Discuss your challenges with our solutions experts

The Russian energy transition: what makes it different

Understanding the uniquely Russian approach to the energy transition and the risks and opportunities that presents

1 minute read

With contributions from Nikolai Novikov, senior research analyst, Russia upstream oil and gas, Donald Maclean, research manager, EMEARC upstream oil and gas, and Michael Moynihan, research director, EMEARC upstream oil and gas

Russia is taking a different approach to the energy transition

While many countries are changing their energy mix, shifting away from fossil fuels and towards renewables, Russia remains the third largest hydrocarbon producer globally.

The Government does not intend to change this.

The country’s electricity mix is heavily weighted to thermal power. Gas is seen as a key transition fuel. And yet, despite the continued focus on hydrocarbons, greenhouse gas emissions have fallen by 25% since 1990.

In a recent report, senior research analyst Nikolai Novikov examined the uniquely Russian energy transition and explored the key risks and opportunities this creates along the energy value chain. Here he presents three of the team's key findings. For a more detailed analysis that includes the outlooks for oil and gas, coal, and renewables, buy the full report.

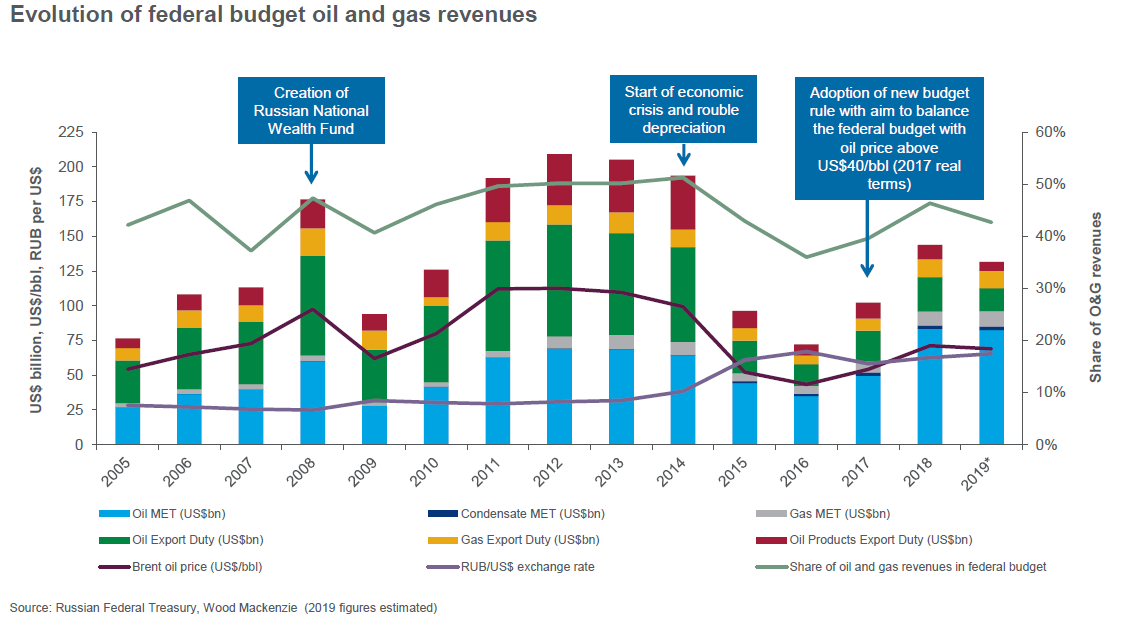

1. Russia’s economy still highly relies on oil and gas

The oil and gas industry has generated US$2 trillion for the federal budget since 2005, which makes up more than 40% of the federal budget revenues.

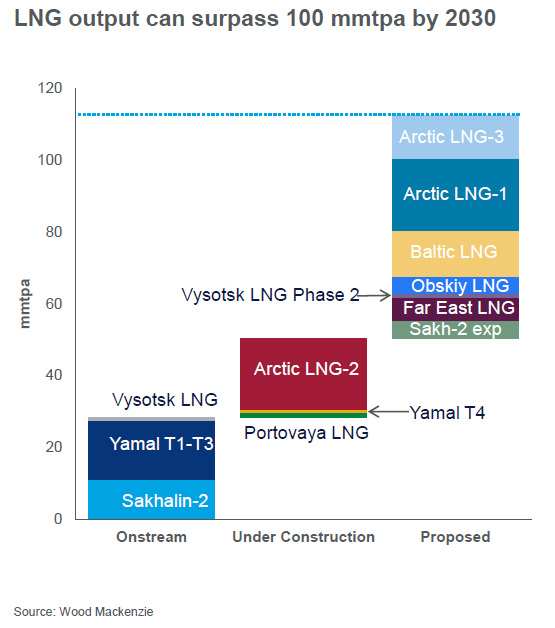

2. Russia is betting on gas

Russia is betting on gas as an energy transition fuel in Europe and Asia to create demand for its growing production. The Ministry of Energy has set ambitious targets for natural gas – Russia’s most conservative energy transition scenario calls for 750 bcma of gas production and about 250 bcma of exports by 2035. New LNG projects will help achieve those targets.

3. Renewables growth will be slow

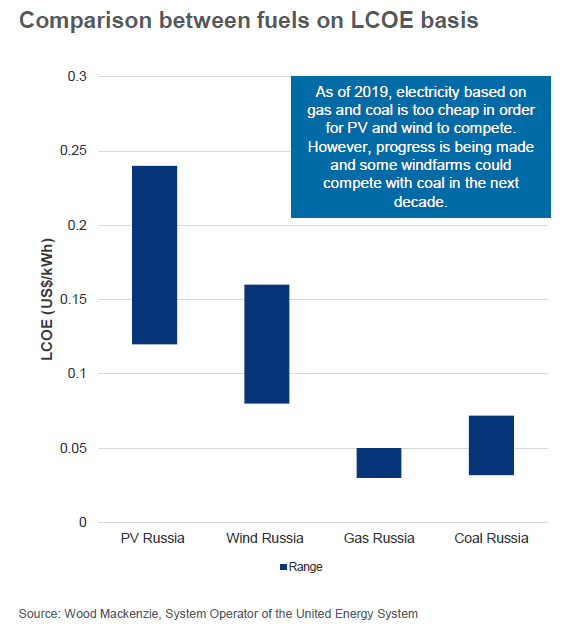

There are several barriers to the uptake of renewable energy in Russia.

First, electricity from coal and gas is significantly cheaper than electricity from renewables. Residential tariffs hovered around US$0.05/kWh in 2018, considerably cheaper than the main Western countries. With a high capacity surplus in the system and few renewable energy targets in place, this is unlikely to change any time soon.

Second, electric vehicles are out of reach for the average citizen. Less than 700 new electric vehicles (EVs) were sold in Russia between 2013 and 2018. Only 144 new EVs were sold in 2018. This compares with 1.8 million internal combustion engine cars sold in 2018.

Finally, that small group of Russian EV owners doesn’t benefit from the types of incentives you find elsewhere in the world. Only vehicles registered in the Moscow Oblast region avoid transport tax. And parking for EVs is free only in certain urban areas. Compare this to the incentives seen in London and Shanghai, where EV uptake is strong.

Plenty of room for hydrocarbon growth

All of the above means that there is room for hydrocarbon business growth; renewable energy will lag behind. Oil and gas operators and contractors have a variety of opportunities in different parts of the value chain. But, risks are there too. First, shrinking hydrocarbon demand in markets focused on the energy transition. Hydrocarbons exports to several countries could become unnecessary. Second, caps on greenhouse gas emissions. If Russia decides to reduce its emissions by 30% or more, that could put a ceiling on output growth.

For a more detailed analysis of the long-term outlook for Russian energy markets, buy the full report.