Three key takeaways from Europe Gas and Power Markets Short-Term Outlook Q3 2023

European gas prices will remain volatile through the winter, but low gas demand could see 20% European gas price fall in summer 2024 compared to the current forward market

3 minute read

Mauro Chavez

Director - Americas Gas and LNG markets Consulting

Mauro Chavez

Director - Americas Gas and LNG markets Consulting

Mauro has more than 14 years of experience and is a recognised specialist in the natural gas and LNG industry.

Latest articles by Mauro

-

Opinion

Three key takeaways from our Europe gas markets short-term outlook Q1 2024

-

Opinion

Europe gas and LNG: 6 things to look for in 2024

-

Opinion

Three key takeaways from Europe Gas and Power Markets Short-Term Outlook Q3 2023

European gas prices will remain volatile through the winter, but low gas demand could see 20% European gas price fall in summer 2024 compared to the current forward market.

However, the market might tighten again in 2025 as LNG supply growth remains limited. Our latest report, Europe Gas and Power Markets Short-Term Outlook Q3 2023, details the data.

Read on for three key takeaways from the report and fill in the form to download an extract from the full report.

1. The outlook for winter 2023 remains volatile

Europe will start the winter with storage levels at least 96% full, with also around 2 bcm available from gas stored in Ukraine. However, the outlook for winter remains finely balanced and prone to volatility. We anticipate demand will be 13 bcm higher than winter 22/23, under normal weather conditions, while limited LNG supply growth and increasing LNG demand in Asia will result in lower LNG availability for Europe. Our expectation is that Europe will end the heating seasons with storage levels at 47% full. While this this a lower level compared to last year (55%), it is still relatively high and well above the 5-year average (35.3%).

Uncertainties around Norwegian production and strikes in Australia continue to add pressure to prices. However, the biggest risk remains the weather, with current forward prices incorporating the risk of limited supply available in the case of a cold winter.

If the winter was going to be extremely cold winter as in 2011, we estimate demand would be more than 20 bcm higher across Europe, risking storage levels to be as low as 26% by March 2024. Under this extreme scenario, prices would spike well above US$20/ per million British thermal units (mBtu).

However, predictions of an El Niño year are increasing the likelihood of a warmer-than-usual winter in Asia and Europe. Under this scenario, prices could be much lower than the US$15/mBtu winter average that the current forward curve suggests

2. Summer 2024 prices could be 20% than the current forward curve

We anticipate a well-balanced European market through summer 2024.

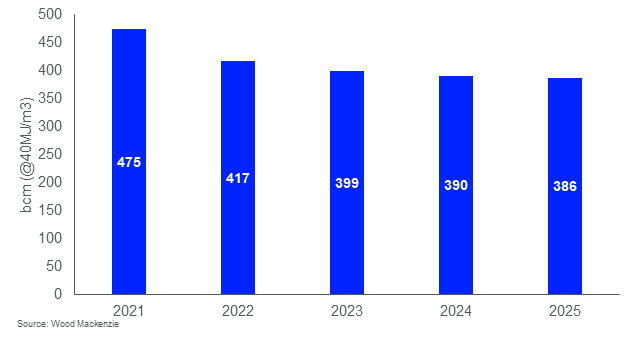

Supply availability will be similar to that of 2023, but we anticipate further reduction in gas demand, particularly in the power sector. The sector is set to absorb up to 60 GW of new solar/wind capacity. And with a rebound of nuclear production in France, combined with still relatively weak electricity demand, gas demand could be 14 bcm lower in 2024 compared to 2023.

As a result, we anticipate storage to reach 96% capacity by the end of October 2024. This could see prices falling 20%, or $4 mBtu, throughout next summer, compared to market expectations in the current forward price curve.

3. 2025 market dynamics and beyond

We foresee renewed pressure on the market in 2025.

The forward market is pricing in a market softening in 2025 on the expectations that more LNG supply will be available for Europe. However, we think this is overplayed as it will take time for supply to ramp up, while LNG demand in Asia will increase. As a result, we anticipate less LNG availability for Europe in 2025, compared to 2024. Additionally, Russian exports through Ukraine will be stopping as the transit agreement expires, reducing exports to the EU by 6 bcm, discounting an upside of 3 bcm in flows through Turkstream string 2. Our analysis suggests that storage levels will be reaching “only” 90% by the end of October 2025. This is a lower level compared to previous years and will result in upward pressure on prices.

Europe Gas demand*

*excluding Turkey and Ukraine

Fill in the form at the top of the page to download an extract of the full report.