Discuss your challenges with our solutions experts

NYISO Central East Interface set to nearly double transfer limit

How should this news affect your winter trading decisions and congestion expectations?

2 minute read

Stephen Ryan

Power Market Analyst

Stephen Ryan

Power Market Analyst

Stephen leads on the NYISO short-term power team forecasting power prices and analysing congestion patterns.

Latest articles by Stephen

-

Opinion

US grid seasonal outlook webinars: Key takeaways for NYISO and ISONE

-

Opinion

NYISO Central East Interface set to nearly double transfer limit

NYISO recently released a draft of the Winter 2023-24 Operating Study comparing changes to the network model year-over-year. Surprisingly, this draft indicated that the Central East Interface Thermal Transfer Limit is expected to increase by 1825 MW, nearly double the previous winter’s limit of 2350 MW. The large limit increase comes as a result of the modeling of the Segment A & B project. This is important for a few reasons:

- While some level of increase to the transfer limit before the end of 2023 was anticipated, the magnitude of the increase surpassed expectations.

- The Central East Interface Transfer Limit has had a substantial impact on congestion in recent weeks, which has been further exacerbated by recent outage extensions.

- During the recent NYISO System Operating Advisory Subcommittee meeting, the scheduled energization date for Segment A was announced for the first time.

The combination of the factors above has already begun to have an impact on forward curves and, if these anticipated timelines materialize, could provide a unique opportunity for market participants.

NYISO Market Implications

The energization of the Edic - Princetown Double-Circuit Tower 345 kV lines is the final step for the Segment A project. This week, the NYISO System Operating Advisory Subcommittee confirmed the scheduled energization date for this upgrade is on 12/7/2023. It was stated in this meeting, that the energization date is not yet published in the NYISO Outages Report because the new lines are not yet a part of NYISO’s network model. Should the current schedule come to fruition, the Central East TTC will exceed 3 GW with upside to the TTC depending on the number of Oswego, Independence, and Athens units in the supply stack.

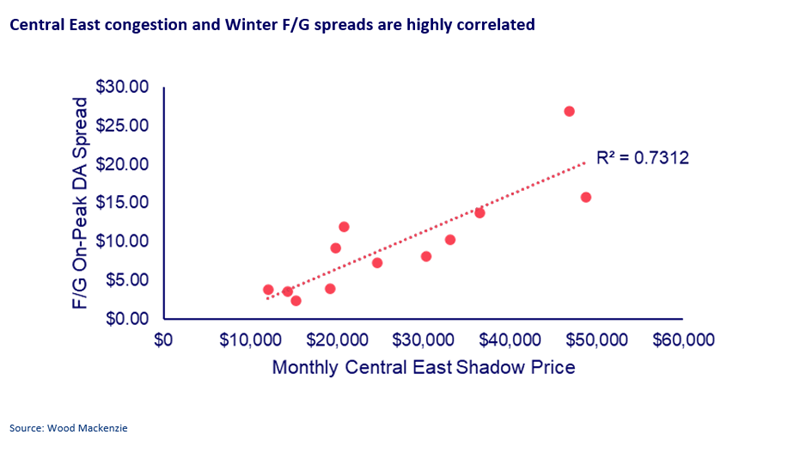

A stronger Central East transfer capacity will enable substantially stronger West - East flows and decrease the likelihood of congestion on the interface. When Central East congestion occurs, Zone F experiences a substantial price premium to Zone G. This relationship is visualized below. Monthly on-peak DA spreads from the past three winters and the total monthly DA Central East shadow price, are clearly highly correlated.

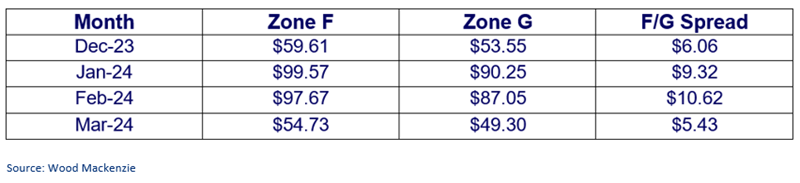

Consequently, forward marks for this winter appear mispriced. Zone F forward marks are trading well above Zone G, despite the primary constraints causing this price pattern becoming significantly weaker with the impending increase of the thermal transfer limit. Here is where winter forward marks were trading as of 11/9/2023:

A stronger Central East Transfer capacity would also impact tie flows with nearby ISOs and RTOs. IMO AC and PJM AC imports on the source-side of Central East congestion could be higher year on year with fewer bottlenecks. Similarly, NE AC exports could also increase year on year, with Central East and Gordon Rd - Rotterdam congestion much less likely to bind. Given the impact of the Central East interface, flow patterns are highly likely to change across the state, potentially presenting new or little-known constraints.

Looking forward

This study is set to be approved at the NYISO Operating Committee meeting on November 16th, while the addition of the Edic - Princetown lines to the Outages report with additional information about exact timing is not currently available.

The Wood Mackenzie NYISO Short-Term Power team is working diligently on staying up to date on this project and its potential implications. To learn more, check out our Winter Seasonal Outlook scheduled next week on Wednesday, November 15th, at 13:00 EST.