US-China trade deal flatters to deceive

Beijing’s commitment to purchase an additional $52.4 billion of energy from the US creates a huge opportunity, but is it realistic and what could be the consequences?

1 minute read

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin Thompson

Vice Chairman, Energy – Europe, Middle East & Africa

Gavin oversees our Europe, Middle East and Africa research.

Latest articles by Gavin

-

The Edge

A world first: shipping carbon exports for storage

-

The Edge

WoodMac’s Gas, LNG and the Future of Energy conference: five key themes

-

The Edge

Nigeria’s bold strategy to double oil production

-

The Edge

US tariffs – unpredictability is the strategic planners’ nightmare

-

The Edge

Upside pressure mounts on US gas prices

-

The Edge

The coming geothermal age

Watching the signing of the Phase One trade agreement between the US and China last Wednesday, my interest was piqued by President Trump’s declaration ‘What the hell, this is a big celebration’. Was it really? Beyond the administration’s hyperbole, subsequent comments from many of 80+ business executives in attendance set a soberer tone.

Realistically, the deal represents a truce in the trade dispute, but much uncertainty still lies ahead. For the US energy industry, clearly of greatest importance is China’s pledge to increase energy imports from the US by $52.4 billion over the next two years (as a part of the broader agreement to spend around $200 billion more on US goods and services than it did in 2017).

Despite the lack of detail, this is encouraging. Prior to the trade dispute, US energy exports to China were skyrocketing, increasing from around $2 billion in 2016 to over $8 billion per year in 2017 and 2018, driven by crude oil. Tariffs and filibuster combined to more than half this figure last year. But while committing to ‘ensure’ this increase, China’s continuing radio silence on any future tariff removal for US energy imports remains the most obvious.

Raising crude imports is critical

I know it’s stating the obvious, but $52.4 billion buys a lot of energy (equivalent to around 900 million barrels of crude oil at today’s prices). And this is in addition to the $8.4 billion China spent on US energy in 2017.

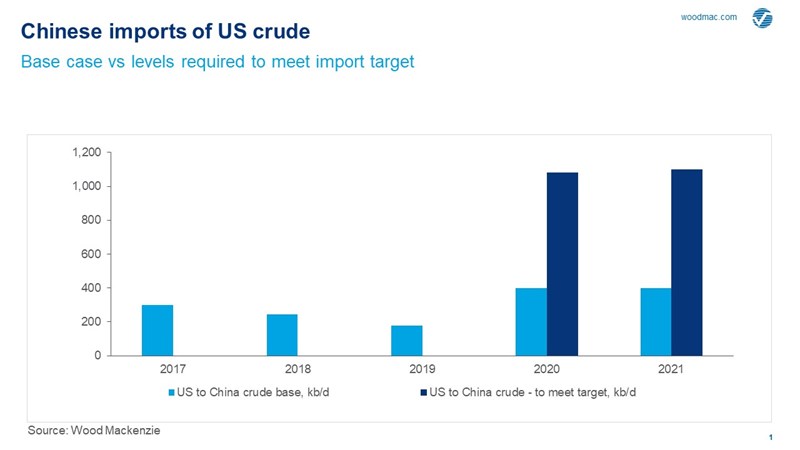

Looking more closely by commodity, if China is to get anywhere close to the target then this must be underwritten by a major increase in US crude imports. US crude oil and oil product (mainly LPG) exports to China stood at around $4 billion in 2019, half of that in 2018 as tariffs kicked in. At current WTI prices, to meet targets, China would need to buy about 1.1 million b/d of US crude per year in 2020 and 2021, equal to an additional $24 billion per annum.

In terms of China’s total crude imports, this would require a relatively modest sounding shift to sourcing an additional 10% or so of imports from the US. Not wildly improbable, but a big deviation from the optimal case of US imports of around 400 kb/d in 2020 and 2021. The 5% tariff imposed by China on US crude is an issue here, but one I expect could be removed by Beijing with relative ease.

Read more: What does the US-China trade deal mean for refiners - and for the market?

Potential upside for LNG

The trade dispute has been acutely felt in the US LNG sector, with China’s imports all but evaporating after Beijing’s retaliatory 25% import tariff was introduced in June 2019. This is unfortunate as China’s shift towards a greater use of gas has coincided with the phenomenal increase in US LNG capacity in recent years, with six projects now online.

Unlike China’s modest tariff on US crude, the hefty 25% duty on US LNG imports is a deal breaker. The stark reality is that if we are to see a significant increase in US LNG as part of China’s purchase commitments then the current tariff must be removed. I expect this is now under active consideration.

If the tariff is removed, it would be good news for portfolio suppliers including Shell, Total and BP with existing contracts with Chinese buyers. It would also allow US LNG to compete on an equal footing in the Chinese spot market. My colleagues in Beijing expect China will need an additional 17 Mt and 23 Mt of LNG in 2020 and 2021 respectively, and companies with US LNG to sell will certainly be looking to target this market.

What would be the consequences of China meeting the target?

Given these challenges it’s likely that the reality of China’s purchases of US energy will fall some way short over the next two years. But much will depend on China; if the country’s leadership is fully committed to meeting the target then it has the executive power to remove tariffs at any time.

If this were to happen, and China does spend over $50 billion more on US energy exports, there would inevitably be consequences for both competing suppliers and the already volatile global energy prices. Reaching this target would represent a significant realignment of China’s energy imports towards the US, particularly for crude oil and would disrupt existing relationships with traditional suppliers in the Middle East in particular. Competition for the Chinese oil market is already intense and would become more so, impacting prices.

Similarly, a sharp uptick in US LNG into China would pose a competitive challenge for other suppliers, most notably Australia. Spot LNG prices are already at rock bottom and with an over-supplied market pushing down US Gulf Coast FOB prices to around $2.50/mmbtu, the removal of tariffs would inevitably create rising competition from US LNG into China.

A major increase in Chinese purchase of US energy would also be at risk from any future re-escalation in the trade dispute, which remains a distinct possibility. The Phase One agreement’s enforcement mechanisms are politically charged, and future energy agreements could be hit by accusations of non-compliance in other areas of the deal.

APAC Energy Buzz is a blog by Asia Pacific Vice Chair, Gavin Thompson. In his blog, Gavin shares the sights and sounds of what’s trending in the region and what’s weighing on business leaders’ minds.