Golden opportunities to drive down mining and metals carbon emissions

While there may not be a single silver decarbonisation bullet, there are emerging and significant opportunities in the mining and processing sectors to leave fossil fuels behind

2 minute read

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony Knutson

Global Head, Thermal Coal Markets

Anthony is the global head of our thermal coal markets research for the Metals and Mining group.

View Anthony Knutson 's full profileIn the quest for decarbonisation, every industry must navigate its own unique challenges and embrace opportunities to reduce emissions across the entire supply chain over the remainder of this decade.

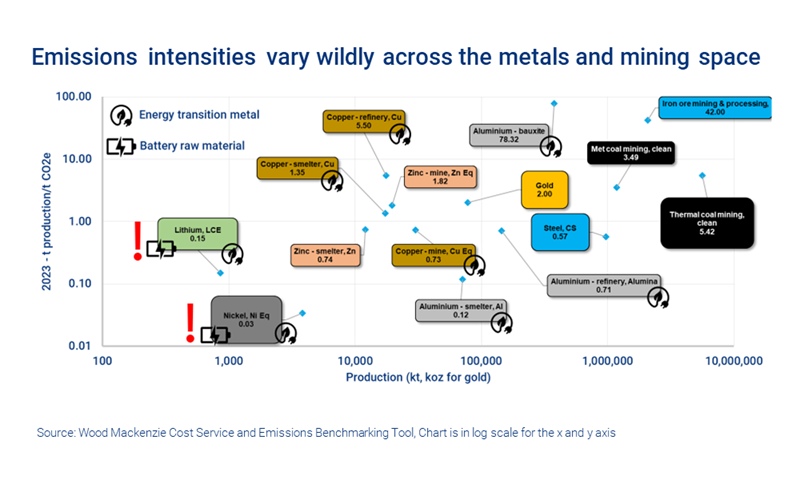

Our latest report, Building the foundation: M&M emissions opportunities and challenges to 2030, delves deep into the carbon emissions of raw materials supplying the energy transition and other industries, revealing that within the metals and mining sector, emissions intensities vary significantly. And this presents a promising window for change. 2030 will be important milestone, marked by emission reduction targets, in the journey to net zero.

Fill out the form to read a complimentary extract from the full report and read on for an introduction.

It's time for a multi-pronged attack

Analysing emissions intensities across different metals and mined commodities unveils a crucial baseline for decarbonisation, and that the global resource industry is on the cusp of a pivotal revolution to reduce direct emissions.

Reducing scope 1 emissions:

While the potential for scope 1 emissions reductions is growing, wholesale changes are not expected to occur before 2030. This period serves as a pivotal phase for establishing a robust foundation for decarbonisation – from mining to metals processing.

This shift will largely involve rolling out the first wide-scale fleets of fossil-free mining equipment while modernising mines, and investigating how to remove carbon from processing to improve smelting and refining efficiencies.

Investments in storage (CCUS) present an avenue to achieve significant progress – especially where carbon is hard to remove from processes. Hydrogen will also begin to get a look as the replacement for carbon in processing, smelting and refining.

Collaboration among industry stakeholders and equipment manufacturers is becoming vital to test and scale up technologies. Early adopters will reap the rewards of higher profit margins as carbon pricing mechanisms drive up prices.

Reducing scope 2 emissions:

Although national electricity grid emission intensities are projected to decline over the next decade, the pace may not be sufficient to meet mining and metal company decarbonisation aspirations.

Many companies are taking the matter into their own hands. Opportunities to lower scope 2 emissions are growing, though it is important to understand the individual risk and rewards. Alternatives to reduce carbon range from direct ownership and operation of power plants to buying carbon credits.

Reducing scope 3 emissions:

Tackling scope 3 emissions, recognised as the most significant challenge, necessitates breaking down barriers and fostering partnerships across value chains.

Early adopters will wield the power to shape the landscape and withstand the pressure of the coming transformative change to the metals and mining space.

Want to learn more about emissions risks, challenges and opportunities across the metals and mining space?

To read an extract from our full report Building the foundation: M&M emissions opportunities and challenges to 2030, fill out the form at the top of the page.

Metals & Mining Emissions Benchmarking Tool

An independent assessment of the full cradle to gate emissions of mined commodities production

Learn more