The US solar industry looks ahead after a volatile year

A return to growth is expected in 2023, but major uncertainties linger

3 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

The US solar industry shrank by 16% in 2022. It was a volatile year characterized by the anticircumvention investigation, widespread equipment detentions at ports and the historic victory of the Inflation Reduction Act (IRA). On balance, all the uncertainty surrounding various trade issues as well as supply chain constraints took their toll on industry growth.

As the industry looks ahead to 2023, there is cause for optimism. Most expect supply chain relief in the second half of this year as importers satisfy Customs and Border Protection (CBP) requirements and shipments make their way to project sites. But major uncertainties remain regarding new anticircumvention tariffs, domestic solar module supply and US Treasury guidance on various aspects of the IRA.

To help the industry benchmark these uncertainties, we’ve created a set of alternative scenarios. In our US solar market insight 2022 year in review report, created in collaboration with the Solar Energy Industries Association (SEIA), we highlight these forecast scenarios in addition to our annual 10-year outlook.

Fill in the form for a complimentary copy of the 15-page executive summary. Or read on for some key highlights.

Supply chain constraints limited US solar buildout in 2022

Last year was a tumultuous one for the industry. Utility-scale, commercial and community solar segments were all down compared to 2021. Utility-scale volumes were down 31% for the year – the last time utility solar shrank that much was in 2017, when the industry had been expecting the full expiration of the investment tax credit (ITC).

The exception to the 2022 slowdown was the residential solar segment, which had another record-breaking year of 40% growth. This segment is more insulated from the impacts of trade issues since over half of the segment utilizes domestically sourced modules.

Uncertainties persist in 2023

2023 should be a much better year. We’re expecting 41% growth over 2022 as supply chain relief arrives. However, there are several major uncertainties from 2022 that the industry is still contending with.

The first is the supply of available modules for the US market once the new anticircumvention tariffs are implemented no later than mid-2024. In December, the Department of Commerce (DOC) issued a preliminary ruling in the ongoing anticircumvention case. It determined that several companies were circumventing tariffs directed at Chinese solar equipment. New tariffs will apply to some suppliers shipping cells and modules from Southeast Asia. These circumstances will create immense pressure to procure non-tariffed solar module supply.

The future supply of domestically produced modules will also factor into this supply/demand balance. There are currently only 9 gigawatts of module manufacturing capacity based in the US, and only a portion of that capacity is producing equipment. The IRA has successfully instigated a flurry of announcements for new facilities, but the pace and scale of buildout is unlikely to follow announced timelines perfectly.

The second major uncertainty is related to the pending guidance for the various tax credits and incentives in the IRA. While some guidance has already been published, much more is yet to be released.

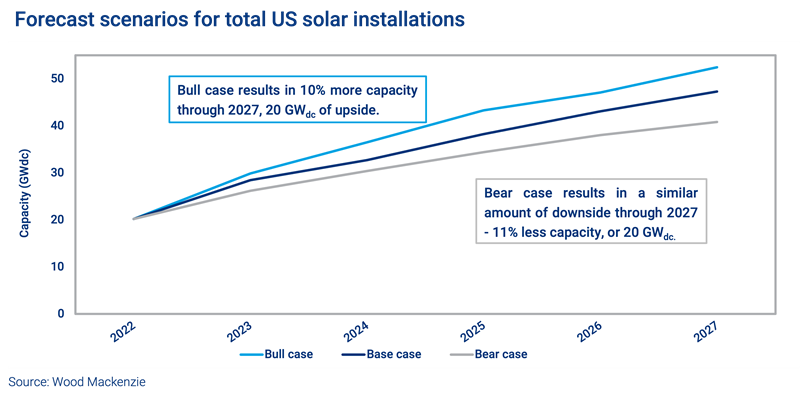

Benchmarking US solar industry uncertainty – bull and bear scenarios

To benchmark these uncertainties, we’ve created two alternative scenarios – a bull and a bear case to accompany our standard base case. These scenarios consider various outcomes related to module supply and demand, domestic production of modules, and the ease of qualifying for various tax credits and adders. The bull case assumes more favorable outcomes: more module supply imports, faster ramp-up of domestic manufacturing and less arduous qualifications for the IRA tax credits and bonus adders. The Bear case generally assumes the opposite.

Our bull case puts cumulative US solar installations 10% higher than our base case and our bear case puts cumulative installations 11% lower through 2027 – about 20 gigawatts in either direction. Put another way, there is roughly 20 gigawatts of upside or downside risk for the US solar industry over the next five years. And that equates to roughly US$30 billion in solar capital investment.

US solar industry to multiply five times in the next ten years

Our Year in review report also explores a longer-term, 10-year forecast horizon for our base case. By 2033, cumulative solar installations will grow from 141 gigawatts installed today to over 700 gigawatts. Growth accelerates in the near-term and then moderates after 2028 as grid constraints limit utility-scale solar and distributed solar markets hit market penetration thresholds.

The full report explores each segment in greater detail, including the assumptions for the alternative scenarios and more details on distributed solar-plus-storage trends.