Upstream M&A and oil price uncertainty

Portfolio repositioning on temporary hold?

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

Will this latest bull run in oil prices trigger a new phase of upstream M&A? The sector is feeling emboldened again – a confidence that’s justified up to a point.

Oil and gas companies cleaned up their own act well before oil prices recovered to today’s lofty levels, reducing the sector’s cash flow breakeven to US$53/bbl.

At US$70/bbl plus, there’s money to spend on organic investment, dividends, buybacks – perhaps even M&A.

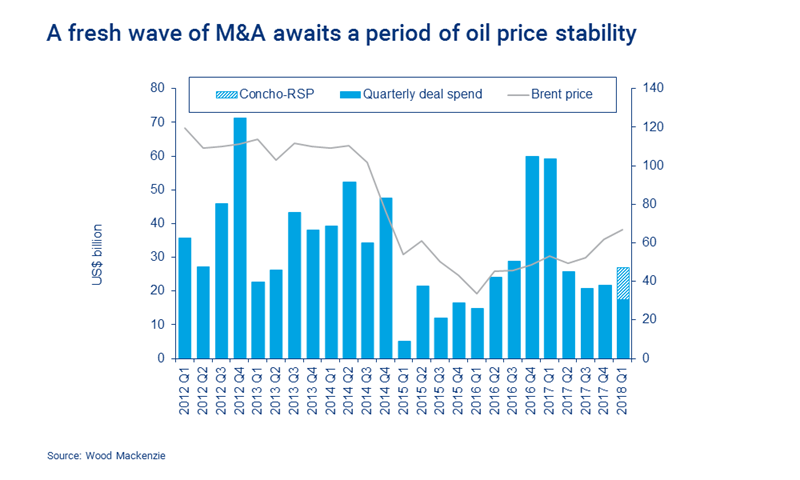

A hiatus in M&A activity followed in the immediate aftermath of the 2014 price crash, reflecting general uncertainty, a lack of finance-ability and disparity on oil price expectations. The bid-ask spread on deals blew out. Buyers wanted assets at the bottom of the market, but sellers wouldn’t sell then unless they absolutely had to.

This kind of environment always stifles transaction activity. The market won’t get going until a settled consensus emerges on future prices, allowing a ‘fair’ valuation of assets that works for both sides.

The bottom of the market was 2015, when 334 deals were transacted globally – down one-third from the three prior years. Total spend that year was US$55 billion, also the lowest for a decade if Shell’s giant acquisition of BG is excluded.

Activity has picked up – the two subsequent years averaged 400 deals, up 20%. Much of the activity has been in the US, but other regions have also experienced a sharp uptick. Spend recovered to US$128 billion in 2016 and US$143 billion in 2017, close to the annual average for the decade.

The rally in oil prices through 2016 was the spark that lit the fuse. Brent rose from US$30/bbl to over US$50/bbl through the year. A moribund M&A market turned into a feeding frenzy.

Companies were trading assets again, strengthening balance sheets weakened by the downturn, and starting the process of adapting portfolios to lower prices. Consensus on price had emerged: companies were in broad alignment around US$60-70/bbl Brent as the range for completing M&A. The bid/ask transaction spread narrowed, and deals started to flow.

Oil prices are once again on a similar upward surge, Brent jumping from US$50/bbl in Q3 2017 to more than US$70/bbl today. But unlike 2016, M&A activity hasn’t yet ratcheted up.

Indeed, Concho Resources’ US$9.5 billion all-equity acquisition of US tight oil player RSP Permian has single-handedly rescued what’s otherwise been a limp start to the year. Two factors are at play.

Firstly, geopolitical events are driving the oil market as much as fundamentals, undermining the consensus view on future prices that’s supported deal making in the last two years. It will take time, and a period of price stability, for a new consensus to emerge and narrow the bid-ask spread.

Secondly, companies are still prioritising returns and cash generation. Growth-focused M&A is on the back burner. The mentality could change if oil market fundamentals tighten decisively and planning prices shift upwards. Meanwhile, we expect the industry to be circumspect.

The argument for sustained M&A activity in the coming years still holds. The higher levels of activity of the last two years are not a blip in our view, more likely the start of a prolonged phase of M&A as companies reposition portfolios for the longer term.

Greig Aitken, Director of M&A Research, reckons it’s about getting lower on the cost curve, adapting for the energy transition, and sustaining the business in an era when exploration is downgraded. Less about getting bigger, more about portfolio focus and sustainability. Companies will look to consolidate advantaged projects, sell non-core assets, and build exposure to new, competitive long-life assets.

The Majors have only just begun the process of high-grading portfolios, and others will follow in their wake. The shakeout will provide ample opportunity for private equity and regional E&Ps to build and grow full-cycle portfolios. Asian NOCs, absent from the M&A market since the downturn, need to avert looming production declines. They could return as a driving force for a new phase of M&A activity.