1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

The Chinese energy companies we met were noticeably concerned that without a swift resolution, the effect on business will be material – in all sorts of ways.

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Upstream’s mounting challenge to deliver future oil supply

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

US upstream gas sector poised to gain from higher Henry Hub prices

Beijing is an adrenaline rush, each visit a chance to be dazzled by this 21st-century city as it's being built before your very eyes. The stellar economic growth this past decade isn’t just visible, it’s palpable. Yet strange things are happening, as I witnessed on a trip last week with Gavin Thompson, Vice Chairman, Asia Pacific Research. No queues at the notoriously seething Beijing Capital airport on the way into the country and out. Arriving early for meetings, no sign of the clogging traffic congestion that invariably dictates logistics.

What is going on? Gavin and I chewed the fat on the economy, the implications for commodities and challenges for the energy industry.

The trade dispute with the US?

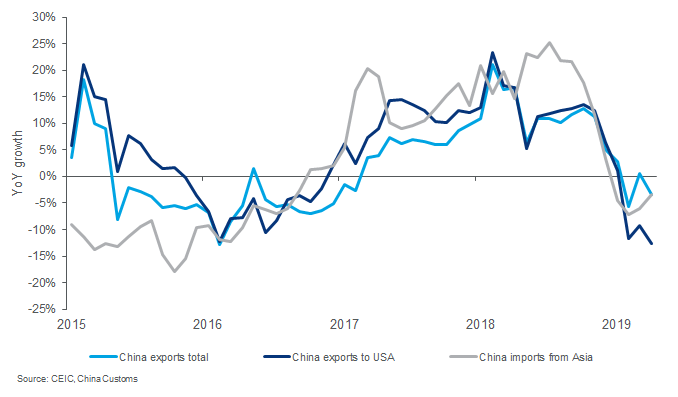

The economic data supports the anecdotal evidence. Ever wary of official GDP numbers, like Premier Li Keqiang, we see electricity demand data as a less ambiguous barometer. The pace of power demand growth is slowing, 3.8% down on last year through May. Trade growth ground to a halt within months of the US imposing tariffs worth US$32 billion on imports from China last summer. The impact of the latest tariffs targeting US$200 billion of goods will be that much bigger. The Chinese energy companies we met were noticeably concerned that without a swift resolution, the effect on business will be material – in all sorts of ways. We have a scenario where Chinese GDP is 100 basis points lower at 5.1% in 2019 and 4.9% in 2020.

The effect of a slowing economy on commodities?

The Chinese economy has changed since the last recession a decade ago – it’s bigger, and services now represent a bigger proportion of it. Yet China is still the biggest market for seaborne commodities. We think coal and oil will be more affected than gas if we see a steeper slowdown. In our scenario for 2019/20, Chinese thermal coal demand falls 79 Mt; oil demand by 0.2 million b/d wiping out half of annual growth. Weaker Chinese oil demand would only add to the burden of OPEC+ in its efforts to manage supply and support price.

What about LNG?

China’s LNG market remains vibrant, buyers jockeying to secure new volumes for the medium to longer term. There’s still healthy growth this year even though LNG demand may ‘only’ rise 9 Mt, down from the record 16 Mt last year (storage playing a part). Government policy on air quality and lower carbon intensity is bullish for gas demand growth, and it won’t all be met by domestic production and piped imports. We expect LNG demand growth to return to double digits in the coming years.

And US LNG imports?

China’s 25% tariffs price US LNG out of the market, forcing US projects to look elsewhere. This is frustrating for both sides since US sellers and Chinese buyers should be pushing ahead on deals right now. The Chinese want the flexibility of US LNG. They also want Henry Hub pricing to diversify predominantly oil-linked portfolios and stay competitive as the domestic gas market opens up. Without progress on trade talks, this just isn’t going to happen.

Is gas market reform happening?

Yes, though slowly. There’s a lot of uncertainty among gas companies as to the future market structure. Central to reform will be unbundling transportation and opening pipelines to third parties, a model that’s been successful elsewhere. But there’s no visibility on the valuation of the pipes, ownership and regulation. Change always unsettles incumbents, all along the value chain. Absent major reform, we doubt China can grow the gas market as planned, incentivise new sources of gas whether domestic or imports, or attract sufficient new entrants.

What are energy companies doing to adapt?

Whereas the Majors have seized opportunities in the downturn and strengthened portfolios, the Chinese NOCs, for the most part, have been inward looking. CNPC and Sinopec Group need to address a looming decline in production, which won’t be solved by spending predominantly on domestic projects. Accessing equity in LNG projects has begun, with CNPC and CNOOC taking stakes in Arctic LNG 2. Spurred on by CNOOC’s triumphs in Guyana, and with US tight oil a no-go area, there’s a realisation that offshore and deepwater are where they can access resource of scale – and value.