Get Ed Crooks' Energy Pulse in your inbox every week

US oil producers live up to their promises on spending restraint

As crude prices have rebounded over the past year, E&Ps have stepped up activity only gradually. They still face fundamental strategic choices

1 minute read

Ed Crooks

Vice-Chair, Americas

Ed Crooks

Vice-Chair, Americas

Ed examines the forces shaping the energy industry globally

Latest articles by Ed

-

Opinion

How global trade can help build the clean energy economy

-

Opinion

Biden exit shakes up US presidential race

-

The Edge

Is it time for a global climate bank?

-

Opinion

Are low profits to blame for the energy transition lagging?

-

Opinion

Day 3: How can we finance the energy transition? Discussions from the final day of the Reuters Global Energy Transition Conference 2024

-

Opinion

Day 2: The Energy Gang at The Reuters Global Energy Transition Conference 2024

Mr Micawber’s well-known principle of financial management is set out in Charles Dickens’ David Copperfield: “Annual income twenty pounds, annual expenditure nineteen nineteen and six, result happiness.” US independent oil producers are holding to a much more demanding standard of frugal conduct. Listed US E&P companies reinvested just 48% of their cash flow on average in the first quarter of 2021, and the rate is likely to have been even lower in the second quarter.

Their cautious approach to spending, largely sticking to budgets and drilling programmes set last year when prices were much weaker, will make it possible for E&P companies to pay down debt rapidly. It raises questions about the US industry’s longer-term strategy, at a time when many governments around the world are setting goals for greenhouse gas emissions that imply a significant decline in oil demand over the coming decades.

As oil prices have rebounded over the past year, with WTI holding above $70 a barrel since June, the cash flows coming in to US E&Ps have soared. At current prices, all the Tier 1 and Tier 2 acreage in the tight oil basins of the US Lower 48 is profitable to develop. But the industry’s response to these price signals, in terms of increased activity and production, has so far been restrained, and much more cautious than has been typical over the past decade.

The four most expensive words in the English language are famously “this time it’s different”. But so far in this upturn there really does seem to be something different about the capital allocation decisions of the publicly traded US E&P companies. Management teams have for years been telling investors about their commitment to strengthening balance sheets and rewarding shareholders, rather than going for growth at the first opportunity. Now they are backing those words with action, or rather inaction.

Privately-held companies have been more ambitious with their drilling programmes than their listed peers. In the Lower 48 states there are now more horizontal rigs running for privately-held operators than for listed companies. In the Permian Basin, private companies accounted for about 70% of all new wells in the first quarter. Endeavor and Mewbourne, both privately owned, are currently operating about as many rigs in the Permian as EOG and Devon, two of the largest listed independents. But the total effect across the industry has still been a relatively slow rebound in activity.

“A look back at history shows us how unique this moment is,” writes Linda Htein, Wood Mackenzie’s senior research manager for Lower 48 oil and gas supply in a new note. “Never before has tight oil investment been so low with prices so high.” Last week there were 339 oil-focused horizontal rigs active in the US, according to Baker Hughes, well below the numbers in past periods when crude prices were at similar levels.

That number of horizontal wells is below the number of 400 or so required to keep US tight oil production flat, barring a change in the numbers of drilled but uncompleted wells. Production from the Lower 48 has remained broadly unchanged at about 9 million barrels per day for the past year, as companies have worked through their inventories of DUCs.

The steep backwardation in crude futures is part of the explanation for the industry’s cautious response. August 2021 WTI is trading at about $72 a barrel, while the December 2022 contract is about $63. Next year’s production cannot be hedged at current front-month prices. The most significant factor, though, is that the listed companies are standing by their commitments to investors on capital discipline, at least for now. The E&Ps’ presentations of their first quarter earnings in April and May were full of discussions of debt reduction and distributions to shareholders, including EOG Resources’ special dividend and Continental Resources’ reinstatement of its quarterly payout, which was suspended last year.

The combination of these policies with the rebound in oil prices has paid off for investors. The S&P select index of E&Ps has risen by 50% year-to-date, comfortably eclipsing the 18% rise in the broad S&P 500. The rebound has not come close to undoing the weakness of the past seven years — the E&P index is still down 73% from its peak in July 2014 — but has been a welcome reversal of a long downward trend.

Spending restraint means that the listed companies’ debts are falling fast. The average gearing for the leading E&Ps was about 43% at the end of 2020, and about 40% at the end of the first quarter of 2021. If WTI stays at around $70 a barrel, most of those companies will reach 25% gearing next year.

The big strategic questions for those companies will come if they are still generating strong cash flows once their balance sheets are in a much stronger position. They cannot go on paying down debt forever. As Robert Clarke, Wood Mackenzie’s vice-president of upstream research, says: “What is the right level of debt for an E&P? It isn’t zero.”

US oil companies face a range of strategic options for capital allocation. They could follow the European Majors into diversification into alternative energies including renewables and EV charging. They could follow companies such as Occidental Petroleum that are staying focused on hydrocarbons, but aiming for zero emissions through carbon capture. They could aim for stable or declining production and maximise distributions to shareholders. Or they could return to growth.

All of these approaches have their pros and cons. With many governments around the world committed to steep reductions in emissions over the coming decades, and incentivising or mandating the electrification of transport to support those goals, the outlook for oil demand is clouded. But the capabilities and culture of E&Ps are likely to make a return to growth the most appealing strategy for many, as soon as they are able.

Mr Micawber finds it impossible to adhere to his own principle of frugality, and gets sent to a debtors’ prison after “some temporary embarrassments of a pecuniary nature”, although ultimately (spoiler alert) everything ends happily for him. For US E&Ps, too, asking them to maintain their current spending discipline for the long term is an instruction that goes against their nature.

The EU’s ambitious climate plans include a carbon price at the border

“Fit for 55” is the snappy title the European Commission has chosen for the largest legislative package in its history, intended to cut the EU’s greenhouse gas emissions by at least 55% from 1990 levels by 2030. The EU’s ambitious climate goals have made it one of the world leaders in addressing the threat of climate change. They are extremely demanding objectives, as Wood Mackenzie research from earlier this year made clear, and it is no surprise that the policies for achieving them will have far-reaching effects.

The goal of the 55% reduction in emissions by 2030 was last month formally enshrined in law by the European Council and Parliament, and the new package sets out proposals for reaching that goal. They include lowering the cap on allowances in the EU’s emissions trading system; expanding the system to cover aviation and shipping; setting new targets for forest protection and land use; accelerating the development of renewables and energy efficiency; and requiring all new cars sold to be zero-emissions by 2035.

Perhaps the most contentious proposal is for a carbon border adjustment mechanism, which would impose costs on imports into the EU based on their associated emissions. The Commission has offered six different options for how the mechanism could be designed, including carbon taxes, excise duties, and certificates that would have to be bought and then surrendered when the goods enter the EU.

The idea of the border adjustment is to prevent carbon leakage: manufacturing operations being moved to other countries to escape the carbon price in the EU, and then exporting their production back into Europe. The European Commission argued that the mechanism “helps to ensure that our climate goals are not undermined by the threat of carbon leakage, by encouraging global climate action.”

It is a real problem. But the proposed solution could bring EU climate policy into conflict with other goals, for economic management, trade and international relations.

If the EU goes ahead with its plan, other economies around the world will be pushed towards following suit. It did not look like a coincidence that US Senate Democrats’ $3.5 trillion spending plan, announced on Tuesday, included a proposal for a “polluter import fee” related to carbon emissions. There have been warnings that a “carbon trade war” is looming.

But although these ideas are clearly gathering political momentum, making them a reality will not be easy. James Whiteside, global head of multi-commodity research at Wood Mackenzie, warned: “Implementation could prove to be a logistical nightmare.” There is little transparency around the carbon emissions associated with specific products, and even determining country of origin is often difficult. If the EU, the US or any other economy is to put a carbon border mechanism in place, there will have to be entirely new systems in place to administer, monitor, and enforce them.

The US government launches an “earthshot” for long duration energy storage

One of the most challenging goals set by the Biden administration is for the US electricity sector to be emissions-free by 2035. A technological breakthrough that would make a huge difference in achieving that goal would be cost-competitive long-duration energy storage, which at the moment does not exist in any form that can be widely deployed across the grid. Jennifer Granholm, the US energy secretary, this week launched the “long duration storage shot”, a federal government initiative intended to cut by 90% the cost of systems for providing more than 10 hours of storage.

The administration is seeking $1.16 billion from Congress to fund energy storage R&D. The technologies that are eligible for support could be electrochemical, mechanical, thermal, chemical carriers, or any combination. Granholm said: “We’re going to bring hundreds of gigawatts of clean energy onto the grid over the next few years, and we need to be able to use that energy wherever and whenever it’s needed… That’s why DOE is working aggressively toward cheaper, longer duration energy storage.”

In brief

Following last week’s failure by the OPEC+ countries to reach agreement on relaxing production curbs, uncertainty has continued to swirl around the group’s position. The central conflict preventing a deal was the disagreement within OPEC between the United Arab Emirates and Saudi Arabia over the UAE’s production limits. This week news outlets reported that the two countries had agreed a compromise, but the UAE’s energy ministry quickly poured cold water on those suggestions, saying that an agreement had not yet been reached, and talks with the OPEC+ group were still under way. The Financial Times reported that a deal was close, but had yet to be finalised.

China is this month finally launching its long-awaited emissions trading system. In its first phase the system will cover only the power sector, but the government plans to expand it to other carbon-intensive industries including construction materials, steel, and petrochemicals.

Plug Power, a hydrogen fuel cell company, has signed a 345 MW wind power purchase agreement with Apex Clean Energy in Texas to supply a planned hydrogen plant. The two companies say it is the largest power purchase agreement for green hydrogen in the US so far.

Microsoft, which last year announced a goal of being carbon negative by 2030, has made a new commitment on its energy use. It has pledged that by 2030 it will have “100% of our electricity consumption, 100% of the time, matched by zero carbon energy purchases”. The goal reflects the fact that it is very difficult to run operations entirely on renewable energy. Facilities require power from grids that still rely heavily on coal and gas. Microsoft said in a statement: “We know that our actions alone won’t decarbonize the grid, but we are committed to doing our part to help drive important market demand signals that influence the speed and scale at which the grid decarbonizes”.

The US Senate’s energy committee has approved an energy infrastructure bill with bipartisan support. The bill includes measures to support carbon capture, use and storage, low-carbon hydrogen, nuclear power and grid resilience. It would also mandate the government to set up a programme to plug and reclaim orphan wells on federal lands.

Virgin Galactic successfully flew its billionaire founder Richard Branson and five other people to suborbital space, about 53 miles above the earth’s surface. The two crew and four passengers experienced weightlessness for about four minutes. Branson, who has long been a campaigner on climate change, rejected suggestions that the flight was a waste of energy. A single trip on Virgin Galactic uses twice as much energy as the average American consumes each year, according to estimates from the Breakthrough Institute. Branson argued that development of space flight was essential for monitoring climate-related questions such as the degradation of rainforests. “These things are essential for us back here on earth. So we need more spaceships going up to space, we don’t need less,” he told the talk show host Stephen Colbert.

And finally: another winner from the Euro 2020 football championships. The final between England and Italy drew large audiences in those two countries, of course, but was also the most watched European championship game ever in the US, watched by almost 6.5 million. It was good exposure for the sponsors, including Volkswagen, which managed to create a cult following for the small model electric car that carried the ball onto the pitch for the beginning of the game. The 1:5 scale model of VW’s ID.4 electric car, used for several matches, was described as “an internet sensation”. The ID.4 has been selling fast in Europe, although sales in China have been reported to be disappointing. With the EU planning to mandate that all new cars must be zero-emissions by 2035, establishing strong EV brands will be important for all manufacturers.

Other views

Simon Morris — Champagne supercycle: Taking the fizz out of the commodities price boom

Simon Flowers — How to scale up carbon capture and storage

Andrew Latham — Exploring the deepwater advantage

Julian Kettle — Carbon taxes: which mined commodities will be the winners and losers?

Energy Pulse will now be taking a break for the summer. See you in September!

Quote of the week

“Advancing solar is absolutely good for the world… Do you just think about money? Is that your motivation? What is your purpose in life?” — Elon Musk, taking a combative tone with the lawyer questioning him in a videotaped deposition for the trial over Tesla’s 2016 acquisition of SolarCity.

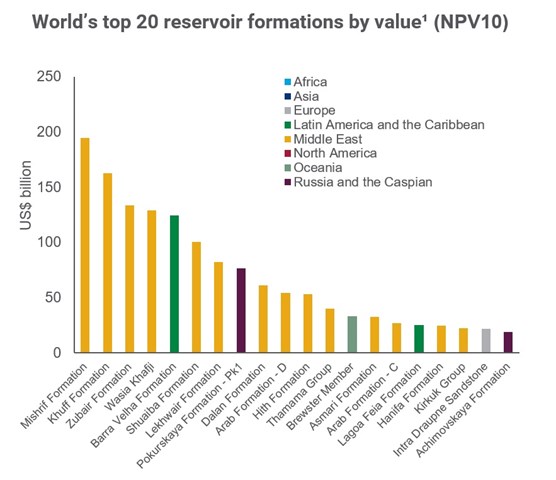

Chart of the week

This comes from recent research by Alexandre Araman, Wood Mackenzie’s principal analyst for Middle East Upstream. It emphasises just how dominant the Middle East is for the future of oil and gas. With just 3.6% of the world’s land area, the 14 countries of the Middle East hold 53% of the world’s remaining proved and probable recoverable reserves of oil and gas. Of the world’s largest reservoir formations by value, eight out of 10 are in the Middle East. Araman’s work, using our Lens Subsurface data platform, provides fascinating detail on the unique geology of the Middle East that has made it such a prolific region.