Discuss your challenges with our solutions experts

Which installers and battery vendors top the US distributed solar-plus-storage leaderboard?

As solar-plus-storage gathers momentum, a new leaderboard tracks the competitive landscape

4 minute read

Max Issokson

Research Analyst, US Distributed Solar

Max Issokson

Research Analyst, US Distributed Solar

Max supports research and data collection for our US Distributed Solar practice.

Latest articles by Max

-

Opinion

Tracking distributed solar and storage competitive landscapes

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

The state of US distributed solar-plus-storage

-

Opinion

US distributed solar and storage competitive landscapes shift in 2023

-

Opinion

Which installers and battery vendors top the US distributed solar-plus-storage leaderboard?

-

Opinion

Distributed solar-plus-storage holds much promise, but where does it stand today?

As a solar analyst, it’s increasingly hard to talk about distributed solar without mentioning storage in the same breath. Direct incentives for storage, transitions away from net metering, grid services opportunities and grid reliability concerns have fueled attachment rate growth. In Q3 2023, 11% of US residential solar and 5% of non-residential solar installations were paired with storage.

With these exciting changes underway, Wood Mackenzie is thrilled to introduce the US Distributed Solar-Plus-Storage Leaderboard to track competitive landscapes. Available each quarter via the US Distributed Solar Service and the Energy Storage Service, it provides rankings and market shares for solar-plus-storage installers and battery vendors. Read on for an overview of our first edition.

Competition heats up among residential solar-plus-storage battery manufacturers in the US

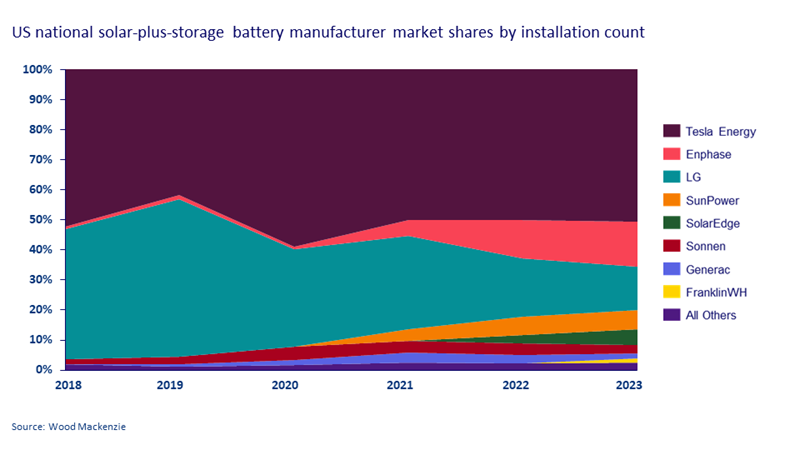

Tesla’s Powerwall and LG’s RESU line have been the most popular residential products over the past five years, holding 77% of the cumulative market from 2018 through Q3 2023. However, their dominance has recently come under pressure from new entrants. Whereas Tesla and LG products were installed on 96% of US residential solar-plus-storage projects in 2018, they made up 65% of installations in 2023 through Q3.

Established energy equipment companies such as Enphase, SunPower, Generac and SolarEdge have entered the market and carved out spots amongst the top seven manufacturers. Notable new entrants also include FranklinWH who, less than two years after launching their first storage project, ranks eighth among manufacturers nationally.

With more options on the market than ever before, battery vendors must differentiate through price, warranties, rate optimization software, ease of installation, inverter power levels, and other traits. Strategic relationships with installers will also play an important role in helping secure market share in the years to come.

Tesla, Sunrun and SunPower installed 55.3% of residential solar-plus-storage in the US so far this year

The residential solar-plus-storage installer market is far more consolidated than the residential solar installer landscape. The top five players in the former hold 59% of the market, while the top five players in the latter hold just 24%. Tesla claims the top spot in the residential solar-plus-storage rankings with a market share of 30.2% in 2023 through Q3 followed by Sunrun at 20.5% and SunPower at 4.6%.

These leaders have a few things in common. They are large players in the residential solar industry that have invested in storage for years, either in their own products or through relationships with vendors. And they have developed ambitious storage sales strategies. Tesla, for example, requires at least one Powerwall for each 7.6 kW AC of solar included in the backup circuit. This storage-as-the-default approach has led Tesla to take the top spot in the solar-plus-storage rankings despite trailing Sunrun by 9 percentage points in the latest residential solar rankings.

While the big players hold much of the market, we have also seen smaller installers build expertise in installing and selling storage. Installers such as Cinnamon Energy in California and Sun Valley Solar Solutions in Arizona appear in our ranking of the top 75 national players despite their smaller regional footprints due to their focus on selling storage. As favorable solar-plus-storage policies grow, there’s much potential for regional installers to develop storage expertise and gain market share.

We’re also closely tracking how the Net Billing Tariff in California will impact market shares. As the tariff is implemented, we expect storage attachment rates to grow, giving installers with more experience selling and installing storage an advantage.

Early signs of this trend emerged in Q2 to Q3 2023. When the attachment rate in California rose from 7% to 13% over this time, Sunrun’s California market share climbed from 20% to 27%, signaling early success for the company in selling their non-backup ‘Shift’ product designed to optimize savings under Net Billing. It will be interesting to see how the big players continue to perform as solar-plus-storage continues to grow.

The commercial solar-plus-storage landscape remains limited to a few key markets

Commercial solar-plus-storage remains limited to a few key markets with direct storage incentives. New York, Massachusetts and California have accounted for 60% of installed non-residential storage-paired solar capacity nationwide since 2018.

Given the ’lumpy’ nature of non-residential solar installations (large projects distributed over several quarters), the first edition of the distributed solar-plus-storage leaderboard ranks non-residential installers by their cumulative installations since 2018. Unsurprisingly, the leading installers have strong footholds in the key markets mentioned above.

Borrego leads with 20% market share driven by strong installations in California and Massachusetts. Nexamp follows with a market share of 7% fueled by their installations in Massachusetts and New York. And American Renewables Construction comes in third with a market share of 6.8% from projects in Massachusetts.

With Borrego having spun off its distributed solar business (which formed the early-stage developer New Leaf), and new market opportunities emerging with favorable storage policies, we expect much quarter-on-quarter variability and opportunities for shakeups in the commercial installer rankings.

Find out more about the US distributed solar landscape

Our US Distributed Solar Service provides in-depth residential, commercial and community solar market analysis.