Get this complimentary article series in your inbox

1 minute read

Julian Kettle

Senior Vice President, Vice Chair Metals and Mining

Copper will play a pivotal role in the energy transition. Aluminium may be an abundant and cheap competitor for electrification applications, but carbon footprint issues for primary metal may give copper the edge. Ultimately that point is somewhat moot, as both will experience rapid growth in power generation, transmission, distribution, storage and motive uses. Put simply, the energy transition cannot happen without sufficient, timely and ESG-compliant copper and aluminium supply in place.

Under our base case scenario demand for primary copper is set to grow by an average of around 2% per year over the next 20 years. That represents an incremental rise of around 9 Mt over the period. Our Accelerated Energy Transition Scenario (AET-2), which limits the average global temperature increase to 2˚ C above 1990 levels, boosts copper demand growth to 3.5% per year. This scenario would double global primary demand by 2040, equivalent to an additional 10 Mt.

So, can copper keep pace with demand growth and claim its energy transition crown as ‘King Cobre’? Or will a lack of investment in supply development come back to bite the industry?

Rhetoric on supply development is no substitute for action

Grade decline and mine closures are an ongoing feature of the copper industry — without additional investment in supply this will lead to output declining.

Currently, we estimate the industry has committed around US$120 billion in capex to expand production to offset the impact of grade decline and depletions. Nonetheless, without additional substantial investment, production will decline from 2024 onwards. Coupled with demand growth, this decline in output will lead to a theoretical shortfall of around 16 Mt by 2040.

Plugging that gap requires an investment of in the region of an additional US$325 billion, which under our AET-2 scenario leaps to in excess of US$0.5 trillion. In short, the copper industry is just not investing enough to meet burgeoning requirements; it’s all well and good governments stimulating the demand side of the equation through policy, and miners talking up the same, but where is the investment in supply?

Obstacles to rapid supply growth

Developing mines is not getting any easier for a number of reasons:

-

Resistance to spending on capital investment: With investors hooked on the dividend drug, an attractive price environment isn't necessarily translating into more license to expand.

-

Historically poor capital allocation: Poor strategy in the last super-cycle saw ill-timed expansions, capital over-runs and delayed project delivery, making investors 'once bitten twice shy’.

-

Increasingly stringent ESG requirements: ESG measures have gone from being a ‘nice to have’ to an essential requirement, extending project lead times and risks.

-

A shortage of quality, large-scale probable projects: There is a lack of sizeable, well-advanced projects in low-risk jurisdictions which are ready to be green-lighted with high confidence of delivery.

A shortage of projects threatens supply from mid-decade

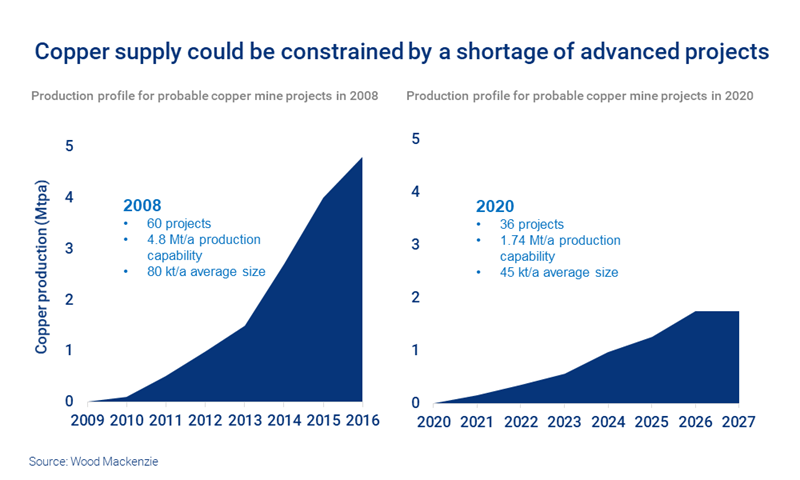

Just prior to the global financial crisis in 2008 there were around 4.8 Mt of probable projects available to be developed. That equated to 30% of the existing market at the time, or approximately 10 years of growth. By comparison, there are currently just 1.7 Mt of probable projects, only enough to meet less than three years of demand growth.

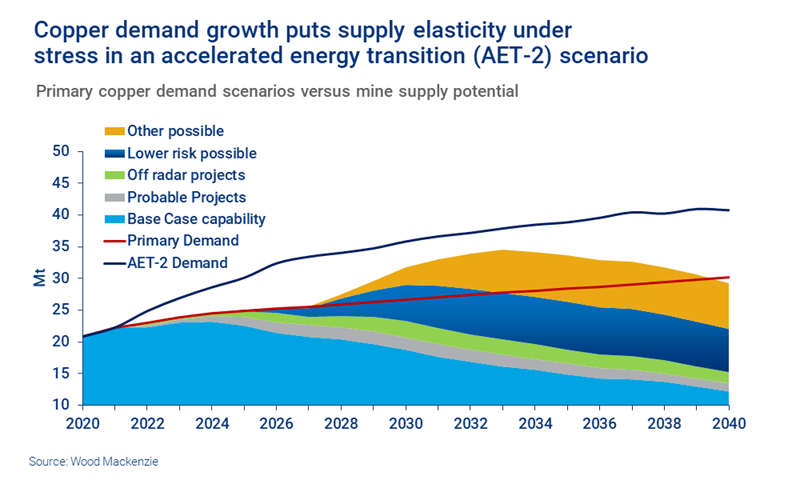

To assess whether or not supply can meet future requirements, we assume our base case for supply growth is a given and that probable projects also proceed and come on-line as envisaged. On the basis that we are forecasting a rapid acceleration of demand growth and elevated prices, we’ve allowed for off-radar projects to add an additional 15% to supply over the next ten years, a peak of around 2.9 Mt per year. (In the ten years of the last super-cycle, off-radar projects accounted for 14% of supply by 2014).

Given high hurdle rates, rising ESG requirements, low risk appetite and associated extended lead times, we assume that 50% of the 15 Mt per year of possible projects are green-lighted. For the same reason we assume production start is delayed by an average of three years compared to the normally assumed earliest-possible date. For the balance of the possible projects we allow a further two years of slippage in starting production, to reflect investor/sponsor risk aversion, more extreme ESG risk and higher project incentive prices in the region of US$4-5 per lb.

Could lack of investment in copper supply slow the pace of the energy transition?

Our analysis paints a picture of an industry able to meet base-case market requirements from base-case capability, highly-probable and off-radar projects until mid-decade. Beyond this period lower-risk possible projects would meet requirements until the mid-2030s. However, the key question is whether these projects will actually get a green light, given that many have been on the drawing boards for years (and in some cases decades).

Meanwhile, under an AET-2 scenario, the stronger demand growth trajectory stresses supply elasticity almost immediately, with deficits ballooning to a potential 6.5 Mt by 2027 as supply fails to meet fast-growing demand. Even allowing for all probable projects to be developed (albeit with delays), supply would be unable to meet AET-2 requirements, thereby becoming a constraint on an accelerated energy transition. This has obvious implications for prices, which could remain in demand destruction territory for long enough to damage the market for copper.

So, how can the industry tackle this looming challenge? Greater availability and use of scrap metal is part of the solution. However, addressing the challenges involved would require a massive policy shift and/or societal change, neither of which would deliver quick results. To paraphrase astronaut Jack Swigert on the Apollo 13 mission, “Houston, we have a problem” — and without decisive action the lack of supply development really could come back to bite the copper industry.

How will the copper Majors tackle the supply challenge — and who are the likely winners and losers in the growth race? Find out more in part two of our copper series.

Get unique insights on metals and mining in your inbox

This article is part of a regular complimentary series exploring opportunities and challenges in the world of metals and mining. Fill in the form at the top of the page to make sure you are notified of new articles in the series as they are published.