Sign up today to get the best of our expert insight in your inbox.

Two very different paths to achieve net zero

The WoodMac 1.5 °C scenario compared to the IEA’s NZE

3 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

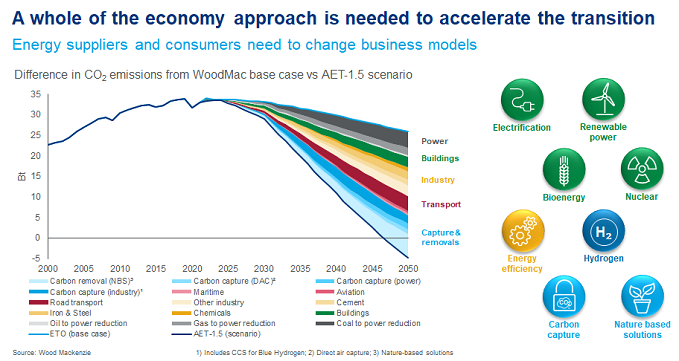

COP27 has been all about getting the world on a path to net zero emissions by 2050. The thing is, there’s no single way to get there – there are many different and difficult choices that governments, producers and consumers will need to make to decarbonise energy consumption and supply. And however bold the ambition, there’s also the question of the pace at which the transition can happen.

That much is evident when we compare the International Energy Agency’s Net Zero Scenario (IEA NZE) published last month with AET-1.5, WoodMac’s accelerated energy transition scenario, published in February. Prakash Sharma VP Energy Transition took me through his thoughts.

Similarities. Generally, there is a strong alignment between the net zero world in 2050 that IEA NZE envisages and AET-1.5. Despite population growth and rising GDP, by 2050 energy consumption will be materially lower than today due to rapid electrification and higher efficiency. AET-1.5 projects 10% lower consumption and the IEA NZE, which is much more bullish on efficiency improvements, 20% lower. Electricity production is three times today’s level in both scenarios, meeting 48% of final energy consumption in AET-1.5.

Wind and solar PV are the biggest winners in a power generation boom. Renewables capacity by 2050 increases 10-fold in AET-1.5 and 15-fold in IEA NZE. Nuclear capacity doubles. Two key emerging technologies, low-carbon hydrogen and carbon capture use and storage (CCUS), grow exponentially from small niches today to play a central role in a net zero compliant energy system by 2050.

Electric vehicles are another measure of the seismic change that achieving net zero will bring about. There were just 17 million electric vehicles on the road in 2021: WoodMac projects 1.7 billion by 2050 (90% of all cars), IEA NZE around 2 billion.

Conversely, fossil fuels’ share of primary energy demand shrinks considerably. Oil demand collapses from just under 100 million b/d today to 33 million b/d in AET-1.5 with IEA NZE lower still. Coal consumption by 2050 is 80% below today’s level in AET-1.5, 90% in IEA NZE.

Differences. We’d highlight three. There’s a much wider spread on natural gas demand than oil or coal. Gas is more resilient in AET-1.5, though still 26% lower than today; but it’s down 70% in IEA NZE.

IEA NZE’s far lower forecast for gas demand assumes that electricity displaces natural gas completely from buildings and transport, while industry consumption falls by more than 80% by 2050. In AET-1.5, we believe full electrification of heating from buildings by 2050 is ambitious, given the requirement for retro-fitting low-carbon alternatives in existing buildings. And, we project, carbon capture combined with gas plays an important role in hard-to-abate sectors and in providing long-duration flexibility in the power sector. Like oil and coal, gas has its decarbonisation challenges but we still think it has a key role in the transition while new technologies scale up.

IEA NZE projects renewables capacity 50% higher by 2050 than AET-1.5. This higher dependence on variable generation will substantially increase the need for energy storage, transmission and micro-grids to manage system resilience and reliability. The market will also need to develop active demand-side flexibility.

Challenges. Investment for one. IEA NZE reckons that spend needs to reach US$4 trillion a year by 2030 to get on a 1.5 °C pathway. We would not disagree, and estimate achieving net zero will require cumulative capex of more than US$60 trillion by 2050. The capital is available, we believe, and the acceleration of policy support in 2022, including REPowerEU and the US Inflation Reduction Act, paves the way for the dollars to flow.

Critical transition metals is another challenge. We have highlighted in AET-1.5 the scale of the supply ramp-up required by 2030 to meet soaring demand for battery raw materials, notably cobalt, lithium (LCE) and graphite, and base metals nickel and copper. Mining companies today are focused on capital discipline and returning surplus cash flow to investors. There appears to be little appetite for developing new large-scale mining projects to supply these critical minerals, many of which have long lead times (7 to 10 years) and are located in difficult ESG jurisdictions.

Delivering the metals for AET-1.5 is hard enough in our view. Building out the additional network and technology infrastructure implied by the IEA NZE’s significantly higher share of variable renewables will be tougher still.

Finally, perhaps the biggest challenge – the pace of transition. IEA NZE’s 2030 target for renewables installation suggests a 5-fold capacity increase for new solar and wind plants, 30-fold expansion in battery storage, and over 1,000-fold increase for new electrolysers. This is a herculean task to design, invest, manufacture and deliver in just eight years.