Get Ed Crooks' Energy Pulse in your inbox every week

The Biden administration finalises 45V hydrogen tax credit rules

Revisions make it easier for producers to claim higher credits. But economics in the US still favour blue over green

9 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

-

Opinion

How do we adapt to a warming world?

Anyone who has ever rented property knows the feeling. As the end of your lease approaches, there is a scramble to pack and clear up before you leave. The US government has had that feeling over the past few weeks, as the outgoing Biden administration has rushed around trying to address as many of its policy priorities as possible before the new Trump administration takes over on 20 January.

One of the outstanding issues for the old administration was the rules for administering the 45V tax credit for low-carbon hydrogen production, created in the 2022 Inflation Reduction Act (IRA). After repeated delays, the US Treasury finally got around to fixing that last week, publishing a final version of the rules.

The revised guidelines for eligibility for the 45V tax credit include some important differences from the initial proposal, published in December 2023. But they do not change the fundamental outlook for low-carbon hydrogen in the US. Prospects for blue hydrogen, made from natural gas with carbon capture, look significantly better than for green hydrogen, made by electrolysing water using carbon-free power.

Many in the hydrogen industry criticised the proposed rules as excessively restrictive, particularly for green hydrogen. Wood Mackenzie analysis, published in February 2024, concluded that the proposed guidelines “make economics, adoption and deployment challenging for green hydrogen”.

The final version addresses some of those criticisms, while retaining the same basic framework. The IRA created a 10-year tax credit of up to US$3 per kilogramme of hydrogen, varying depending on the full life-cycle emissions from production. The revised rules will make it somewhat easier to earn the higher values of credits.

For green hydrogen, the changes include allowing two more years in which producers can use “annual matching” – covering their electricity consumption with zero-carbon generation over a year – rather than “hourly matching”, requiring it to be covered hour-by-hour. Hourly matching will be required from 2030 instead of from 2028.

Other changes include revisions making it easier to claim higher credits while sourcing power from nuclear plants or fossil fuel plants with carbon capture.

For blue hydrogen, one important change allows the use of more detailed data on methane leakage in the supply chain when calculating life-cycle emissions intensity. In the first proposed version, the emissions intensity of all blue hydrogen projects would have been calculated using a national average leakage rate of 0.9% for upstream and midstream operations. Projects with officially verified data will now be able to use their own specific leakage rates, meaning they can claim higher credits if they cut leakage.

A clarification to the rules should also make it easier for blue hydrogen producers to claim higher credits by sourcing renewable natural gas (RNG). They will not need to use the specific gas molecules from renewable sources as feedstock for their hydrogen plants; they can just book RNG supplies somewhere in their operations.

The Wood Mackenzie view

Although the Treasury has moved to address some of the hydrogen industry’s concerns about the 45V guidance, the changes do not fundamentally reshape the sector’s economics. The extra two years of annual matching, for example, will cut the levelised cost of green hydrogen by less than 5% on average.

“The core of the guidance remains the same,” says Hector Arreola, Wood Mackenzie’s principal analyst for hydrogen and emerging technologies. “If a low-carbon hydrogen project was commercially viable before these revisions, it will still be commercially viable. And if it was not viable, the two extra years are not going to make much difference. Good projects are still good, and bad projects are still bad.”

The economics of low-carbon hydrogen production in the US favour blue over green. The blue hydrogen projects in advanced development and under construction in the US have a total capacity of 3.33 million tons per year (Mtpa). The equivalent total for green hydrogen projects is just 0.35 Mtpa. The revisions to the rules for 45V will not change that position, and if anything will probably be more helpful for blue hydrogen producers than for green.

It will be open to the Trump administration to replace the guidance published last week with its own set of rules. There will also be a push in Congress to cut or abolish all of the tax credits for low-carbon energy in the IRA. In a press conference this week, President-elect Donald Trump again called out what he described as “the ridiculous spending on the Green New Scam”.

However, there is widespread backing for some of the IRA tax credits, including among some Republican politicians and in the oil and gas industry. Support for blue hydrogen, in particular, is one of the incentives that is most likely to be retained under the new administration and Congress.

The more fundamental issue for low-carbon hydrogen in the US is that the tax credits are structured to support production, not consumption. Plans for using low-carbon hydrogen in the US to make low-emissions streel, for example, have been facing challenges. And that outlook seems unlikely to change for the next four years, at least.

That means the most attractive markets are likely to be overseas, in Europe and Asia, with low-carbon hydrogen converted to ammonia for transport. EU member states, Japan and South Korea all have policies to support the use of hydrogen. Although the industry has suffered setbacks in recent months, hydrogen is still central to these countries’ ambitions for deep reductions in emissions.

“The US lost the momentum it had in low-carbon hydrogen, because of the time it took to reach decisions on issues such as eligibility for tax credits. Meanwhile, other countries were moving forward,” says Wood Mackenzie’s Arreola. “But US blue hydrogen projects are still going to be competitive in world markets. Are they going to win that competition? That is still up in the air.”

President-elect Trump promises to clear away new offshore drilling restrictions

In another last-minute move to address a key policy goal, the Biden administration this week announced sweeping new restrictions on offshore oil and gas development in US waters. President Joe Biden issued two memorandums under the Outer Continental Shelf Lands Act of 1953, to prevent any further lease sales off the entire east and west coasts of the continental US, the eastern Gulf of Mexico and additional sections of the northern Bering Sea in Alaska.

The orders cover more than 625 million acres of ocean. Most of that area was already covered by state moratoriums or temporary federal bans on oil and gas development. None of it was included in Wood Mackenzie’s forecasts for future exploration and development so the announcement has no impact on our projections for future US oil and gas production.

However, a legal battle over the restrictions is still likely because they raise questions about the president’s powers that the courts have not yet fully resolved.

The National Ocean Industries Association, which represents companies involved in offshore oil and gas and wind development, condemned the announcement as a politically driven mistake that would hurt energy consumers and national security.

President-elect Trump immediately promised to revoke the orders on day one of his administration.

The legal position is not clear-cut. The Outer Continental Shelf Leasing Act grants the president the power to exclude areas from offshore lease sales but does not specify how a future president can remove those exclusions. Attempts under the first Trump administration to undo restrictions imposed by President Barack Obama faced setbacks in court.

Miles Sasser, a Wood Mackenzie senior research analyst for Upstream, said one route to overturning the restrictions would be through legislation, which could be part of the energy agenda for the new Republican-controlled Congress.

In brief

Devastating wildfires in the greater Los Angeles area have destroyed more than 10,000 homes and killed at least 10 people. Climate change is believed to have increased the risk of wildfires in California, and the state’s governor says he has been ramping up spending on fire prevention and resilience.

More than 4 million customers were without power at one point during the week, as electricity companies shut down parts of the grid to reduce the risk of sparks from power lines and transformers starting more fires.

The state of Pennsylvania has filed a complaint with the Federal Energy Regulatory Commission over soaring capacity prices in the PJM power market, a topic that Wood Mackenzie analysts explored thoroughly last year. Pennsylvania’s complaint argues that the state’s ratepayers face “potentially the largest unjust wealth transfer in the history of US energy markets”. It blames this on unexpectedly strong growth in electricity demand, overloaded queues for projects to be connected to the grid and a compressed schedule for capacity auctions.

Constellation Energy, the largest producer of zero-carbon electricity in the US, is close to a US$30 billion deal to buy Calpine, the country’s largest producer of power from natural gas, according to several news organisations. The deal is being seen as a bet on strong growth in US power demand.

Another aspect of the Biden administration’s final burst of eleventh-hour activity has been its attempt to deploy as much as possible of the funding allocated for grants and loan guarantees for low-carbon energy. The administration’s Loan Programs Office announced this week that it had made a conditional commitment for a guarantee of up to US$1.76 billion for the Willow Rock Energy Storage Center project in California. The project is a compressed air storage system, intended to provide 4000 megawatt hours of energy storage for the southern California grid, with a maximum output of 500 MW.

Other views

Five themes shaping the energy world in 2025 – Simon Flowers and others

Upstream oil & gas: region-by-region predictions for 2025 – Fraser McKay and others

Carbon markets: 5 things to look for in 2025 – Nuomin Han

Eye on the market – Michael Cembalest

Quote of the week

“The only people that want them are the people that are getting rich off windmills, getting massive subsidies from the US government, and it's the most expensive energy there is. It's many, many times more expensive than clean, natural gas. So we're going to try and have a policy where no windmills are being built.”

President-elect Donald Trump, in a press conference this week before he takes office on 20 January, said his goal was to stop installations of new wind turbines in the US.

Chart of the week

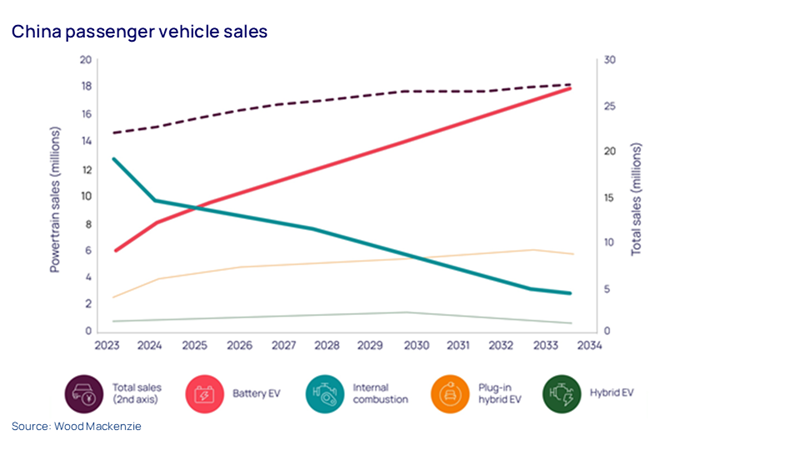

For our last Horizons report of 2024, we compiled five of Wood Mackenzie’s most notable charts of the year, and this one attracted the most interest. It shows sales in China’s passenger car market, broken down by type of powertrain, with data since 2023 and our forecasts out to 2034.

The chart shows just how fast battery electric vehicle (BEV) sales have grown in recent years, and how fast they are expected to grow over the coming decade. There is a good chance that more BEVs than internal combustion engine (ICE) cars will be sold in China this year. By 2034, BEV sales are likely to be several times greater than ICE sales.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.