Discuss your challenges with our solutions experts

US LNG exports slump

The plunge in European gas prices has led buyers to cancel cargoes from the US, and export plants are running well below full capacity

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

What the "big beautiful bill" means for US energy

-

Opinion

Inside the ‘crazy grid’

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

The emergence of the US as a significant exporter of LNG, which began when Cheniere Energy shipped its first cargo in February 2016, has encouraged some high-flown political speech-making. Steven Winberg, the US assistant secretary for fossil energy, said last year that the gas represented “molecules of US freedom” exported to the world.

Underneath the vaulting rhetoric, however, the US LNG industry is a normal business that responds to the usual commercial incentives. Exports of “freedom gas” have fallen sharply in recent weeks, because the economics have become unattractive.

US LNG supply capacity has been increasing as demand has been falling. The tail end of the first wave of export projects is coming into operation this year: last month the third train at Cameron LNG in Louisiana began producing LNG, the third train at Freeport LNG in Texas started commercial operations., and production continued to ramp up at Elba Island LNG in Georgia, despite brief disruption from a fire.

At the same time, demand has been hit by a shock that is unprecedented in the history of the LNG market. World LNG imports are set to be 3% lower in the second quarter of 2020 than in the same period of last year, according to Wood Mackenzie forecasts.

“There would have been too much LNG in the world even without Covid-19,” says Ben Chu, director of equities, LNG and proprietary at Wood Mackenzie’s Genscape service. “Covid-19 has made it worse.”

At a time of a worldwide gas glut, US supplies are the quickest to respond to the changed market conditions. Most US LNG is sold under contracts that have a fixed component for the liquefaction capacity, which must be paid for whether or not it is used, and a variable component for the cost of the gas, which is generally linked to Henry Hub, and which is payable only if a cargo is produced.

Most offtakers of US LNG have the ability to cancel unwanted cargoes under the terms of their contracts, and when prices at destination do not cover the variable costs of production and shipping, that is what many of them have been doing. This month an average of about 3.8 billion cubic feet of gas a day has been flowing into US LNG plants, according to Genscape data. That is well below their full liquefaction capacity of about 10 billion cubic feet a day.

Between 40 and 45 LNG cargoes provisionally scheduled to leave the US in August have been cancelled, Reuters reported this week. That is about the same as the number that were cancelled for July, and up from the 20-30 that were cancelled for this month, Reuters says.

The gas price differentials seem likely to remain challenging for exporters from the US. In Europe, which is generally the market of last resort for US LNG, storage is filling up, as a result of the mild winter and the downturn in the economy, and that has driven down prices.

Gas in the UK and the Netherlands has been trading at the equivalent of about $1.90 per million British Thermal Units. Even though US Henry Hub has been down at about $1.60 / million BTU this week, the variable or cash costs of liquefaction, shipping and regasification are about 70 cents / million BTU, meaning that exports from the US to Europe are typically not profitable. Until the autumn, that seems likely to remain the case, meaning that excess gas supply will also build up in storage in the US.

However, low prices are also starting to have an effect on US production, and the sharp drop in oil development is also having an effect on supplies of associated gas. By November, US gas production will be down to 87.8 billion cubic feet per day, according to Wood Mackenzie forecasts, 8% lower than its level a year earlier. That will help support Henry Hub prices.

In the long term, the slump in US LNG exports this year may not have much effect on future investment in US LNG export capacity. Shipments have fallen more sharply for the US than for other exporters, because its LNG supplies are more flexible. Sales contracts allow buyers to cancel unwanted cargoes, because they are taking gas from the US grid. Any gas that is not wanted as LNG will find a home somewhere else in North America.

In the rest of the world, by contrast, the typical model is an integrated project including linked production facilities. A higher proportion of the costs are fixed, in wells already drilled and infrastructure already built, and production cannot be simply turned off and on at will as market conditions vary.

Total long-term costs for US LNG are competitive on a global basis, and the ability to make decisions on shipments month by month is attractive to some buyers.

“This flexibility could be a way of selling US LNG. It demonstrates that buyers have more control,” says Alex Munton, Wood Mackenzie’s principal analyst for Americas LNG. “It’s not a killer blow.”

Rising coronavirus cases threaten the US recovery

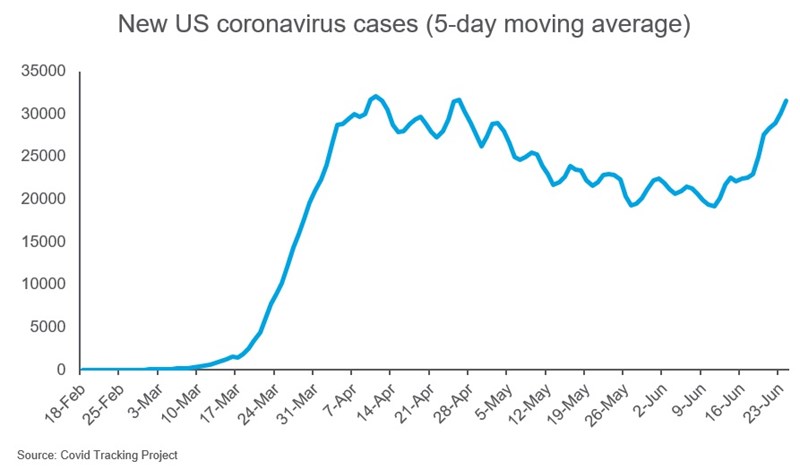

As some of the US states that were hardest hit by the first wave of the coronavirus have managed to bring their infection rates under control, the number of cases in other states has been rising sharply. Texas, Arizona, Florida and California are among the states where new cases have been surging, driving the national total to a new record high of 38,672 reported on Thursday.

The surge in reported cases is partly a consequence of a successful ramp-up of testing. The last time the US was reporting more than 30,000 new daily cases, it was testing about 220,000 people a day. For the past week, it has been testing more than 520,000 a day.

However, the proportion of test results coming back positive has also been rising. It bottomed out at about 4.4% in the first half of June, but had ticked up to 5.7% by the five days to Wednesday.

The threat to the US economic recovery posed by the resurgence of Covid-19 is already becoming apparent. Governor Greg Abbott of Texas this week said the coronavirus was “rampant”, and encouraged people to stay home if possible. He warned that the state might have to “ratchet back” from its reopening unless the numbers of new cases and admissions to hospital could be brought under control soon.

The Walt Disney Company said on Thursday that it would have to delay the reopening of two theme parks in California, which had been scheduled for July 17.

The governors of New York, New Jersey and Connecticut said on Wednesday that anyone entering their states from coronavirus hot spots including Texas and Florida would have to quarantine themselves for 14 days after arrival. Florida has had a similar requirement for visitors from New York since March, although it is unclear how strictly it is being policed. The new rules for New York and its neighbours will be similarly difficult to enforce.

The revival of US gasoline demand has been proceeding steadily, with last week’s sales down just 9% from the equivalent week of 2019, according to the Energy Information Administration. A new round of business closures and restrictions on movement would put a brake on the pace of any further recovery.

US oil production has fallen, even though some wells are being reopened

The rebound in West Texas Intermediate crude to around $40 a barrel over the past six weeks has encouraged some US oil producers to rethink their plans for shutting in wells, but production remains well below its levels earlier in the year.

Continental Resources, for example, said last week that next month it expected to restart production from some of the wells it had kept shut-in through May and June. However, it added that it still expected to curtail approximately 50% of its operated oil production.

As of Monday, US oil production was running about 2 million barrels a day lower than in March, according to Genscape. That is a smaller drop than earlier in June, but a larger reduction than the 1.7 million b/d cut reported as the average for May.

In brief

Nevada’s Governor Steve Sisolak plans to follow California’s vehicle emissions standards, rather than the less demanding federal rules set out by the Trump administration. California’s more stringent rules are currently followed by states accounting for about 40% of US car sales.

Hartshorne Mining Group, the company that was praised for opening the first new thermal coal mines in the US under the Trump administration, went into Chapter 11 bankruptcy protection in February. Now a group of creditors has asked the bankruptcy court to approve a Chapter 7 liquidation, arguing that the company is unlikely to be able to restructure successfully.

The US offshore wind industry could be delivering 25 gigawatts by 2029. But permitting delays and political risk at both the state and federal level could hamper its growth.

System costs for photovoltaic solar in the US are falling faster than expected.

The British government has given an additional £73 million to support research and development for technologies to cut transport emissions, including electric vehicles.

“For now, fracking is over” for the UK, the country’s energy minister has said. Kwasi Kwarteng told BBC North West Tonight: “We had a moratorium on fracking last year and frankly the debate’s moved on. It is not something that we’re looking to do.” Attempts to develop a shale oil and gas industry in Britain have faced sustained opposition, and last November the government imposed a moratorium on hydraulic fracturing.

Daikin Industries, the Japanese company that is the world’s largest manufacturer of air-conditioning units, says it has seen a surge in demand from businesses worried about airflow around their premises, and from people who have been forced to work from home and are trying to keep cool.

And finally: Southwold is a charming seaside town in Suffolk, probably best known for the up-market brewery Adnams and the Swan hotel. I learned from Genscape’s latest European oil products markets report that a section of the North Sea off Southwold is also a designated ship-to-ship area used for floating storage of crude and oil products. The report says that unprecedented volumes of diesel have been accumulating in the area because of the weakness of European demand.

Before the coronavirus, I had been planning to spend a week there this summer. I could have put it down as a research trip.

Other views

Simon Flowers — Big Oil, new energy and the stock market

Gavin Thompson — Australia’s North West Shelf is set for change

Alan Gelder — How will refiners cope with lost oil demand?

Annabelle Swift — Electric vehicle chargers: build it and they will come

Mike Coffin — Net-zero goals for oil companies do not tell the whole story

John Kemp — Oil prices are transitioning to the next phase of the cycle

Caroline Delbert — Why the world’s most advanced solar plants are failing

Quote of the week

“Success is not final, failure is not fatal: it is the courage to continue that counts.” — At an online workshop to celebrate 60 years since OPEC was founded, Mohammad Barkindo, the group’s secretary general, quoted a saying often attributed apocryphally to Winston Churchill to sum up the lessons from its first six decades.

He also paid tribute to OPEC’s “Founding Fathers”: Juan Pablo Pérez Alfonzo, Venezuela’s energy minister, and the senior oil officials of Saudi Arabia, Iran, Iraq and Kuwait, who came together to set up the organisation at a meeting in Baghdad in September 1960.

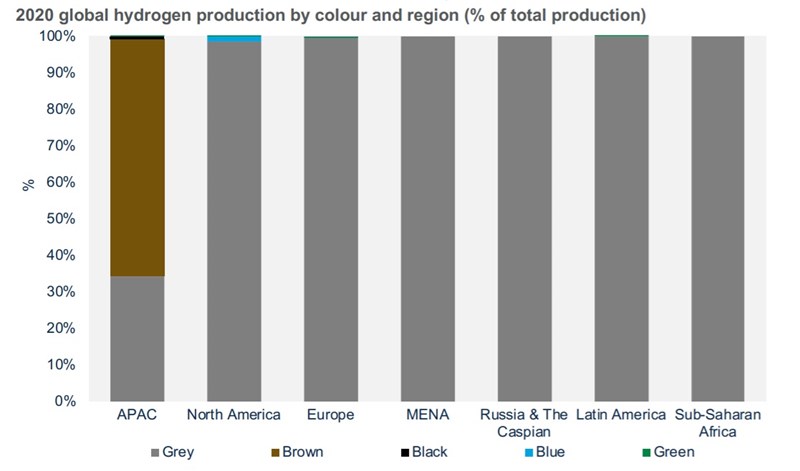

Chart of the week

This chart, showing the regional shares of hydrogen supplies coming from different sources, is included in a recent Wood Mackenzie report, called Hydrogen Landscape 2020. It is a reminder that, although there is huge interest in the low-carbon potential of hydrogen, the great majority of the world’s supply today comes from fossil fuels. Grey hydrogen, made from natural gas, brown hydrogen, from coal, and black hydrogen, from petroleum products, together make up about 99.6% of the world’s supplies. Blue hydrogen, from gas with carbon capture and storage, and green hydrogen from electrolysing water using a renewable energy source, account for barely visible slivers of the market.