What should the E&P sector do with a wall of cash?

The siren call to invest

1 minute read

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon Flowers

Chairman, Chief Analyst and author of The Edge

Simon is our Chief Analyst; he provides thought leadership on the trends and innovations shaping the energy industry.

Latest articles by Simon

-

The Edge

Unlocking the potential of white hydrogen

-

The Edge

Is it time for a global climate bank?

-

The Edge

Are voters turning their backs on the EU’s 2030 climate objectives?

-

The Edge

Artificial intelligence and the future of energy

-

The Edge

A window opens for OPEC+ oil

-

The Edge

Why higher tariffs on Chinese EVs are a double-edged sword

The biggest lottery prize of 2018? A contender is the windfall oil and gas companies find drops into their bank account.

Unlike the lucky punter with a winning ticket, the industry has worked hard to get to this position. Three years of brutal re-setting of costs and a re-evaluation of how future business needs to be done set the sector up to reap the benefits of an oil price rally. It’s just come round much earlier than most expected.

Companies began 2018 set fair to cope with low oil prices, repaired balance sheets, tight capital discipline, and free cash flow breakevens averaging US$50/bbl. Things were primed for any price upside to flow straight to margin, and then Brent took off. Upstream cash margins today at US$75/bbl are 65% higher than at the US$112/bbl peak of 2012.

We calculate the cash windfall will be US$160 billion per annum at today’s price.

This is the extra free cash flow generated by the 48 companies in our Corporate Service (Majors, NOCs, Independents) at current investment budgets, post-dividends and interest. The Majors alone will deliver around US$70 billion of additional cash flow.

All good, but what to do with all the money? Aside from stashing it on the balance sheet, Tom Ellacott, Head of Corporate Analysis, thinks there are three main options.

First, give it to shareholders.

Paying out US$160 billion would almost double current dividends, though buy-backs are the most likely vehicle.

Second, M&A.

Access to capital could accelerate the gradual repositioning underway. Majors have begun to focus portfolios around advantaged assets, and other IOCs and NOCs will join in. The flip side is that the rally in oil price opens up the bid-ask spread, making it difficult for buyers and sellers to find alignment on price.

Third, organic investment.

We already expect global E&P budgets to rise by around 10% in 2018, from the lows of 2016/17, before adjusting for any windfall. Most of the increase is in the US Lower 48, which is brimming with low-breakeven tight oil pre-drill inventory. Investors might allow operators to ease up on the tight rein of capital discipline if there’s a compelling value case.

Outside the US Lower 48, the opportunity set is much thinner. The recent uptick in FIDs reflects conservatism as companies seek to build resilience into portfolios.

Domestic gas projects and incremental developments tied back to infrastructure have been typical of new sanctions. Few larger, oil price–sensitive projects meet the tough economic hurdle rates of the present climate, typically 15% IRR at US$50–60/bbl Brent.

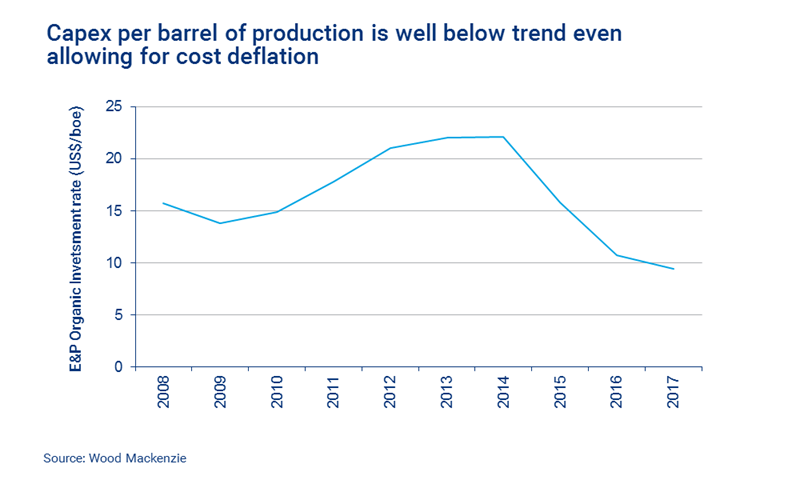

As a result, the industry isn’t spending enough to sustain itself. The investment rate is just US$9 per barrel of production – 55% down on the peak of US$22/bbl in 2013. Lower costs account for around 25% of the drop. This suggests spend is around one-third less than is needed to maintain production; though there is no shame in shrinking if the alternative destroys value.

In the past, a rally in oil prices like this has been a siren call for the industry to launch into a new cycle of investment. This time, it may be different.

Credibility through capital discipline has been hard won, and few will want to give it away easily. The lack of robust investment opportunities is reason enough to justify returning cash to shareholders.

The nagging sense, though, is that companies need to start investing more. It’s one thing to be protected on the downside. But as any fund manager knows, quite another to be under invested when the market goes on a bull run. Few think we’re quite at that point in the oil market, but it probably will happen. And investors will be the first to turn on management if the portfolio is underweight.

Given the uncertainties the sector faces, not least the energy transition, it would be rash in the extreme to commit investment to high-cost projects. But upstream companies do need to beef up the pipeline of future projects that meet two criteria – make money at low prices, and leverage to commodity price upside.