Discuss your challenges with our solutions experts

How badly did Hurricane Rafael hit oil & gas?

Intensifying hurricane activity in the Gulf of Mexico to present a growing risk to US oil and gas production

4 minute read

Emma Weng

Research Associate, Equity Insight, Short-Term Analytics

Emma Weng

Research Associate, Equity Insight, Short-Term Analytics

Emma models and analyses the US EV market, focusing on production levels, company efficiencies and creative efforts.

Latest articles by Emma

-

Opinion

How badly did Hurricane Rafael hit oil & gas?

-

Editorial

Tracking Tesla's revenue generator: the Fremont Factory

Miles Sasser

Senior Research Analyst, Upstream

Miles Sasser

Senior Research Analyst, Upstream

Latest articles by Miles

View Miles Sasser's full profileHurricane Rafael hit the Gulf of Mexico with force in early November, going down as the strongest November tropical cyclone in the region on record. So, what was the impact of Rafael on US oil and gas production?

Using data and insight from our Commodity Trading Analytics product suite, we were able to track the real-time impact of Hurricane Rafael on oil and gas production and how it fed through to markets.

A vulnerable region

The Gulf of Mexico is a hugely important region for energy resources and infrastructure, both onshore and offshore. According to the US Energy Information Administration, offshore production in the area accounts for 14% of total US crude production. However, from June through November it is also a hub of tropical cyclone activity. With hundreds of active oil and gas extraction facilities located in the area, production in the Gulf of Mexico is highly vulnerable to the impact of the hurricane season.

A history of disruption

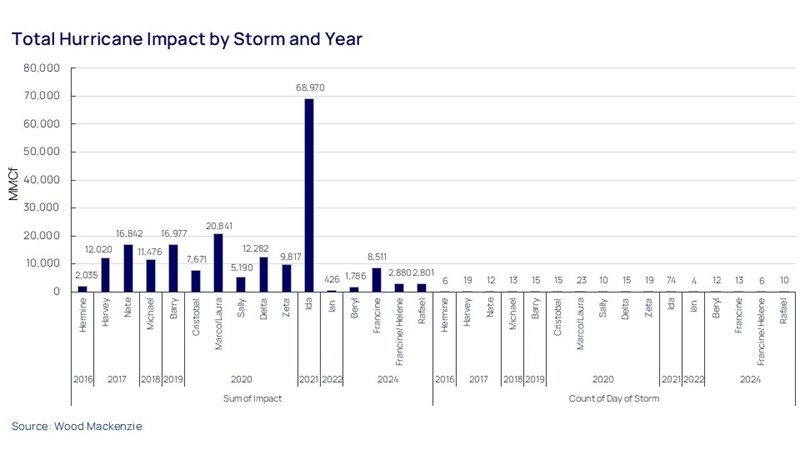

The most significant impact on upstream production was seen with Hurricane Ida, a category 4 hurricane that caused catastrophic damage when it made landfall in southeastern Louisiana in August 2021. Ida caused major disruptions to both crude oil and refined products supply and refiner demand for crude oil across the US Gulf Coast market. The aftereffects of the storm lingered for 74 days and resulted in over 68 billion cubic feet of lost gas production – dwarfing the impact of other hurricanes in the region (see chart below). However, a number of other storms, including Hurricanes Harvey (2017), Nate (2017), Michael (2018), Barry (2019), Marco (2020) and Delta (2020) have resulted in losses of over 10 billion cubic feet.

An intensifying issue

While the total number of tropical storms in the Gulf of Mexico has historically been fairly constant, 2024 has been a particularly hectic year for the region. In the space of two weeks in late September and early October, five hurricanes formed – not far off what would normally be expected over a whole season. What’s more, most experts agree that hurricanes in the Atlantic basin are becoming more intense over time, with higher winds and heavier rain provoking more severe storm surges.

A significant storm

Having never made landfall in the continental US, Hurricane Rafael failed to hit the headlines in the same way as Hurricanes Helene and Beryl. However, Rafael was classified as a major hurricane, and provoked 120 mile-per-hour winds, torrential rain and storm surges, affecting Panama, Costa Rica, Colombia, Jamaica, the Cayman Islands and Cuba.

Rafael emerged as a tropical storm on 4 November 2024, growing in intensity to become a hurricane early on 6 November. By later that day it had become a category 3 major hurricane, causing torrential rain and storm surges as it hit Cuba. Having diminished in strength as it passed over land, it re-intensified to a major hurricane again as it entered the Gulf of Mexico.

Precautionary measures

As the storm gathered on 4 November, Shell began taking precautionary measures. By the hurricane’s peak on 8 November, it had removed non-essential personnel from its Appomattox, Vito, Ursa, Mars, Auger, Stones, Enchilada and Salsa assets. It also announced shut-ins to pause operations at Salsa, as well as in the Conger field. Meanwhile, Garden Banks was evacuating all personnel from its South Marsh Island 76 platform. As the storm developed, dozens of offshore production platforms were evacuated.1

As the storm gathered on 4 November, initial forecasts indicated it may move north-westward in the Gulf of Mexico toward Louisiana. As a precautionary measure, producers pre-emptively began announcing shut-ins. Shell evacuated Appomattox, Mars, Vito, Ursa and Enchilada/Salsa, while BP’s Argos, Atlantis, Mad Dog, Na Kika and Thunderhorse platforms were also evacuated. Chevron shut-in most of its Gulf of Mexico production and development operations. At its peak, 41 platforms and 2 drilling rigs were evacuated.

The event was short-lived, however, and producers redeployed their personnel to the rigs beginning on 10 November.

Production impacts

At the height of the storm on 8 November, Gulf of Mexico gas production was down about 210 million cubic feet per day (mmcfd) compared to the previous week. Shut-ins peaked over the weekend of 9–10 November, with gas production cuts averaging ~470 mmcfd and reaching ~480 mmcfd by 11 November. Crude production losses also peaked at approximately 490,000 barrels per day (kb/d), including over 482,000 barrels shut in on Sunday, 10 November.

On the pipeline side, Sea Robin, which brings gas from the Ship Shoals area in the centre of the gulf to the central Louisiana coast, had reduced gas nominations for two days from 5 November. Meanwhile, Nautilus reported a power outage at its Ship Shoal terminal, resulting in reduced gas nominations starting from 11 November.

On Sunday 10 November more than a quarter of US Gulf of Mexico oil, and 16% of gas, was offline. By Tuesday 12 November, however, 97% of gas production and 90% of US Gulf crude oil was back to normal.

Impact on markets

The lower drilling activity due to Hurricane Rafael, coupled with the Fed's 7 November decision to cut interest rates by 0.25%, were supportive of US crude prices. However, prices quickly settled lower again as traders became less concerned about prolonged supply disruption. Had supply interruptions been more lasting, it could have been a very different story.

We expect intensifying hurricane activity in the Gulf of Mexico to present a growing risk to US oil and gas production. Tracking the real-time impact of storms on supply in the region will therefore be key to anticipating market moves.

Commodity Trading Analytics

Our Commodity Trading Analytics suite provides unparalleled real-time insights into crude oil and natural gas supply and demand, leveraging innovative data points and analysis. By combining proprietary data collection, advanced data science, and expert energy market analysts, we deliver cutting-edge real-time analytics services.