US distributed solar and storage competitive landscapes shift in 2023

Top residential solar installers see market shares decrease

5 minute read

Max Issokson

Research Analyst, US Distributed Solar

Max Issokson

Research Analyst, US Distributed Solar

Max supports research and data collection for our US Distributed Solar practice.

Latest articles by Max

-

Opinion

Tracking distributed solar and storage competitive landscapes

-

Opinion

RE+ 2024: Our 7 biggest takeaways

-

Opinion

The state of US distributed solar-plus-storage

-

Opinion

US distributed solar and storage competitive landscapes shift in 2023

-

Opinion

Which installers and battery vendors top the US distributed solar-plus-storage leaderboard?

-

Opinion

Distributed solar-plus-storage holds much promise, but where does it stand today?

The US solar industry had a strong 2023. The total market increased a remarkable 51% from 2022, with 32.4 GWdc of capacity installed. All segments set record annual installation volumes except for community solar, which was within 5 MWdc of an annual record.

Solar-plus-storage also saw growth. Residential solar-plus-storage deployments came in 13% above 2022 volumes, with nearly 106,000 projects installed. In the non-residential segment, 5% of solar installations were solar-plus-storage (up from 4.5% in 2022).

2023 was not without obstacles for industry players, however. With high interest rates, permitting and interconnection delays, and falling module prices, installers and equipment manufacturers faced unique challenges even in a growth environment.

In Wood Mackenzie’s quarterly US PV Leaderboard and US Distributed Solar-plus-storage Leaderboard, both available via the US Distributed Solar Service, we rank the top solar installers and equipment suppliers. Read on for an overview of our key findings from 2023. You can also fill in the form for a complimentary copy of the 15-page executive summary of our US solar market insight 2023 year in review.

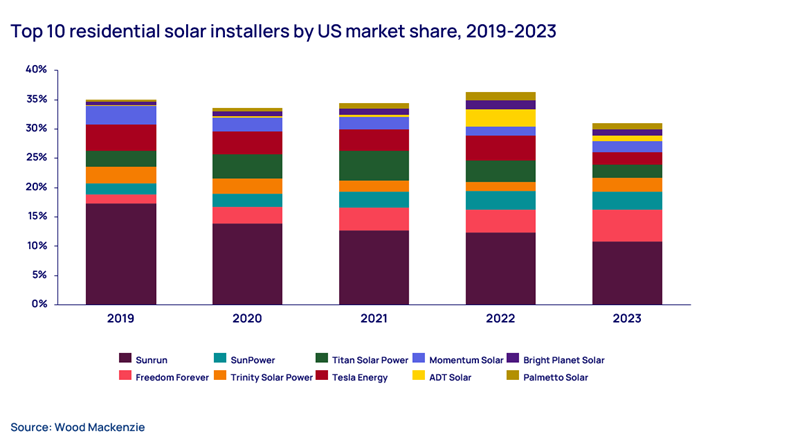

Seven of the top ten residential solar installers lost market share in 2023

While the residential segment grew by 12% from 2022 with 6.8 MWdc installed, this growth was largely supported by installation backlogs from a robust year of sales in 2022. This backlog was especially large in California, where Net Billing Tariff demand-pull in drove growth in 2023. Outside of California, customer acquisition costs, rising interest rates, and consumer hesitancy challenged the industry.

2023 was a tumultuous year for many of the nation’s leading installers. Tesla, ADT Solar, and Sunrun lost 2.2, 1.9, and 1.5 points of market share from 2022, respectively. In Q1 2024, ADT announced it would exit the solar business, citing operational difficulties and macroeconomic headwinds as key challenges. Throughout the year, Sunrun and Tesla saw declining deployments, and anecdotal evidence suggests that they increasingly rely on subcontractors for installations. The only top 10 residential solar installers to gain market share in 2023 were Freedom Forever (ranked #2), Trinity Solar Power (ranked #4), and Momentum Solar (ranked #7).

While the top ten installers combined for 31% of the market compared to 36% in 2022, we expect consolidation in 2024. Bankruptcy announcements from 2023 will impact 2024 installation data. Furthermore, with a forecasted 13% contraction for the residential solar market in 2024 driven by high interest rates and California’s net billing transition, more long-tail installers are at risk of going out of business.

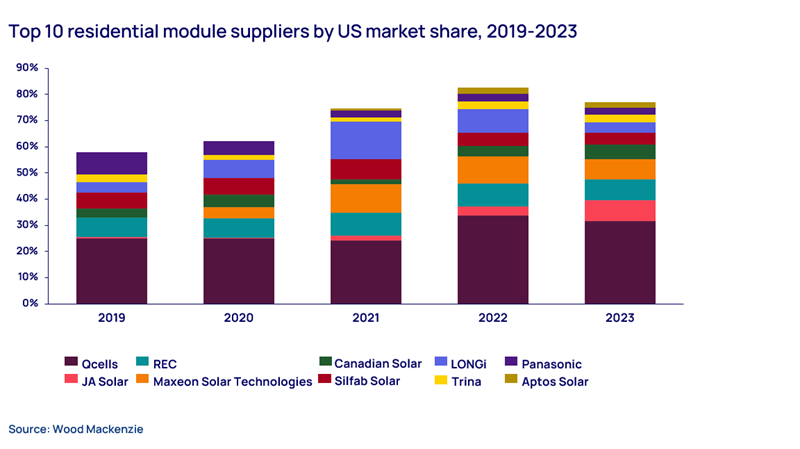

Oversupply and UFLPA enforcement shape 2023 residential module supplier market

2023 saw massive decreases in residential module prices. Oversupply was driven by increasing module imports and a slowdown in residential solar deployments. The low-price environment had a clear impact on premium module suppliers Qcells and Maxeon Solar Technologies. Both companies experienced market share declines of over 2 percentage points compared to 2022.

Uyghur Forced Labor Prevention Act (UFLPA) enforcement also played an important role in shaping 2023 market shares. Companies that faced less scrutiny like JA Solar and Canadian saw significant market share increases, while companies receiving the more intense scrutiny, like LONGI, suffered losses. JA solar saw its market share climb from 3.4% in 2022 to 8.2% in 2023 to claim the #2 spot among residential module suppliers. Similarly Canadian Solar gained 1.3 points of market share from 2023, marking its second consecutive year of market share growth. LONGi, however, saw its market share fall nearly 5-points from 2022.

A variety of residential storage products challenge Tesla’s dominance

In 2023, Tesla maintained the #1 spot in the residential solar-plus-storage battery supplier rankings. With a 47% market share, the company commanded a compelling 30-point lead over second-ranked Enphase. Tesla looks to build on this lead in 2024 with its new Powerwall 3.

However, opportunities remain for long-tail suppliers to carve out market share. As a wider array of customers with different needs choose to adopt storage, installers can no longer take a one-size-fits-all approach. Some residential installers in California have stressed the need to have different batteries on hand. Battery sizes, AC and DC coupled configurations, whole home-integration capabilities, and other differentiating traits provide opportunities for specialized products to capture market share.

Nexamp, Summit Ridge Energy, and CS Energy top community solar rankings

It’s been a year since Wood Mackenize first added community solar rankings to the US PV Leaderboard. And, for the second consecutive year, Nexamp claims a spot among the top three national installers, with a first-place finish in 2023. Their 9.1% 2023 community solar market share represents a 5-point increase from 2022. Summit Ridge and CS Energy follow Nexamp in the rankings with 4.8% and 4.3% market share, respectively.

While many of the top installers are familiar companies, the community solar market holds much opportunity for new entrants. More than half of the top 75 installers in 2023 did not have any community solar installations in 2022, and 28 of the top 75 installers had their first community solar installation ever in 2023.

The opportunity for new entrants is especially exciting given the potential expansion of community solar to new state markets. We continue to track proposed legislation in Midwest states such as Ohio, Wisconsin, and Michigan, as well as Pennsylvania, where pre-development pipelines are currently upwards of 1 GWdc.

The community solar leaderboard is especially volatile because of varying interconnection timelines and project sizes. In 2023, interconnection queue delays in many mature markets held up installations. With our data based off interconnection dates, installers with strong pipelines may see uneven market shares or large quarter-over-quarter changes that do not reflect steady development work. This unevenness is furthered by the fact that community solar projects are large (average size was 1.8 MWdc in 2023) and one or two key installations can significantly change market rankings.

Additional key findings from the latest Leaderboard include:

- Enphase secured the top spot in the residential inverter supplier rankings with a market share of 54.7%. In 2023, the top five residential inverter suppliers represented 96% of the market.

- CS Energy, Nexamp, and PowerFlex topped the commercial solar installer rankings, securing a combined market share of 11.5%.

- In the commercial solar-plus-storage rankings, CS Energy, Agilitas Energy, and REC Solar (ArcLight) led with a combined market share of 37%.

- SMA maintained the #1 commercial inverter supplier ranking for the second consecutive year. Its market share rose from 22.4% in 2022 to 28.5% in 2023.

Learn more

Got questions about the US PV Leaderboard or the US Distributed Solar-plus-storage Leaderboard? Learn more about the US Distributed Solar Service.

You can also fill in the form for a complimentary copy of the 15-page executive summary of our US solar market insight 2023 year in review.