US renewables project finance: five things to know

How will soaring demand for renewable energy financing be met?

2 minute read

With climate change riding high on the global policy agenda, these are exciting times for the clean energy industry. In the US, the Biden administration’s historical infrastructure bill and renewed commitment to combat climate change could provide a massive boost for the renewables sector.

So, what market and policy events could have an impact on the financing of clean energy projects in the US over the next few years? I explored this topic with a panel of industry experts at the recent North American edition of Wood Mackenzie’s Power & Renewables Conference. Read on for an overview of the current state of project financing in the sector. You can also fill in the form to access a complimentary selection of presentation slides from the event.

1. The political environment is extremely positive for renewables

Our panel at the conference were very upbeat about the current political environment for clean energy in the US. “Whether it's state and local, or whether it's Washington, the environment is as positive as it's ever been, certainly in the last two decades,” commented Marshal Salant, Head of Alternative Energy Finance at Citi, summing up the general mood.

At the federal level, investment tax credits (ITC) and production tax credits (PTC) are set to be extended and broadened, while the US Department of Agriculture and Department of Energy are working hard to support energy transition-related initiatives. Meanwhile, plans for a ‘green bank’, should they go through, would be highly significant.

At the same time, the majority of states have introduced policies to support clean energy: “At least 29 out of 50 states have some sort of renewable portfolio standard,” pointed out Patrick Pfeiffer, Managing Director, US Operations at Norwegian renewable energy company Statkraft.

2. Clean energy is benefiting from a strong market focus on Environmental, Social and Governance (ESG) policies

On the demand side, exploding investor interest in ESG is another big positive for clean energy. “I feel that ESG has taken off faster in the financing world than just about any phenomenon we've seen,” remarked Marshal Salant. “It's massive. And it’s only going to get bigger.”

Elina Coss, Of Counsel, Energy and Infrastructure at Wilson Sonsini, agreed, pointing to examples of institutional clients whose ESG policies are pushing them towards investing in renewable energy. “A lot of pension funds, especially out of Canada, are really starting to implement their ESG goals,” she said.

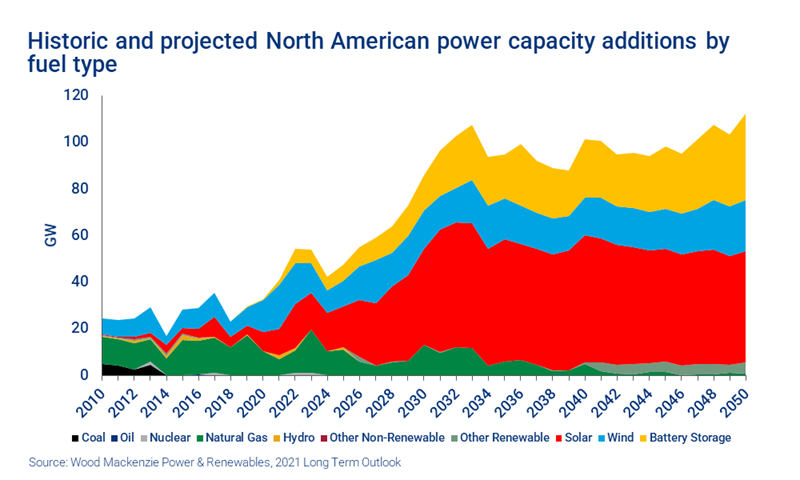

Corporations are reacting by aligning both with the growing focus on ESG and with state-specific policies on carbon reduction. As a result, recent record growth in wind, solar and energy storage is likely to become a long-term trend, as shown in the chart below, taken from our North America power markets long term outlook.

3. Overlooked sub-sectors are turning to newer investors and novel deal structures

Areas of the market such as community solar and energy efficiency have traditionally been underserved and undervalued by investors, who have seen them as too complex and risky. However, the ongoing search for yield means that is starting to change.

“We’re seeing yields generally get compressed on large scale utility projects,” commented Christopher King, Managing Director, Renewables at Lafayette Square. “I think for some investors, the complicated tariff nature associated with community solar and other kinds of more distributed type products creates an opportunity to still find that yield.”

As Elina Coss pointed out, these new players are employing deal structures which differ from the traditional tax equity arrangement: “A few are structured as debt, although it seems like preferred equity is the preferred way to go because it's typically a bit of a higher return and they can limit some of their downside.”

4. There is not enough tax equity money to go round

Despite record amounts of capital in the market, demand for investment dollars continues to outstrip supply: “over the last five years at least, if not 10 years, there's always been more demand for tax equity from developers than there were investors to invest,” said Marshal Salant. He highlighted what he called the “bifurcation of the tax equity market”, with big investment-grade developers able to raise plentiful tax equity while smaller developers struggle.

Marshal also flagged a lack of skilled underwriters as an issue: “There are only a handful of people that lead most of the tax equity deals in the US. And that number, although we've all tried to increase it, has not increased by much,” he commented.

5. Tax policy will be key to unlocking growth

With a lack of tax equity a major issue, decisions made on Capitol Hill around tax policy will have major implications for the sector. Marshal Salant pointed out that tax incentives are only effective if there is someone who can help monetise tax capacity. An alternative is ‘direct pay’, which is similar to past initiatives sometimes referred to as refundable credits or cash grant deals. Direct pay would allow project developers or load serving entities to receive incentives regardless of their tax liability and corresponding capacity to use tax credits. “Direct pay would be an awesome way to do it,” he said. “It would allow current players to do more and it would allow us to bring in some new players.”

If congress passes the direct pay provision, it could greatly accelerate the build out of wind, solar, and battery storage projects to deliver the energy transition. Without it, the potential tax equity shortage for the market could be a significant barrier to growth for the renewables sector.

Missed the North America Power & Renewables Conference? On demand access is available. You can also fill in the form at the top of the page to access a complimentary selection of the presentation slides.