Discuss your challenges with our solutions experts

Shale oil in China: the long journey ahead

Can China’s shale oil industry replicate US success?

1 minute read

Faced with declining crude output and increasing pressure from the government to lift production, China’s NOCs are turning to shale oil.

As it looks westwards to the US, where the shale industry has shifted the country from net oil-importer to oil-exporter, analysts Angus Rodger and Xianhui Zhang ask if China could replicate its success.

What’s the size of the shale opportunity in China?

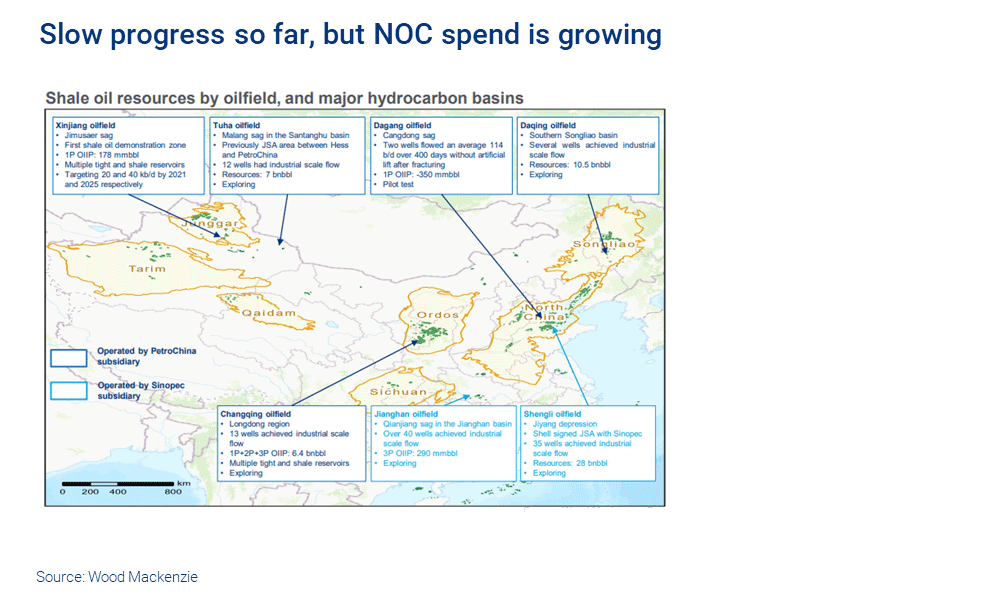

China’s first successful shale oil well was drilled in Xinjiang in 2011, but progress has been relatively slow since then and has focused more on resource estimation than development.

So far, Chinese NOCs have identified over 50 billion barrels of shale oil resources and 10 billion barrels of oil-initially-in-place (OIIP) in the major conventional oil-producing basins.

China’s shale gas industry has moved at a faster clip, going from 120 mmcfd in 2014 to 1450 mmcfd in 2019. But it will struggle to grow at such a rate, and we see output peaking at 2125 mmcfd in 2023.

As with shale oil, all the major developments are driven by the onshore NOCs – PetroChina and Sinopec – and IOCs have so far struggled to make any progress.

Notes: 1. All resources and OIIP (oil-initially-in-place) estimates are from Chinese NOCs. However, there is inconsistent use of reserves terminology across Chinese publications. 2. Geologically, a basin can be divided into several first-order structural units that can be further divided into second-order structural units. Depression is used in China to refer to a first-order structural unit while sag refers to a second-order structural unit.

-

50 billion

barrels of shale oil resources identified in China

-

US$1.5 billion

Planned investment in Dagang, a pilot Chinese shale oil project

-

>1%

Share unconventional oil resources contribute to China’s total crude output

But the economics of China’s shale oil remain challenging

Unconventional oil output – through a variety of techniques – makes up less than 1% of China’s crude output. One of the reasons for that, despite the large volumes-in-place, is high breakevens and non-commercial economics.

China’s shale formations tend to be deeper, harder to frac and more heterogenous than in the big US plays, making it challenging to identify sweet spots. Heavier, waxy oils that are more difficult to recover also mean that well costs are substantially higher than in the US.

Nonetheless, the NOCs have grown their shale oil spending, driven by the need to secure and develop energy resources for strategic reasons. In 2019, China’s first shale oil pilot projects were started in Xinjiang and Dagang, with plans to invest US$1.5 billion in the latter.

Although costs in China’s shale oil industry are high in the short term, this will not stop the NOCs from focusing on a rare opportunity to grow domestic oil output.

Angus Rodger

Vice President, SME Upstream APAC & Middle East

Angus leads our benchmark analysis of global Pre-FID delays, and deep water developments.

Latest articles by Angus

-

The Edge

Why upstream companies might break their capital discipline rules

-

Featured

Upstream oil & gas regions 2025 outlook

-

Opinion

How to make upstream licensing work

-

The Edge

What’s driving the upstream revival in Southeast Asia?

-

Opinion

A two-decade decline in exploration is driving the need for carbon neutral investment in Australia’s upstream sector

-

Opinion

Asia Pacific upstream: 5 things to look for in 2024

Can the NOCs crack the code?

Well, the lacustrine-deposited (from freshwater lakes) shale formations in China do make development much harder than the simpler marine-deposited (from larger seas) ones in the US.

Faced with these technical difficulties, NOCs are developing new technologies to aid commercial recovery.

Driven by the strategic national need to develop energy resources, the NOCs are likely to continue to push on. But limited competition in the market does mean there are fewer opportunities to accelerate exploration, drive innovation and test new production techniques.

You might also like:

What role will the Chinese government play?

A more diverse, competitive corporate environment would undoubtedly help China’s fledgling shale oil industry to develop. That is one of the key takeaways from shale’s runaway success in the US.

Similarly, data sharing and preferential fiscal policies are needed if shale oil has a chance at commercial success. As ever in China, government policy will be critical to facilitate competition and economic support, if required.

Are there partnership opportunities for IOCs?

Yes and no.

The good news is that China is slowly opening up to collaboration opportunities. Shell has recently signed a shale oil joint service agreement (JSA) with Sinopec in the NOC’s largest oil field, Shengli: a positive sign that Chinese NOCs acknowledge the need for technical assistance.

But the bad news is that quality acreage is still largely unavailable and remains under NOC control. The unsuccessful results of shale gas cooperation do suggest that the NOCs place less importance on the role of IOC participation. But if shale oil really struggles to take off, that view might have to change.