Discuss your challenges with our solutions experts

Major Chinese companies leading the charge in renewed Belt and Road push

Two Chinese NOCs have each acquired a 10% stake in Novatek’s Arctic LNG-2 project. What’s the significance of these deals for China's Belt and Road Initiative?

1 minute read

At China’s second Belt and Road Forum for International Cooperation, held in Beijing in late April, China National Petroleum Corporation (CNPC) and China National Offshore Oil Corporation (CNOOC) announced they had each acquired a 10% interest in Novatek’s Arctic LNG-2 development.

By volume, this marks the largest overseas M&A deal made by Chinese NOCs since 2013.

The Belt and Road Initiative (BRI) has been much maligned in Western press. But it is not well understood – particularly when it comes to energy.

What does the investment in the Arctic mean for the future of the initiative? And what role will Chinese NOCs play?

Renewed Belt and Road focus

The announcement is a clear signal that Chinese NOCs are taking a lead role in advocating for the BRI at an enterprise level.

Energy investments, with their huge levels of infrastructure spending, are an important aspect of the BRI. The Belt and Road Energy Partnership, which was signed by 30 participating countries at the April forum, shows that energy projects will be a key focus going forward.

China’s appetite for power continues to grow, and with imports an expensive necessity, energy security is high on the agenda. Currently, China imports more than 60% of domestic demand for oil, gas and iron ore.

As such, BRI-branded LNG investments such as this one come as no surprise and tick several boxes for the NOCs.

You might also like:

- China's energy markets feel the squeeze

- China's economic slowdown: three reasons why it's different this time

Why Arctic LNG-2?

The investment in the Russian project is a strategic move for China for a variety of reasons.

1. It feeds China’s need for LNG

China is the world’s second-largest LNG market and needs to secure supplies fast. Russian LNG helps meet China’s growing gas demand, diversifies import routes and strengthens bilateral ties with an important neighbour.

2. China needs a BRI success story

The success of Yamal LNG has emboldened China to invest in similar opportunities. China is searching for the next Yamal to showcase the BRI’s achievements.

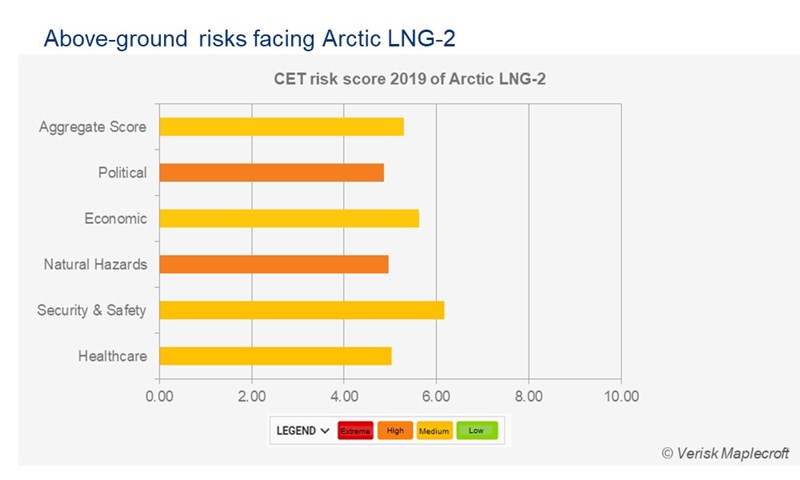

Verisk Maplecroft’s Corporate Exposure Tool (CET) scores the risk profile for Arctic LNG-2 as similar to Yamal LNG. Both projects are categorised as medium risk across a majority of political and operational risks, in contrast with CNPC's higher risk global upstream portfolio.

3. It shows China can manage large-scale projects

Arctic LNG-2 will allow China’s energy industry to prove it has the industrial and management capability to handle mega-projects. Having this project as a proof-point will also support China’s ambition to transform itself into a global manufacturing leader.

Projects in remote places such as this one are inherently risky. But Novatek has been laying strong foundations for success. Listen to our experts discuss the outlook for Arctic LNG-2 now that the Chinese NOCs are on board.

While Russia’s 'Pivot to the East' is in full swing, investing in Arctic LNG-2 is a way for Beijing to cultivate goodwill in the Kremlin, strengthening Sino-Russian oil and gas strategic cooperation.

4.Cultivating goodwill with Russia

The investment will help to cement bilateral relations in a year when Russia will sell its first gas to China through Gazprom’s Power of Siberia project.

5. Opening the Polar Silk Road

The project offers China a legitimate reason to expand activities in the Arctic, in line with the idea of the Polar Silk Road, which aims to expand Arctic shipping routes and grant non-Arctic states a bigger say in the governance of the region.

Risks ahead as NOCs look abroad for growth

China’s appetite for energy will continue to grow, and security of energy supply remains high on the agenda. We can expect the NOCs to push ahead with further investments in energy projects under the BRI banner.

Most of the countries along BRI routes rank as medium or high risk in our sister company Verisk Maplecroft’s Political Violence Index for 2019. Political violence, terrorism, conflict and civil unrest are major concerns.

There are added fiscal pressures in countries such as Russia, Tanzania and Saudi Arabia, where companies could face stronger local content requirements and changing contractual terms.

The Belt and Road is an ambitious cross-border development project. Working across multiple host countries can increase the risk of project delays due to weak contract enforcement and regulatory delays.

Where could Chinese NOCs make their next investments? Purchase the full report by Verisk Maplecroft Senior Analyst Kaho Yu, written in conjunction with Wood Mackenzie's Angus Rodger, Fu Feng and Gavin Thompson.