Inflation Reduction Act tailwinds – and other tales from the grid edge

Three key trends from the latest grid edge quarterly briefing

3 minute read

What are the hottest topics for the US grid edge right now? Each quarter our experts provide a comprehensive briefing, including updates and analysis of the key themes and ecosystem developments.

Read on for three highlights from the latest edition – or get it in full via our Grid Edge Service.

1. The Inflation Reduction Act (IRA) is providing a boost to all grid edge sectors

The IRA is making significant waves as one of the biggest energy sector public investment proposals in US history. Its presence is being felt across the grid edge.

The improved economics of commercial electric vehicle (EV) charging is a key benefit. The 30% investment tax credit (ITC) has been extended through 2032, and the restriction for a single charger per site has been removed. That creates an incentive that’s scalable to public charging stations, fleet depots and workplaces. The cap has been raised to US$100,000, and the credit can be combined with other federal and state measures – enabling massive incentive stacks.

The IRA also delivers a US$1 billion spur to public fleet vehicle electrification, with grants or rebates of up to 100% for electrifying state or municipal Class 6 or 7 heavy-duty vehicles.

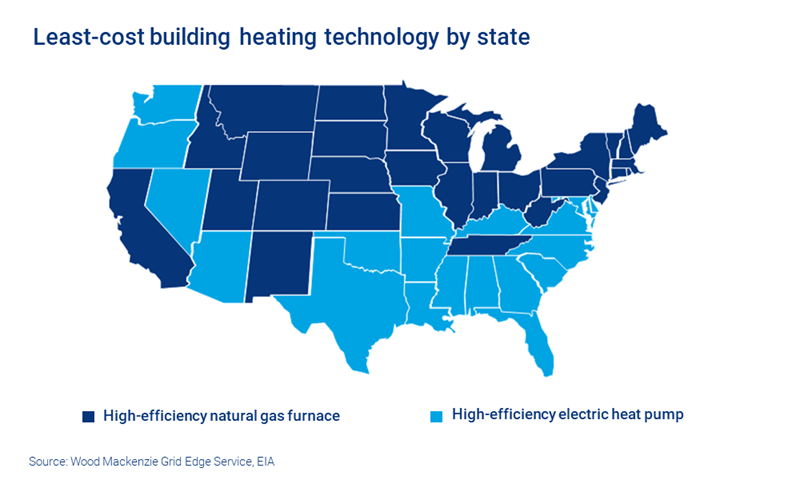

Elsewhere on the grid edge, the IRA incentivises widespread investment in building energy efficiency, offering homeowners up to US$14,000 in rebates for whole-home electrification. The economics of electrification are very location-dependent, however, and depend sensitively on the spread between retail electricity and fuel prices.

The IRA will also drive a rush to build fuel-based energy solutions – fuel cells, linear generators, CHP systems – including microgrids that incorporate these technologies. Projects whose construction begins before 2025 are eligible to claim an ITC for each of these technologies, including microgrid controllers.

2. Solar and storage microgrids are emerging as a viable resilience option at commercial and industrial sites

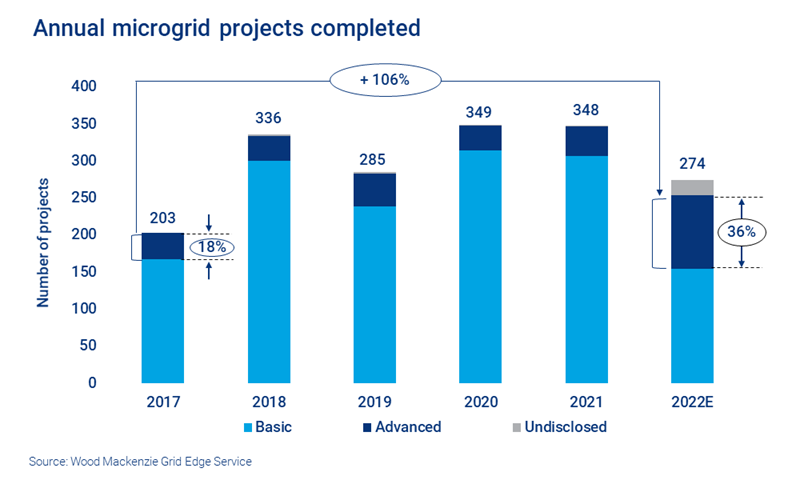

Solar and storage technologies are gaining traction as a resilience solution, reducing the dominance of generators. Advanced microgrids – those with multiple DER technologies – are on the rise, mainly because of solar and storage inclusion.

We’ve seen multiple projects of note in this space this quarter. Hitachi Energy, for example, was tapped by Nevada Vanadium Mining Corp. to set up microgrid and battery energy storage for their Gibellini mine. In the first phase of the development, Hitachi Energy will collaborate with M3 Engineering & Technology to design the mine’s energy system with 100% renewable energy.

Meanwhile, Bloom Energy is partnering with Ameresco to develop a solar and storage microgrid at a 450,000 sq. ft. Taylor Farms facility.

Solar and storage is also being relied on for increasingly critical use cases, from utility to military bases and hurricane evacuation sites. Ameresco, for example, is installing a microgrid as part of a US$140 million resilience and energy efficiency project for Joint Base McGuire-Dix-Lakehurst (JBMDL) – one of the largest federal solar PV deployments to date. And Duke Energy is developing a 3.5 MW solar plus storage microgrid at Pinellas County’s John Hopkins Middle School in Florida. The microgrid will keep the school running as a hurricane evacuation site, and support the grid during normal operation.

3. The developer channel business model is allowing distributed energy resource (DER) providers to deliver solutions at scale

Community-scale energy technology is more feasible for new developments than retrofits but does come with economic risks. Reliance on new construction leaves technology providers vulnerable to cyclical residential real estate markets. However, strong consumer interest in properties with energy-efficient and resilient technology could provide a buffer for both vendors and developers.

Partnerships between real estate developers or investment trusts and technology providers create benefits for both parties, as well as for homebuyers and renters. Expensive technology, such as community microgrids, virtual power plants (VPPs) and district heating systems can be bundled with home construction costs. Economies of scale can be delivered during the construction phase as complexity is removed from the project.

DER developers Sunnova, Sonnen and Tesla are, for example, entering such partnerships to deploy assets in new residential communities. This enables deployment at scale, along with the opportunity to deliver value-add capabilities, such as islanding and grid services.

Looking for more insight into the latest grid edge trends and technologies?

The Grid Edge Innovation Summit 2022 will bring together Wood Mackenzie experts with representatives from the leading distribution utilities, software technology developers, public utility commissions (PUCs) and distributed generation players in North America. Check out the agenda.