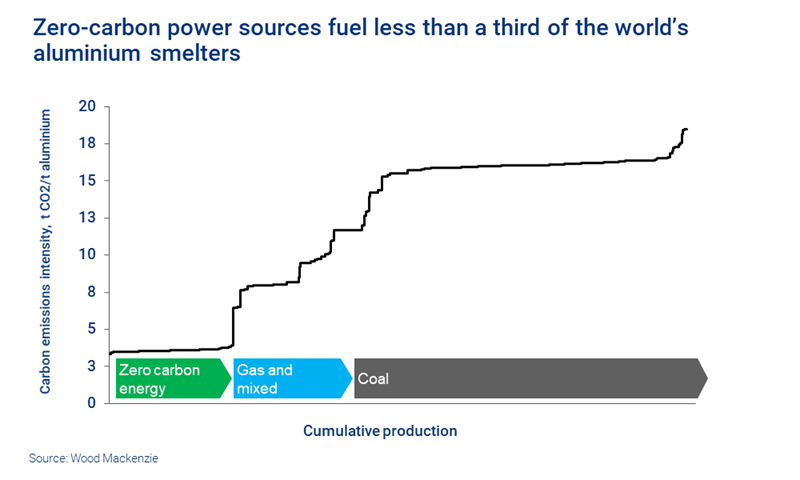

Despite being dubbed the green metal, aluminium is not carbon neutral when the entire value chain is considered. In our analysis, cradle-to-gate CO2 equivalent emissions range from 5-25 tonnes per tonne of metal produced.

As carbon policy evolves, aluminium has a lot to lose – as does steel – and the incentives to decarbonise are strong. If, and when, a global carbon tax is implemented, that would fundamentally shift the economics of the aluminium industry in favour of low-emissions production.

We’ve developed an emissions benchmarking tool that assesses cradle-to-gate emissions, from raw materials extraction to the cast house gate. This gives us a holistic view of the carbon footprint of aluminium production – and how producers might reduce it. Find out more about our Emissions Benchmarking Tool.

Where are the biggest pain points on the road to decarbonisation?

For aluminium, it’s the metal’s heavy reliance on fossil fuels. On average, it requires up to eight times more energy per kilogram than steel production. Making the shift to renewable power will be one of the biggest factors in reducing the industry’s carbon footprint.

And there is a long way to go: zero-carbon power sources currently fuel less than a third of the world’s aluminium smelters.

For steel, it’s at the mill: the blast furnace production process is fundamentally carbon-intensive. Coal is an integral part of the process. While its low cost allows the industry to operate at scale, emissions are unavoidable.

What does the journey to decarbonisation look like?

1. Recycling is the first logical step to reducing emissions

Increasing the use of scrap is the simplest way to decarbonise.

Electric arc furnace (EAF) production using scrap produces 30% of the Scope 1 and 2 emissions of blast furnace steel production. Likewise, aluminium produced from scrap uses a tiny fraction – 5% – of the energy that is required to make the primary metal.

But scrap is just one part of the solution. There are limits to the aluminium applications that can use scrap as feed. And only a small amount of scrap can be used in the steel blast furnace process. For EAFs, scrap metal isn’t always of the quality required, and there simply isn’t enough available to meet global demand. Improving collection infrastructure and recycling value chains will help.

Governments know that if they want to achieve carbon neutrality by 2050, a technological shift in steelmaking must be part of the energy transition.

Alex Griffiths

Director, Metals & Mining, Curated Services

Alex draws on his experience as a Resource Geologist to analyse and forecast global steel and iron ore markets.

Latest articles by Alex

-

Opinion

Green steel gets a boost from European economic recovery plans

-

Opinion

Tighter at the top: taking a look at the premium end of iron ore's two-tier market

2. Technological innovation will be crucial

Inert anode technology (aluminium electrolytic cells using none-carbon or inert anodes), green and blue hydrogen and carbon capture and storage are just some of the technologies that, once at more advanced stages of their development, will help both steel and aluminium to make significant strides to becoming greener.

Many of these technologies aren’t yet at a scale that is big enough to support these industries. But there are plenty of examples of investments in innovation.

The EU is set to be home to the world’s first fossil-free steel plant when Sweden’s Hybrit project starts late this decade, with the goal to have a completely fossil-free process by 2035. The plant will use hydrogen, direct reduced iron (DRI) and EAF technology that is powered renewably.

In Japan, coke oven gas hydrogen amplification and blast furnace injection, capable of reducing emission from blast furnaces by 30%, are being developed, and the new technology shows promise.

Over the coming decade, carbon capture, use and storage will play an essential role in green steel. It will be the only way to reduce steel sector emissions without completely rebuilding existing infrastructure before it reaches the end of its life.

And in the aluminium industry, various producers and research and development organisations are exploring inert anode technology. UC Rusal, Alcoa and Rio Tinto are developing or operating pilot cells, but none of them has yet reached commercial scale.

Nascent technologies will play a critical role in long term decarbonisation, but they will take decades to commercialise. Greater policy support will be needed to further incentivise their development.

Decarbonisation of the aluminium and steel industries is a colossal challenge that will take decades, not years.

Edgardo Gelsomino

Research Director, Aluminium

Edgardo has over 30 years' experience conducting research and advising stakeholders across the aluminium industry

Latest articles by Edgardo

-

Opinion

Can America smelt again?

-

Featured

Investment in new aluminium capacity needed to avoid supply crunch

Long road ahead to greener metals

While new technologies are maturing, a seismic shift away from traditional production methods will be a lengthy process. Every year, there is incremental progress. But decarbonisation for steel and aluminium is decades away.

Find out more

We explored this topic in a recent webinar, ‘What is the true carbon footprint of the metals we produce?’. Fill in the form at the top of this page for a complimentary replay that includes:

- How a global carbon tax would shift smelting economics

- Case study: how a change in raw material sources affected one Canadian smelter’s carbon footprint

- Presentation slides, including charts.