Lower 48 supply: impacts of evolving investor demands

*Please note that this report only includes an Excel data file if this is indicated in "What's included" below

Report summary

Table of contents

-

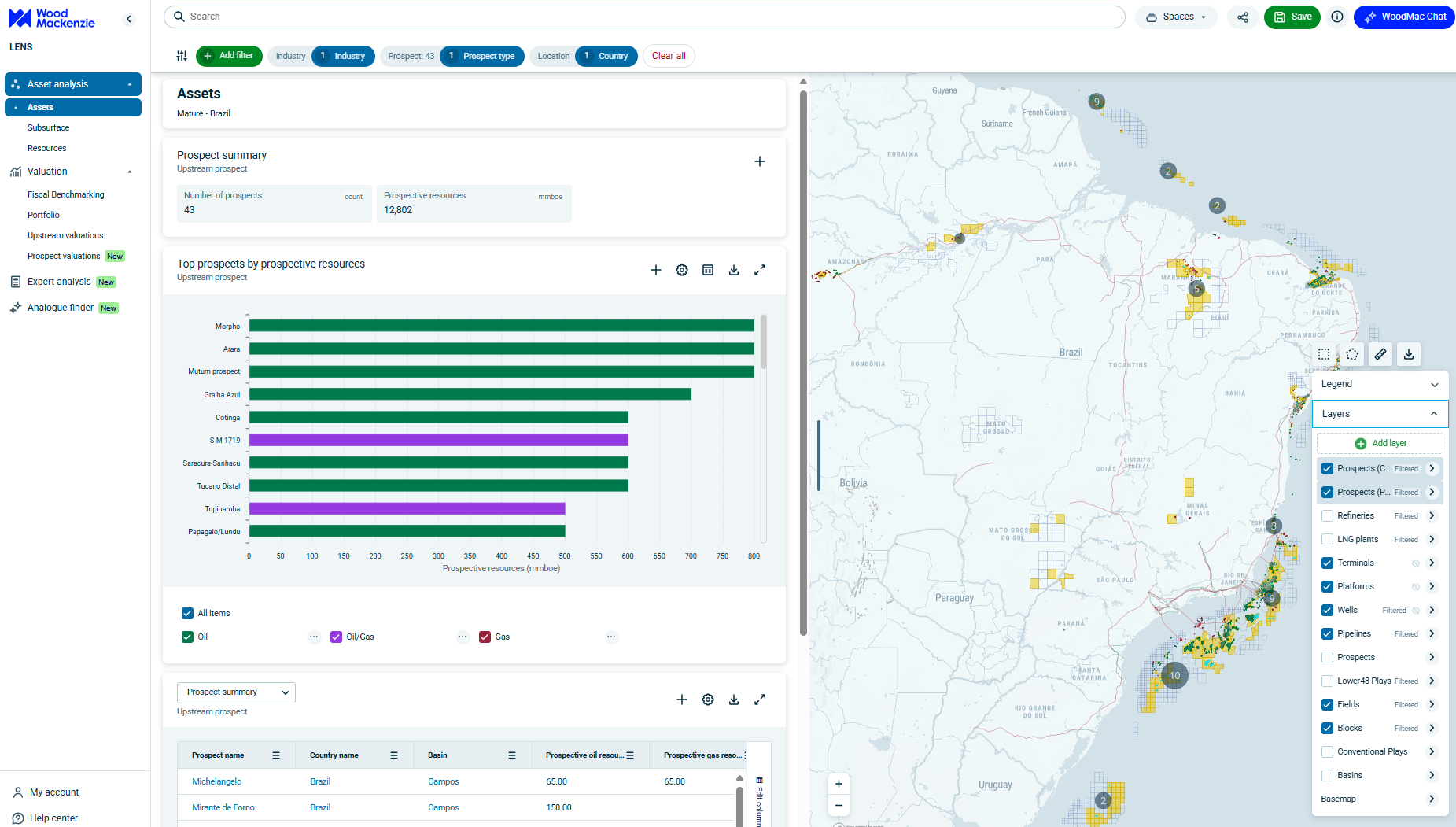

A first time for everything: downward supply revision

- Price is no longer the predominant driver for tight oil supply

- Core inventory is not infinite

-

What changed in our forecast?

- Permian Basin: majors rig up while everyone else rigs down

- Rocky Mountain region: surprisingly resilient

- Eagle Ford & Mid-Continent: rising gas cuts threaten infill locations

- Conclusion: a path forward

Tables and charts

This report includes the following images and tables:

- Regional forecast revision H1 vs H2

What's included

This report contains:

Other reports you may be interested in

Tariff turmoil: how big a cost hit will US oil and gas operators take?

We assess the impact of the Trump administration's 2025 tariff policies on the US upstream oil and gas sector.

$1,350Lower 48 H2 2019 supply: a self-correcting market

The boom years for Lower 48 production growth are behind us.

$1,350Reexamining Lower 48 oil supply elasticity

How much do oil prices need to swing to significantly change US Lower 48 production and activity?

$1,350