The US solar industry waits

Before the solar industry can take advantage of the Inflation Reduction Act, it needs government guidance and supply chain relief

4 minute read

Michelle Davis

Head of Global Solar

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

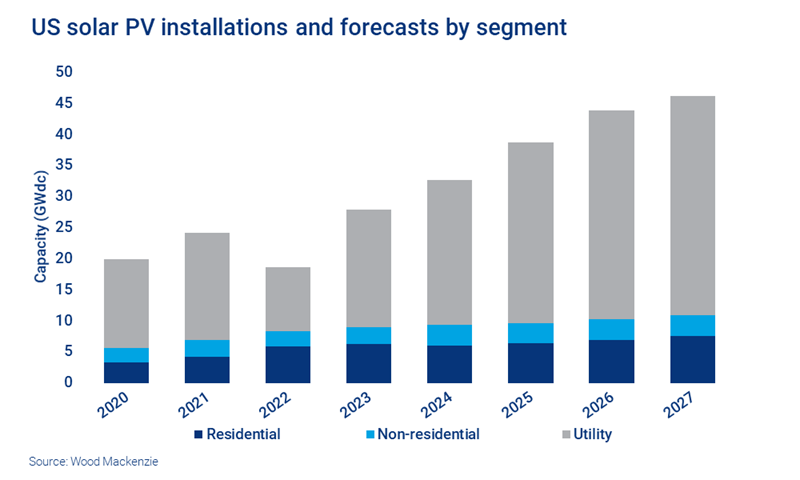

The Inflation Reduction Act (IRA) is expected to bring massive benefits to the US solar industry. Last quarter, when the legislation passed, we increased our five-year outlook for the whole industry by 40%.

But before those benefits can be fully realized, the solar industry is waiting on the outcomes of several key policy issues. The first is how Customs and Border Protection (CBP) will manage the approval process under the Uyghur Forced Labor Prevention Act (UFLPA) and the release of hundreds of solar equipment shipments still being detained. And the second is further US government guidance on specific requirements to qualify for the various tax credits and adders in the IRA.

In the meantime, solar installations so far this year have been relatively anaemic (except for residential solar). The drivers of supply chain constraints continue to pile up: pandemic-related shortages, the threat of anticircumvention tariffs earlier this year, enforcement of the Hoshine Withold Release Order (WRO), and most recently, enforcement of the UFLPA. In Q3 2022, 4.6 gigawatts-direct current (GWdc) of capacity was installed – average quarterly installations in 2021 were above 6 GWdc. We expect 18.6 GWdc to come online in 2022, a 23% reduction compared to 2021.

In our US Solar Market Insight Q4 2022, created in collaboration with the Solar Energy Industries Association (SEIA), we analyze these near-term challenges on each segment of the industry. Fill in the form for a complimentary copy of the 15-page executive summary. Or read on for some key highlights.

UFLPA compliance uncertainty puts solar supply chain relief at risk

The UFLPA took effect on 21 June, with detentions beginning shortly thereafter. But even after several months, CBP has not made major releases of solar equipment. The requirements to demonstrate compliance are more rigorous than those for the Withhold Release Order (WRO) issued last fall. Last quarter, importers were working with CBP on the required documentation and were expecting near-term releases, as some manufacturers had started to file admissibility packages.

Detentions are still being released from last fall’s WRO, a foreboding sign that UFLPA releases could take just as long.

Michelle Davis

Head of Global Solar

Michelle leads our solar research, identifying emerging industry themes and cultivating a team of solar thought leaders.

Latest articles by Michelle

-

Opinion

What could further trade actions mean for the US solar supply chain?

-

Opinion

Sunny skies ahead: the solar market and supply chain in 2024 and beyond

-

Opinion

Our top takeaways from the Solar & Energy Storage Summit 2024

-

Opinion

The US solar industry is off to a strong start in the first quarter

-

Opinion

Is the IRA paying off for the US solar supply chain?

-

Opinion

US solar shattered records in 2023, but will this continue in 2024?

Unfortunately, little has changed. It is proving more difficult than expected to provide traceability for the sourcing of quartzite used in solar equipment. There are many questions around the required documentation that is needed to demonstrate compliance with the UFLPA. Furthermore, detentions are still being released from last fall’s WRO, a foreboding sign that UFLPA releases could take just as long.

Supply chain relief is still expected to arrive in the second half of 2023, but the exact timing is uncertain given the current circumstances.

US solar industry eagerly waits for guidance on IRA requirements

The solar industry is also waiting on guidance from the US Department of Treasury on how to qualify for the various tax credits and adders within the IRA. These incentives will undoubtedly provide upside for solar project development, but without more specifics from the US government, it’s difficult to assess which projects will and will not qualify for various adders. The overwhelming sentiment from developers this quarter was that it’s too soon to know how the bonus adders will impact their business.

The Department of Treasury collected public comments on various aspects of the IRA tax credits, which were due on 4 November. Guidance on the prevailing wage and apprenticeship requirements was released on 29 November and was generally in line with industry expectations. While there’s no firm deadline for the rest of the guidance, most is expected sometime in the first quarter of 2023.

Given this uncertainty, Wood Mackenzie has assumed most projects will earn the 30% ITC or US$26/MWh PTC. In the medium-term, the availability of bonus adders will certainly provide upside to our outlooks after supply chain issues have been resolved.

After 2022, US solar to have average annual growth of 21%

Starting next year, the solar industry is expected to return to growth.

Utility solar installations should increase as importers work through the aforementioned supply chain constraints. IRA-driven demand and supply normalization will increase 2023 utility-scale installations by 84%. Through 2027, 150 GWdc of utility solar installations should come online.

Commercial and community solar have suffered similar delays in installations through the third quarter. Commercial solar will grow by 17% in 2023 after a flat year in 2022. And while 2023 community solar installations are expected to be flat compared to 2022, growth picks up dramatically in 2024 once California’s new community solar market bears fruit.

Unlike the other sectors, residential solar has had a record-breaking year thus far. Installers report that installations would be higher if it weren’t for supply chain constraints and interconnection and permitting delays. In 2022, we’re expecting 37% growth over 2021. However, due to the newly revised NEM 3.0 policy in California, market contraction is expected starting in late 2023. Since California is the largest residential solar market, this will result in more modest 6% growth in 2023 and a 3% contraction in 2024.

The full report explores each segment in greater detail, including more details on California’s latest NEM 3.0 policy.