Discuss your challenges with our solutions experts

Saddlehorn-Grand Mesa pipeline to increase Cushing pipeline imbalance to record high

1 minute read

Ryan Saxton

Director, Head of Oil Data, Short-term Analytics

Ryan Saxton

Director, Head of Oil Data, Short-term Analytics

Ryan oversees a team dedicated to monitoring oil transportation, storage and refining.

View Ryan Saxton's full profileThe Saddlehorn-Grand Mesa joint interest crude pipeline is on track to open in September to bring up to 340,000 bpd of crude from Platteville, Colorado, to Cushing, Oklahoma, where stocks have hovered at close to capacity this year, according to Wood Mackenzie. The pipeline project, which has Noble Energy and Anadarko as committed shippers, is forging ahead despite lower year-on-year Niobrara crude production and underutilised existing takeaway capacity from the Denver-Julesburg (DJ) Basin.

The new pipeline will run alongside SemGroup’s 215,000 bpd White Cliffs pipeline system, which has averaged approximately 70% utilisation since its expansion in January. Production in the Niobrara, which is located in the DJ Basin, has decreased from a May 2015 high of more than 500,000 bpd to just over 400,000 bpd in May 2016, according to the US Energy Information Administration estimates.

Saddlehorn-Grand Mesa will have an initial capacity of 340,000 bpd, expandable to 450,000 bpd. Of that capacity, 190,000 bpd is owned by Saddlehorn Pipeline's partners (Magellan Midstream Partners, 40%; Plains All American Pipeline, 40%; and Anadarko Petroleum Corporation, 20%, and the remaining 150,000 bpd is allocated to Grand Mesa Pipeline, which NGL Energy Partners own.

During Wood Mackenzie's flight of the pipeline right of way on 8 April, work crews were observed at all six of the pump stations identified for the Platteville to Cushing segment of the pipeline. All were in a similar stage of completion. While most piping was installed along the right of way, several excavated segments were observed during the flight, with construction materials and earth moving equipment present. Significant portions of the pipeline were still exposed, and additional piping has yet to be installed, primarily in and around the pump stations.

While pump station connections were still being secured, initial testing on Saddlehorn-Grand Mesa has begun. Hydrotesting has been initiated along completed segments of the pipeline, and testing is expected to be underway at the Platteville terminal in Q2, according to Magellan. Once fully tested, Saddlehorn-Grand Mesa will require about 1.08mn bbls for line fill, according to Wood Mackenzie’s.

An additional segment from Carr, Colorado, to Platteville, Colorado, will be constructed on a delayed timeline. That segment will facilitate additional crude volumes from the Powder River Basin in addition to Bakken volumes from Kinder Morgan’s 99,000 bpd Double H pipeline and potentially Canadian volumes from Spectra Energy’s 282,000 bpd Express pipeline. Saddlehorn began securing easements for that right of way in January 2016, according to Weld County, Colorado, property records. That segment is expected to come online in late 2016 and is only accessible to Magellan, Plains and Anadarko.

Saddlehorn-Grand Mesa will increase total pipeline capacity into Cushing to about 3.55mn bpd from 3.21mn bpd, compared to the 2.57mn bpd of existing takeaway from the hub, where stocks have climbed this year amid a global low-price environment and an oversupply of domestic crude.

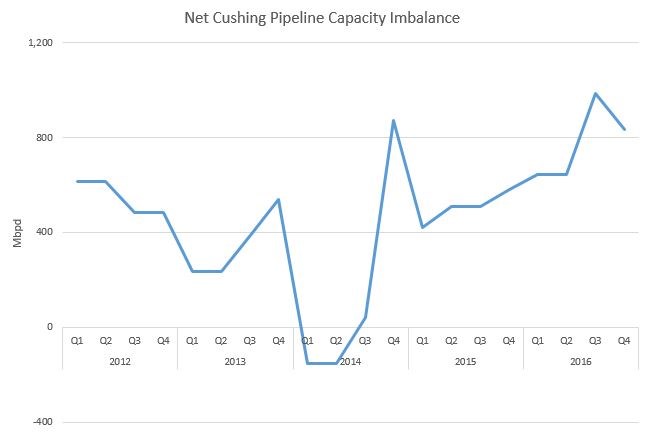

This additional inbound capacity will increase the net pipeline balance to almost 1mn bpd, with incoming capacity outpacing outgoing. The impending pipeline imbalance would be the highest since at least 2012, which was prior to reversal and expansion of Enterprise’s Seaway pipeline system, according to Wood Mackenzie.

Despite imbalance, pipeline capacity may remain underutilised

Despite an additional 340,000 bpd of capacity coming online, capacity utilisation from the DJ Basin may remain underutilised. To date, the Saddlehorn portion of the pipeline has just 40,000 bpd of committed shipments, although that number is expected to ramp up to 80,000 bpd, according to Magellan.

With White Cliffs pipeline averaging around 70% utilisation since January, and Tallgrass Energy’s 90,000 bpd Pony Express Northeast Colorado Lateral from the DJ Basin having come online in April

2015, it is unclear just how much Saddlehorn-Grand Mesa’s capacity will be needed amid declining production.

Wood Mackenzie's Mid-Continent Pipeline Service provides total visibility into what's driving the US and Canadian crude oil markets, with insight into critical pipelines supplying storage hubs and refineries. Find out more or request a free trial.