How will a global slowdown impact chemicals markets?

A strong correlation between GDP and plastics demand growth means that macroeconomic conditions have a significant impact on the chemicals industry

3 minute read

The chemicals industry has faced multiple headwinds in 2022, from ongoing Coronavirus outbreaks and lingering supply chain issues to the energy crisis provoked by the war in Ukraine. With demand already weakened, the risk of recession is a serious threat to the sector.

Our report, The global economy and chemical industry growth, sets out how evolving macroeconomic conditions could impact chemical markets. Fill out the form to access a complimentary extract, or read on for the answers to four key questions.

How does inflation affect chemicals consumption?

At a macro level, the key question for the global economy is how elevated inflation is kept under control and when it will peak. In the short term, inflation is likely to persist, resulting in decreased purchasing power for consumers.

For the chemicals industry, that means less demand for materials used in sectors such as car manufacturing and construction. These include engineering plastics, industrial fibres and other polymers.

What is the outlook for global plastics demand?

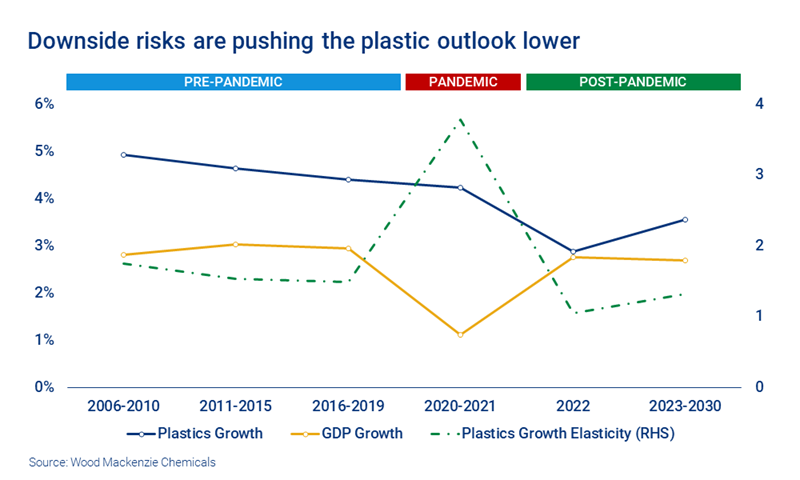

Our base case points to lower plastics growth in 2022, although this is relative to 2021 – a very strong year for the industry.

Prior to 2020, the increasing focus on services saw a significant slowdown in plastics demand from developed economies. However, this was partly offset by growing demand from China. In 2020, despite global GDP stalling, lockdowns lead to higher packaging consumption that bolstered demand. But in 2022, a return to more service-focused consumption patterns in the West is pushing the plastics outlook lower. At the same time, inflationary pressures are reducing demand from non-FMCG sectors.

Overall, we expect demand for plastics to continue to grow in 2022, albeit at a reduced rate of 2.9%, compared to 4.2% in 2020-21. Demand should then continue to rise slowly throughout the rest of the decade. However, should conditions deteriorate further, risks will become stacked to the downside.

What are the key downside risks for the chemicals sector?

Should macroeconomic conditions deteriorate further, lower consumption could stall chemical industry growth. The war in Ukraine has already sent Russian petrochemicals in alternative directions, while mounting disruptions to gas flows present a growing issue for chemicals plants.

A slowdown in property markets would also impact demand, while any resurgence in Covid-19 could result in new lockdowns that would affect supply.

Other issues that could affect demand include economic policy missteps, rising debt and bursting bubbles. Meanwhile, rising inflation could lead to labour unrest and strikes that would see renewed disruption to supply chains.

Which regions are most exposed to downside risk?

Risks are present across many parts of the world, although issues vary.

In Europe, the chemicals industry accounts for 35% of gas demand, so reduced gas supplies and higher prices are a major issue. In Russia, investments in the petrochemical industry are being undermined as foreign stakeholders suspend participation in projects.

In Asia, overall growth is resilient, but energy net importers including Sri Lanka, Thailand and Bangladesh have already slipped into recession. Meanwhile, in Turkey, export volumes are declining as exporters are obliged to convert 40% of receivables into volatile Turkish lira. Local producers are also suffering from a flood of highly discounted Russian product in the market.

What could affect future investment in the chemicals sector?

Large-scale investment in Asia Pacific means the industry is moving through a period of overcapacity that will last through to the middle of the decade. Risks around lower consumption, supply chain constraints and input costs are leading to increased uncertainty, and this could slow future investment. That could impact long-term industry plans around sustainability and decarbonisation.

The global economy and chemical industry growth includes a more detailed analysis of these themes, along with the implications for chemical industry earnings and future investment. Fill out the form at the top of the page to access a complimentary extract.