What does Milei mean for oil and gas in Argentina?

Argentina’s new president is committed to privatisation and deregulation, but first inflation must be tamed

4 minute read

Adrian Lara

Principal Analyst, Upstream Latin America

Adrian Lara

Principal Analyst, Upstream Latin America

Latest articles by Adrian

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Recursos gasíferos en América Latina: los desafíos para el desarrollo

-

Opinion

Gas resources in Latin America: the challenges to development

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael Portela

Principal Research Analyst, Corporate Analysis

Raphael focuses on Latin America and its national oil companies as a senior analyst on our Corporate Research team.

Latest articles by Raphael

-

Opinion

What does Milei mean for oil and gas in Argentina?

-

Opinion

Are NOCs prepared for the energy transition?

-

Opinion

Unwrapping key players in Colombia's upstream sector

-

Opinion

Are NOCs rising to the energy transition challenge?

-

Opinion

How are global NOCs tackling the energy transition?

Shares in majority state-owned Argentinian oil company YPF jumped 40% in value last week following the election of Javier Milei as Argentina’s new president. In the wake of his win, Milei reiterated his commitment to privatising YPF and deregulating the country’s oil industry.

Milei hopes to attract more investment to the country’s strategically important hydrocarbon sector, but before that can happen rampant inflation must be brought under control. Can a Milei-led government succeed in stabilising Argentina’s economy where others have repeatedly failed?

We have just published an analysis of this and other issues facing the Argentinian oil and gas sector. Fill out the form to download a complimentary extract containing key slides from the extract or read on for our view on the outlook for oil and gas in Argentina in the wake of Milei’s victory.

What does Milei’s victory mean for Argentina’s oil and gas sector

For YPF, domestic operators and foreign oil companies alike, Milei’s market-oriented policies are likely to be a net positive. Lifting capital controls, removing import-export taxes and lifting oil price caps will potentially help unlock sales and future investments. Meanwhile, other campaign promises such as a lower tax burden would improve the industry’s bottom-line.

Having said this, the political change also comes with plenty of downside for YPF and other operators. Existing gas subsidies are unlikely to be renewed, while Milei’s desire to favour private investment over public money for key projects could backfire unless the political and regulatory situation is rapidly stabilised. We see seven specific issues that will need to be resolved to ensure a brighter future for Argentina’s upstream oil and gas sector.

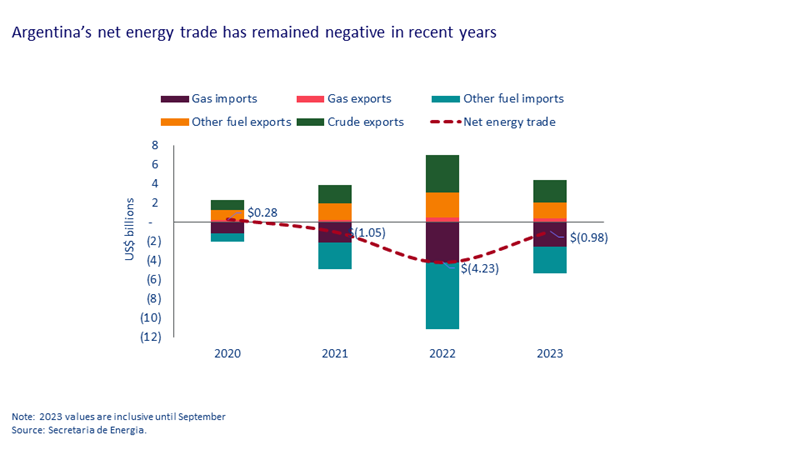

Issue 1: Improving Argentina’s energy trade balance

Monetary flows from energy trading are strategically important to the Argentinian economy, playing an important role in government finances and dollar supply-demand dynamics. However, the country has been a net importer of both oil and gas in recent years (see chart below). There is plenty of potential to increase oil and gas exports, but significant investment will be needed to make this happen.

Issue 2: Transition from energy subsidies to liberalised market prices

Energy subsidies to both producers and consumers across the hydrocarbon and power sectors have accounted for over 10% of the Argentinian government budget over the last decade. Low domestic production, Covid-19 and the conflict in Ukraine have all been factors that have resulted in increased subsidies in recent years. To boost investment, a liberalised market-based pricing system is badly needed.

Issue 3: Growing gas production and building exporting capacity

Argentina has the potential to become a regional gas exporter, sending gas to Chile, Brazil and possibly Bolivia. However, this will require significant funding. Milei favours using private sources of investment, assuming they can be found. But gas subsidies put in place by the former administration, which succeeded in boosting production, are unlikely to be renewed, reducing the potential ROI for investors.

Issue 4: Increasing oil exports and related infrastructure

Current oil export capacity is around 600,000 barrels per day (b/d). New planned pipeline and port capacity could take that above one million b/d as soon as 2026 if projects are developed in a timely manner. However, massive investment will be needed to increase and sustain production at that level throughout the next decade. For that to happen, industry participants and investors will need to be convinced a sufficiently stable political and regulatory regime is in place.

Issue 5: Maximising the strategic and market value of YPF

President Milei has promised to privatise majority state-owned oil company YPF. However, given the political obstacles we think an outright sale is unlikely. Instead, expect disposals of non-core assets in the fertiliser, gas & power and downstream segments. Overall, given Milei’s expressed desire to boost hydrocarbon exports, YPF will continue to play a major role in generating ongoing government revenue.

Issue 6: Loosening import restrictions on drilling equipment

To successfully fill new pipeline capacity, ideally both drilling days and the number of rigs in operation need to increase. Currently, Argentina’s difficult economic situation limits access to dollars for import purposes. The resulting shortage of equipment and key parts for rig repair and maintenance causes regular bottlenecks in drilling activity. In this respect, Milei’s plans to lift capital controls should help.

Issue 7: Addressing market distortion caused by government control of oil prices

Argentina has long controlled the domestic oil price for refiners in order to keep prices low and reduce inflationary pressure. This severely distorts the price formation mechanism for crude and refinery fuels, discouraging increased domestic production. Milei plans to remove price caps, however, this will only be possible if the Argentinian economy can be stabilised, and inflation brought under control.

As is usually the case, the devil will be in the details. Time is of the essence, with voters unlikely to demonstrate a great deal of patience. However, past evidence indicates that stabilising the Argentinian economy and encouraging inward investment is unlikely to be achieved overnight.

Don’t forget to complete the form at the top of the page to download your complimentary extract from the report. This includes deeper analysis of the key issues, supported by a wide range of charts and proprietary data.