Which global steam crackers are at most risk of closure?

With ethylene producers facing multiple headwinds, we benchmark facilities to see which plants are under threat

3 minute read

Kelly Cui

Principal Analyst, Petrochemicals

Kelly Cui

Principal Analyst, Petrochemicals

Kelly is an expert in the coal-to-olefins (CTO) and methanol-to-olefins (MTO) sector.

Latest articles by Kelly

-

Opinion

Which global steam crackers are at most risk of closure?

-

The Edge

Big Oil’s opportunity for M&A in the petrochemicals downturn

-

Opinion

Why crude-to-chemicals is the obvious way forward

-

Opinion

Coronavirus to disrupt China’s chemicals sector more than SARS

-

Opinion

Can China’s CTO and MTO industries survive the threat of massive steam cracker investment?

-

Editorial

Why is China the early adopter of CTO/MTO

Shruthi Vangipuram

Senior Research Analyst, Base Chemicals

Shruthi Vangipuram

Senior Research Analyst, Base Chemicals

Shruthi leads our research coverage for the Americas olefins market.

Latest articles by Shruthi

-

Opinion

Plastic demand could reduce by up to 30% in an accelerated energy transition scenario

-

Opinion

Which global steam crackers are at most risk of closure?

-

Opinion

Ethylene: global carbon contributor

-

Opinion

Part 2: unlocking the value of refinery-petrochemicals integration

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan Gelder

SVP Refining, Chemicals & Oil Markets

Alan is responsible for formulating our research outlook and cross-sector perspectives on the global downstream sector.

Latest articles by Alan

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

Oil and refining market implications of Israel’s strike on Iran

-

Opinion

What is the impact of US tariffs on oil and refining?

-

Opinion

Oil and refined products in 2025: a commodity trader’s guide

-

Opinion

Global refinery closure outlook to 2035

-

The Edge

What a future Ukraine peace deal means for energy (Part 2)

Already in a downcycle, the ethylene industry faces unprecedented challenges. Our analysis shows that a third of steam crackers globally are at some risk of closure over the next five years. But which assets are most under threat, and why?

Using our Ethylene Asset Benchmarking Tool, we compared plants’ ethylene production margins in 2023 and 2028, using the results to classify assets into three risk levels. Fill out the form at the top of the page to download an extract from the resulting report – or read on for some key takeaways.

The ethylene industry faces multiple headwinds

Already reeling from the impact of the COVID pandemic and the outbreak of the war in Ukraine, global ethylene producers must confront continuing headwinds and uncertainties. As well as the sluggish macroeconomic environment, high energy costs and conflict in the Middle East, overbuild means the industry is dealing with considerable overcapacity.

Many facilities are unprofitable

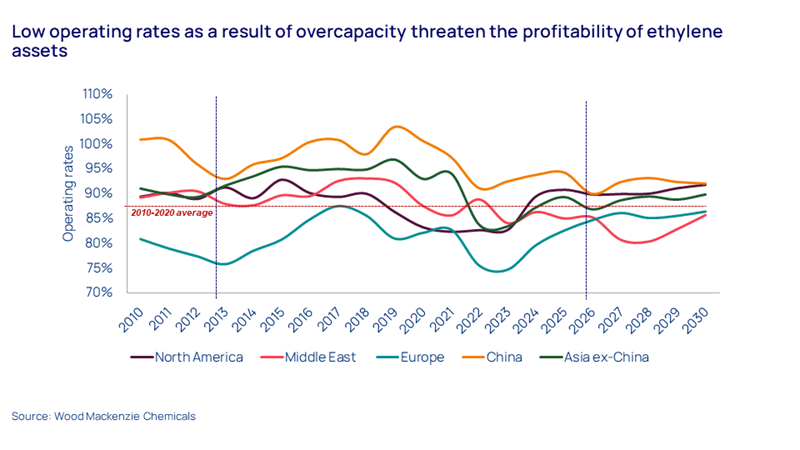

Average operating rates hit a low of 82% in 2023, significantly below pre-2019 levels of over 90% (see chart below). Our projections indicate low utilisation will continue in the next decade unless further rationalisation happens. That presents a particularly serious threat to those units in Asia and Europe that are already enduring squeezed margins from high energy and feedstock costs.

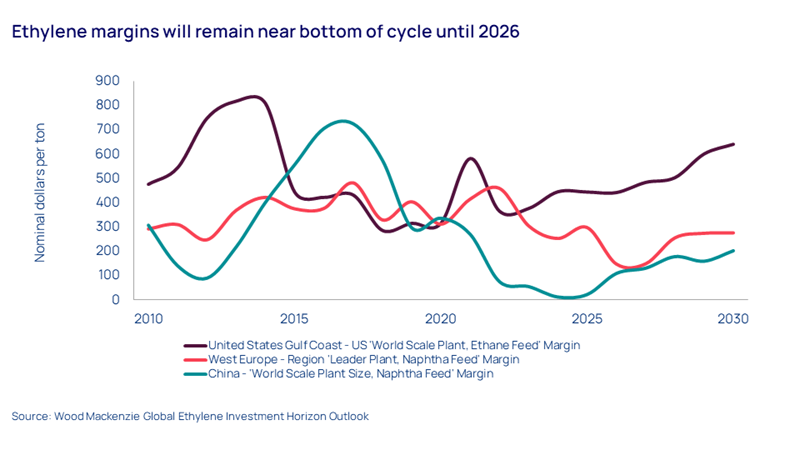

Ethylene production margins are set to remain low

Average return on investment (ROI) for ethylene plummeted to a new low of -1% in 2023. Margins along the petrochemical value chain remain depressed, and we project ROI for ethylene to stay in negative territory until 2027 (see chart below). Weaker players cannot therefore rely on market dynamics to improve their profitability. At the same time, the diminished ROI discourages fresh investment.

Nearly a quarter of global production volume is under threat

Rationalisation pressures will intensify in the medium term as demand growth lags capacity expansion. Based on our analysis, 114 out of 330 screened assets, or close to 35%, were at some risk of closure. Together, these facilities constitute 24% of global ethylene production capacity by volume, or around 55 million tonnes per annum (Mtpa). What’s more, over half of threatened facilities are in the medium or high-risk categories.

China leads closures but is investing heavily in new assets

Chinese assets have the lowest current margins in the sector, but they maintain higher operating rates over assets in other regions thanks to refinery integration and government ownership. However, under energy saving and carbon reduction regulation, the country’s small and aged crackers are being phased out and replaced with more cost-competitive and energy-efficient new assets. As a result, 3.3 Mtpa of existing Chinese capacity faces a high risk of closure, while another 2.4 Mtpa is at medium risk.

The rest of Asia will be impacted by China’s increasing self-sufficiency

Persistent losses have already prompted Asian producers to shut down plants or consolidate assets. Going forward, China’s increasing self-sufficiency will limit its appetite for ethylene imports, leading to a structural surplus in the region. This will impact production in the rest of Asia to varying degrees. Crackers in Northeast Asia ex-China remain the most vulnerable, with about 9 Mtpa at risk. By comparison, crackers in Southeast Asia that benefit from advantaged feedstock are more cushioned from the industry downturn.

European closure risk is concentrated in the Western Europe

Europe is experiencing unprecedented supply fragility amid rising energy prices caused by the conflict in Ukraine. As a result, European operating rates fell to a new low in 2023, and while they are now rising, they remain below the 2010-2020 average. Added to already-high operating costs, higher energy and feedstock prices make assets in the region uncompetitive against their peers elsewhere. In an oversupplied market, this creates an existential threat; we estimate that 2.6 Mtpa of European ethylene capacity is at high risk of closure before the end of the decade. Of these assets most under threat, 84% are located within Western Europe.