Discuss your challenges with our solutions experts

Offshore drilling and completion inflation expected to slow amid cooling floater market

The floater market has been a bull one the last few years, and rig rates are at decade highs, but the market is showing signs of cooling as operators show capital discipline and appetites for risky projects diminish

1 minute read

Devin Thomas

Vice President, Supply Chain Data & Analytics

Devin Thomas

Vice President, Supply Chain Data & Analytics

Devin leads our supply chain group and leads on creating new or improved supply chain products and research.

Latest articles by Devin

-

Opinion

Offshore drilling and completion inflation expected to slow amid cooling floater market

-

Opinion

Making the connection: the electric T&D supply chain challenge

The floater market has been a bull one the last few years, and rig rates are at decade highs. But the market is showing signs of cooling as operators show capital discipline and appetites for risky projects diminish. Accordingly, Wood Mackenzie has revised our offshore well demand and rig rate forecasts downwards. After two straight years of greater than 20% YOY growth, 2024 rig rates will end the year up only 4% relative to 2023, and 2025 rates will grow at an even more modest rate of 2% YOY, according to Wood Mackenzie’s Deepwater Drilling Service.

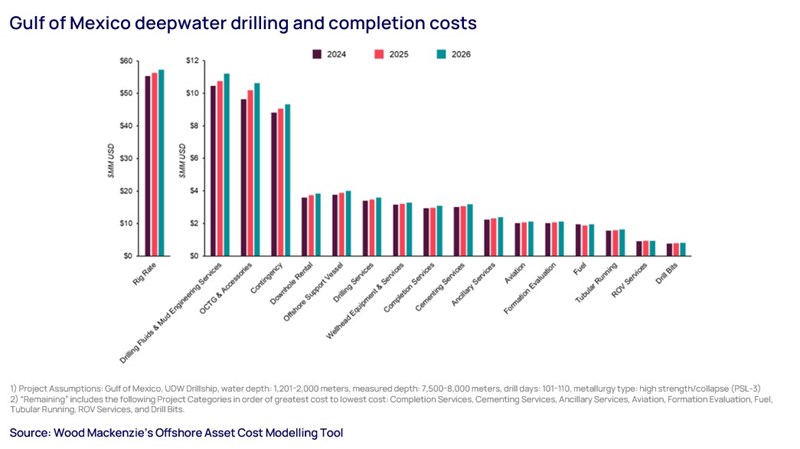

Furthermore, in 2024 and beyond, offshore operators will no longer have to contend with double digit inflation in the broader drilling and completion (D&C) space. After increasing 10% YOY in 2023, total D&C costs will end 2024 up a modest 4% YOY and will increase 2-3% YOY in both 2025 and 2026. While the largest driver of this trend is the aforementioned softening of the rig market, other cost categories are also influencing Wood Mackenzie’s forecast.

Of note, Drilling Fluids & Mud and OCTG represent a meaningful 9% and 8% of total D&C costs, respectively. In the last 18 months, markets for each have offered some cost relief for operators due to lower raw material prices, namely steel, organic & inorganic chemicals, and barite. However, any relief will be short lived, and we forecast higher raw material prices to push up costs for both, adding upward pressure on total D&C costs.

Learn more

For more details, please reach out to our Supply Chain Intelligence team.