Shake-up on the US distributed solar leaderboard

Market consolidation slows as competition intensifies for US solar installers and equipment suppliers

6 minute read

Caitlin Connelly

Senior Analyst, US Solar

Caitlin Connelly

Senior Analyst, US Solar

Caitlin focuses on distributed solar and supports research and data collection.

View Caitlin Connelly's full profileThe US solar industry endured a particularly challenging 2022. The total market declined 16% compared to 2021 with commercial, community and utility-scale segments all experiencing year-over-year declines. Between the anticircumvention investigation, wide-spread equipment detentions and passage of the historic Inflation Reduction Act (IRA), solar installers and equipment manufacturers faced unique challenges and unprecedented market uncertainty.

In Wood Mackenzie’s quarterly US PV Leaderboard, available via the US Distributed Solar Service, we rank the top solar installers and equipment suppliers. Read on for an overview of our key findings from 2022 and how these companies fared in a tumultuous year.

You can also fill in the form for a complimentary copy of the 15-page executive summary of our US solar market insight 2022 year in review.

Sunrun, Tesla and Freedom Forever top residential installer rankings in record-breaking 2022

Despite a lackluster year for the US solar industry as a whole, the residential solar segment grew 40% over 2021, reaching a record-breaking 5.9 GWdc of new capacity. Residential solar was more shielded from supply chain constraints than other segments, but the year was not without challenges. Installers reported module shortages in the first half of the year, and rising interest rates forced salespeople to adapt to selling higher APR loan products with less customer savings.

So which installers navigated these challenges most effectively in 2022? Publicly traded Sunrun continues to dominate the residential solar installer rankings, securing 12.5% of the total market in 2022. And in a surprise return to the top of the Leaderboard, Tesla’s market share grew to 4.2% in 2022 after two years of volume declines.

However, Tesla remains highly dependent on subcontractors for installations, so we expect the company will continue to shift away from its direct install business. Freedom Forever secured the #3 spot with 4.0% market share, ranking higher than Titan Solar Power (#4) and SunPower (#5). Freedom Forever’s installations grew by over 43% compared to 2021, but the company’s market share grew only .1% – a testament to the growth of smaller players.

Several top installers experienced market share declines due to increased competition.

Caitlin Connelly

Senior Analyst, US Solar

Caitlin focuses on distributed solar and supports research and data collection.

View Caitlin Connelly's full profileFurther down the rankings, competition continues to intensify for a spot in the top 10. Despite year-over-year growth in installations, several top installers experienced market share declines due to increased competition. The installers that managed to increase their market shares include SunPower (ranked #5), Bright Planet Solar (ranked #8), Palmetto Solar (ranked #9), and LGCY Power (ranked #10).

Supply chain constraints and equipment detentions slowed market consolidation in non-residential module manufacturer rankings

Fueled by trade policy uncertainty, the solar equipment manufacturing landscape experienced an extremely volatile 2022. Manufacturers navigated the anticircumvention investigation during the first half of the year and enforcement of the Uyghur Forced Labor Prevention Act (UFLPA) in the second.

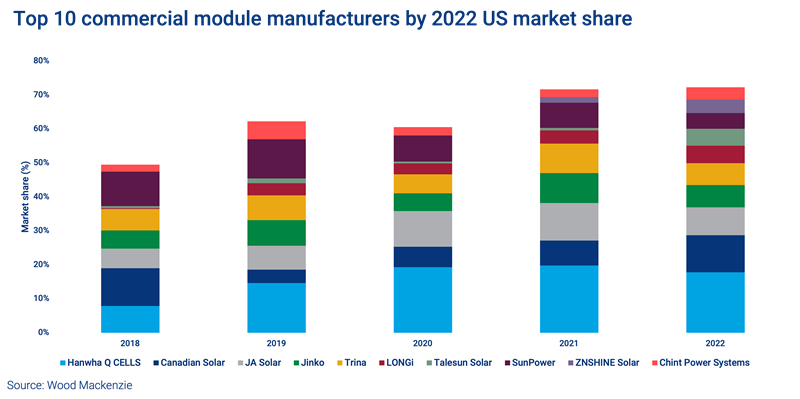

The resulting supply chain constraints had a clear impact on the commercial module manufacturer rankings. The top five commercial module manufacturers represented just under 50% of the total market in 2022 compared to 56% in 2021. This highlights a significant fragmentation of the competitive landscape after several years of market consolidation.

Based on year-over-year market share changes, the companies most impacted by the challenges of this past year include top manufacturers like LG Electronics, JA Solar, SunPower and REC. All experienced market share declines of over 2.5% compared to 2021. Even top manufacturer Hanwha Q CELLS was not spared, witnessing market share declines for the first time since 2018.

On the other hand, some companies saw significant increases to their volumes and market shares as the industry sought alternative sources of modules. The most notable of these is Canadian Solar, which jumped in the rankings from #7 in 2021 to #2, securing 11% of the total market. Canadian Solar has several manufacturing facilities outside of Southeast Asia, including in Canada, the US and South Africa, partially shielding the company from exposure to new tariffs.

Also notable is that market shares for Telesun Solar and ZSHINE Solar grew 4.3% and 2.4% respectively year-over-year. Without clear answers on when supply chain uncertainty may begin to ease, installers will continue to diversify their equipment offerings to ensure availability and limit project delays.

Distributed Solar Development, Amp Energy and Nexamp top new community solar installer rankings

As of Q4 2022, our US PV Leaderboard now features separate community solar installer rankings in addition to our broader non-residential installer rankings (combined commercial and community solar). Cumulative US community solar installations have doubled since Q2 2020 and annual installations broke 1 GWdc in 2022 for the second consecutive year. As policy continues to enable the creation of new state markets, the competitive landscape for community solar will continue to expand and evolve.

Developing community solar projects is more complex than traditional commercial projects. Community solar projects are larger in size and involve more stakeholders and customer offtakers, leading to longer project timelines and increased risk.

For installations in 2022, Distributed Solar Development, Amp Energy and Nexamp top the community solar installer rankings. Both Distributed Solar Development and Amp Energy grew their market shares by 5% compared to 2021 largely driven by significant projects in New York. Borrego, which dominated the 2021 rankings with 18.8% market share, dropped out of the top three after the company shifted its business model to focus solely on utility-scale developments.

Loans continue to dominate the residential solar financing landscape, but a shift toward TPO is expected in 2023

Loan volumes made up over 60% of the total residential solar market in 2022 and continue to dominate new growth over third-party owned (TPO) capacity. GoodLeap held onto its position as the top financier and loan provider for the third consecutive year, capturing 26% of the total market. Sunrun leads the TPO market, but its market share for total financed systems declined from 15% to 12% in 2022.

Prior to the passage of the IRA, we anticipated this trend toward cash and loans would continue. However, the IRA stipulates that only TPO systems will qualify for the ITC bonus adders. Because of this, excitement has grown in favor of TPO, and we have heard from several installers that there has been a recent uptick in TPO sales. While we have not yet seen this shift reflected in installation data as of 2022, we expect TPO shares will increase throughout 2023.

Additional key findings from the latest Leaderboard include:

- Ameresco, PowerFlex, and Distributed Solar Development topped the commercial solar installer rankings, securing a combined market share of 9.3%

- Enphase secured the top spot in the residential inverter manufacturer ranking with a total market share of 48.1%. Tesla, which began manufacturing inverters in Q1 2021, ranked third with a market share of 5.5% - a 1% jump from 2021.

- Hanwha Q CELLS maintained the #1 residential module supplier ranking for the fifth consecutive year. Its market share jumped from 24% in 2021 to 32% in 2022. The top five residential module manufacturers represent 67% of the total market in 2022.

Questions about the US PV Leaderboard? Learn more about the US Distributed Solar Service. You can also fill in the form at the top of the page for a complimentary copy of the 15-page executive summary of our US solar market insight 2022 year in review.