Discuss your challenges with our solutions experts

Will sodium-ion battery cells be a game-changer for electric vehicle and energy storage markets?

CATL’s Na-ion batteries could provide a lower-cost alternative to Li-on cells

1 minute read

Le Xu, Senior Research Analyst, APAC Energy Storage Markets and Max Reid, Research Analyst, Battery Raw Materials Service

Top tier battery supplier Contemporary Amperex Technology Co Ltd (CATL) impressed the industry by unveiling its first-generation sodium-ion (Na-ion) battery on 29 July. The new product is designed for the global transportation electrification and energy storage markets, with an expected timeline of mass production targeting 2023.

We explored the potential of Na-ion batteries in a recent insight, CATL’s sodium-ion cells: game changing or window dressing? Visit the store to access the full insight, or read on for a brief introduction

What’s special about sodium-ion cells?

The Na-ion cells are composed of a Prussian white cathode and a hard carbon anode, which looks to reach 160 Wh/kg, near-lithium iron phosphate (LFP) specific energy.

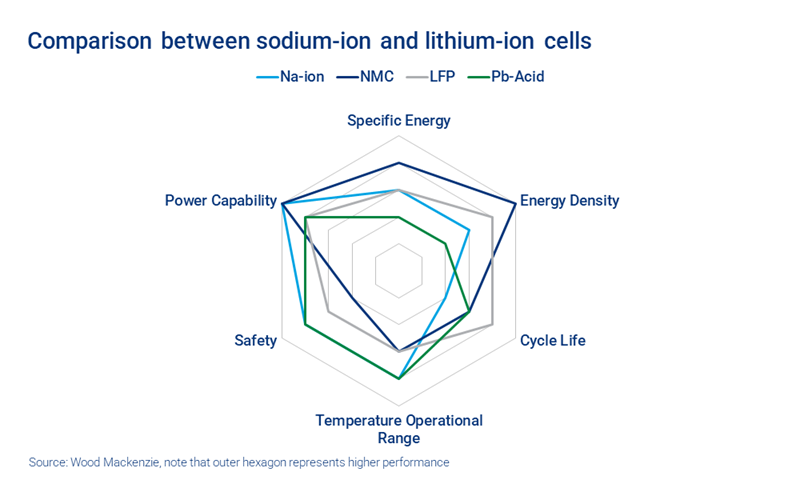

Compared to the extensively-used lithium-ion (Li-ion) cells, Na-ion cells have a lower energy density and cycle life but perform better in a wide operational temperature range and are safer. Na-ion cells have a similar working principle to Li-ion cells and are expected to be at least 20% cheaper than LFP due to their lithium-free nature. However, separator and electrolyte costs could be significant and result in Na-ion being more costly.

By taking advantage of the low-temperature performance of Na-ion cells – 90% of high-capacity retention at -20 °C – and the high energy density performance of Li-ion cells, CATL aims to combine both cells into the same electric vehicle (EV) battery pack as the AB battery pack for better results.

A lower-cost alternative to Li-ion batteries that eases supply chain pressure?

Raw materials play a key part not only in the performance of the batteries but also in costs. Taking LFP and lithium-manganese-cobalt-oxide (NMC) cells as an example, materials represent 30% and 46%, respectively, of battery pack prices.

By comparison, Na-ion cells are expected to be less sensitive to rising material costs from lithium, cobalt and nickel. If all material prices rise 10%, Na-ion material costs will only increase 0.8%, while LFP and NMC 532 costs will increase 3.2% and 4.6%, respectively.

Na-ion material costs are expected to remain stable over the next 10 years. We expect battery pack prices to continuously fall, but not as dramatically as in earlier years due to rising raw material prices. Na-ion batteries, as a lithium-free technology, have the potential to mitigate the supply chain pressure currently falling on LFP and NMC battery cells.

What does the future hold for Na-ion cells?

Compared to the heavy deployment of Li-ion cells in energy storage sectors, portable electronics, EVs and large-scale energy storage, Na-ion cells are still in research for pilot plant-scale production. But things will change driven by the next-generation technology invocation and cost reduction.

Na-ion batteries are expected to replace some of the LFP shares in passenger EVs and energy storage, reaching 20 GWh by 2030. The cost saving is incredible: the production of 1 GWh Na-ion cells will save 41% of the material expense compared with LFP cells.

By 2030, Na-ion cells will drive 82 kt of aluminium, sodium and hard carbon demand, representing a niche market compared to Li-ion batteries.

Fill out the form at the top of the page to talk to an expert, or visit the store to access the full insight.