Discuss your challenges with our solutions experts

Solar technology got cheaper and better in the 2010s. Now what?

No other power-generation technology matched solar’s pace of cost reduction this past decade. The game will change again in the 2020s.

1 minute read

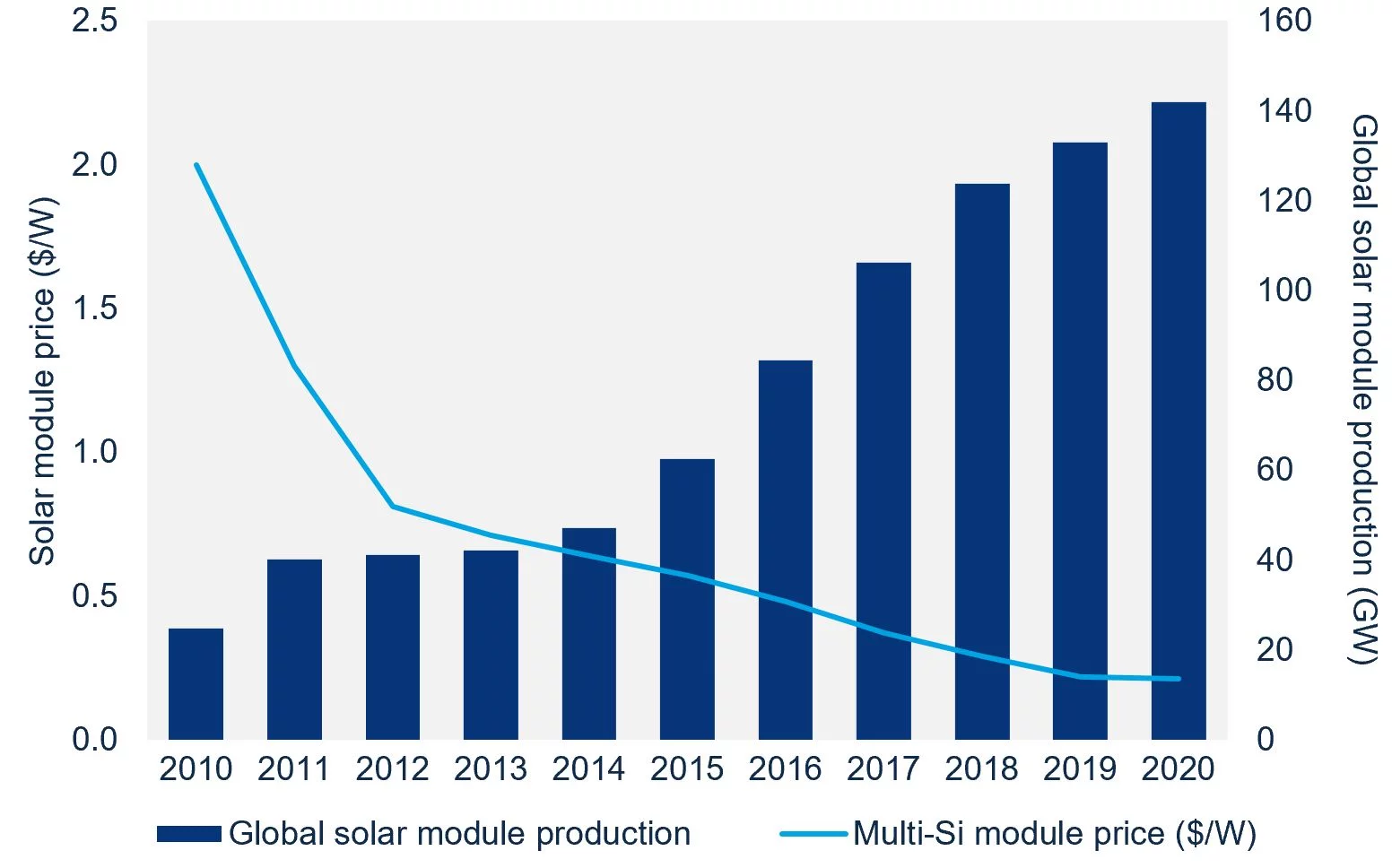

Solar energy grew by leaps and bounds in the 2010s. According to Wood Mackenzie, global annual solar installations grew more than sixfold this past decade, from 16 gigawatts in 2010 to 105 gigawatts in 2019.

In the meantime, multi-silicon solar module prices dropped from over $2 per watt to just over $0.20 per watt in Q3 2019. That 90% price reduction is one of the most critical factors driving the global expansion of solar.

No other electricity generation technologies have been able to keep up with solar’s pace of cost reduction over this period.

The U.S. Energy Information Administration’s data shows that the overnight capital cost required to build new onshore wind and conventional natural gas combined-cycle power plants in the U.S. decreased by 38% and 2% respectively between 2010 and 2018.

In the meantime, the cost to build combustion turbine plants has gone up by 11%. The same unfavourable economics have led to very few new coal plant constructions in the second half of the 2010s.

Economies of scale and supply-chain development drove solar's cost reduction

The main reason solar modules have become increasingly cost-competitive is due to economies-of-scale production along the entire supply chain. Global polysilicon production capacity grew more than fourfold this past decade, while the price of polysilicon, the primary feedstock for solar module production, declined from over $80 in 2010 to just $8.40 in 2019.

Similarly, accompanying the steep module price decline was a fivefold increase in the global module production capacity. Wafer and solar cell production capacity also experienced huge growth over the decade.

Global solar manufacturing capacity vs. module price, 2010-2020E

Source: Wood Mackenzie

This supply-chain-wide development created a robust and competitive solar marketplace. Nowadays, successful manufacturers continue to produce at scale while innovating their business models and technology offerings.

Cheaper AND better

In addition to their significant cost decline, solar panels have improved a lot in the past decade.

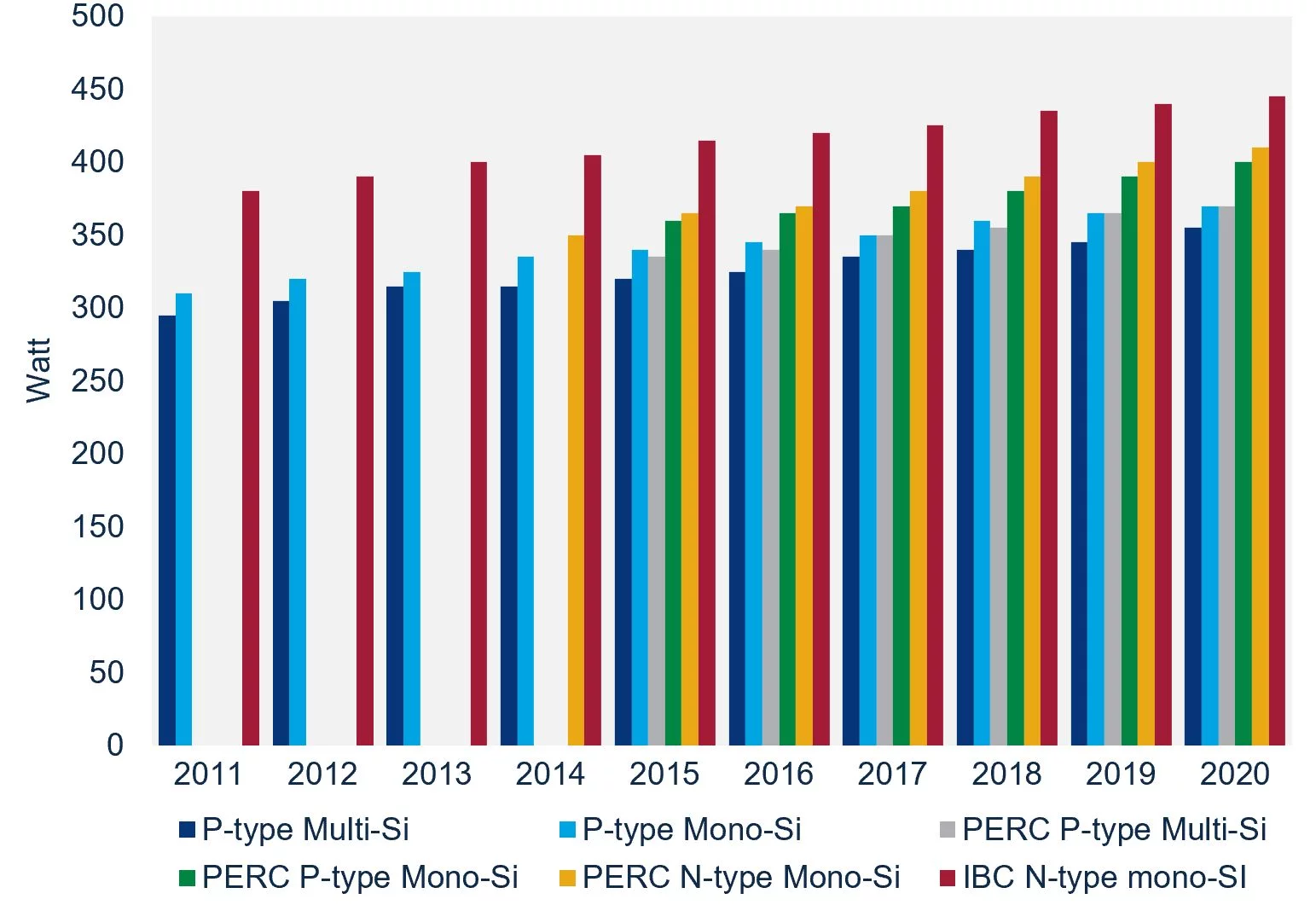

The average nameplate power output of a standard 72-cell multi-silicon module was around 290 watts in 2010. Today, consumers can expect at least 345 watts at one-tenth of the 2010 price. It is like getting the latest iPhone at a 90% discount on the old iPhone price. Although that may never happen in the mobile phone market, solar has been seeing better products at lower prices every year for a decade.

The 2010s also witnessed solar modules getting better in a few other ways:

- Higher-efficiency mono silicon-based modules are replacing multi silicon modules to become the predominant module type.

- Modules increasingly use advanced cell architectures such as passivated emitter and rear contact (PERC), interdigitated back contact (IBC), heterojunction with an intrinsic thin layer, and bifacial cell technologies.

- Modules based on larger wafers (158 mm and above) and n-type wafers are gaining market traction.

- Innovative module techniques such as half-cuts and shingles are capturing market share.

Solar module power output by technology, 2011-2020E

Source: Wood Mackenzie

Technology innovations will reduce solar LCOE in the 2020s

Solar energy is a shining example of renewable energy's increasing affordability in the 2010s. Now, at the turn of a new decade, a sea change is happening in the global solar industry where the focus is shifting from lowering capital expenditure to decreasing projects' levellised cost of energy. Solar modules with high power output and low degradation rates are crucial to this mission.

Current innovations in solar wafers, cells and modules will increase the panel's power output without proportionally increasing the manufacturing costs, resulting in lower dollar-per-watt module cost and balance-of-system (BOS) cost savings.

For instance, bifacial solar modules can provide a 5% to 15% bonus in power output with only a 2% to 3% price premium. Since fewer modules are needed to produce the same amount of electricity, bifacial modules could reduce BOS cost by 3% to 7%.

Large wafers allow modules to have more space for photoelectronic reactions, increasing the electricity generation per panel while reducing the need for wires, junction boxes and other BOS components.

Modules with improved hot spot performance and lower light- and temperature-induced degradations will be able to produce more electricity over a project’s lifetime and reduce LCOE.

Last but not least, more and more module manufacturers are offering warranties that last up to 30 years, which put solar power plants’ lifetime on par with that of natural gas combined-cycle plants. The additional electricity generation near the end of a solar project’s lifetime would also further lower the LCOE and increase competitiveness in the marketplace.

The new decade will see the global solar energy industry tapping into innovative technologies to enhance long-term project performance while continuing to lower system costs.