Get Ed Crooks' Energy Pulse in your inbox every week

US Infrastructure bill bets on breakthrough technologies

The US Congress has voted to spend an extra $550 billion on infrastructure. The bill’s greatest impact on energy could come from its support for hydrogen, carbon capture, and new nuclear

1 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

The Big Beautiful Bill is close to passing

-

Opinion

Ceasefire in the Israel-Iran conflict

-

Opinion

The impact of the Israel-Iran conflict escalation on the global energy market

-

Opinion

EBOS: the unsung hero that’s accelerating clean energy deployment

-

Opinion

What the US attack on Iran’s nuclear installations means for energy

-

Opinion

How do we adapt to a warming world?

J.K. Galbraith famously described the US in the 1950s as having “an atmosphere of private opulence and public squalor” because “public services have failed to keep abreast of private consumption”. That criticism has been heard again increasingly loudly in recent years: from crumbling bridges to dangerous water supplies, the signs of failing national infrastructure have been widespread. In the energy industry, blackouts in Texas and California, and the mounting strains created by the push to cut greenhouse gas emissions, have highlighted concerns about the condition of the electricity grid.

After years of failed attempts, Congress has this month finally passed a bill to address some of those issues. The Infrastructure Investment and Jobs Act, passed with bipartisan support in both the Senate and the House of Representatives, commits to additional spending of about $550 billion over the next five years, for purposes including repairing roads and bridges, replacing lead water pipes, and building out broadband internet networks. President Joe Biden plans to sign it into law at a ceremony on Monday.

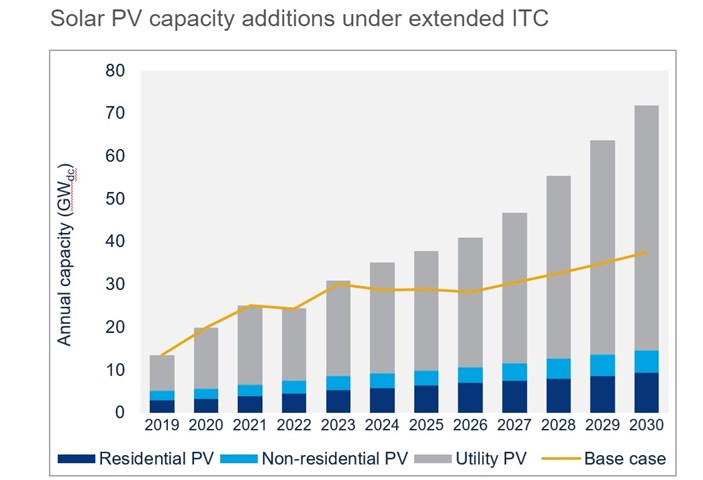

For the energy industry, the infrastructure bill is not as significant as the separate Build Back Better Act, which is still being debated in Congress. That includes proposed expansions and extensions of the tax credits for wind, solar and storage, which could supercharge the growth of those sectors (see ‘Chart of the week’, below). One analysis published by Princeton University’s Zero Lab suggested the impact of the infrastructure act on US greenhouse gas emissions would be minimal. But the just-passed act does include some significant provisions that should help smooth the progress of the energy transition in the US. Crucially, it provides significant support for technologies, including low-carbon hydrogen, carbon capture, use and storage, and nuclear, that are likely be vital for the US in moving towards net-zero emissions over the coming decades.

These are the energy sectors that are the principal focus for support through grants, loans and regulatory changes in the infrastructure bill:

- Power transmission and grid resilience

- US supply chains for battery raw materials and other essential minerals

- Carbon capture, transport, use and storage

- Clean hydrogen, with support including $8 billion for four regional hubs

- New and existing nuclear power plants, with support including $3.2 billion for the advanced reactor demonstration programme announced last year, and a $6 billion credit to support reactors that would not otherwise be economically viable

- Electric vehicle charging infrastructure and electric buses

The implications of the bill for the grid and EV infrastructure were explored by Ben Hertz-Shargel, Wood Mackenzie’s global head of grid edge, in a paper last month. The big winners, he says, will be equipment manufacturers and developers of infrastructure assets, including distributed energy resources, conventional and advanced transmission capacity, and EV chargers. As always when governments try to use spending to stimulate innovation and investment, there are questions over implementation. Federal and state departments and agencies will have to manage the burden of administering the new incentives, and project developers will face the risk of bureaucratic delays. But there are also changes to the legal and regulatory framework that could help expedite projects, including a measure making it easier for the government to designate National Interest Electric Transmission Corridors.

In the long term, however, the most significant provisions in the infrastructure bill may turn out to be the ones providing critical support for nascent technologies that are still at the early stages of commercial deployment, but could have a big impact on the US energy system in the 2030s and beyond. The limitations of wind and solar power, and of today’s standard lithium ion battery technology for energy storage, mean that an electricity system that with net zero emissions is likely to need increased supplies of clean firm power. There are also many uses of energy that are difficult to electrify, including some high-emitting industrial processes, and those will probably need alternative carbon-free options.

There is a range of different technologies that could meet those needs, and ultimately all of them are likely to have some role to play. The infrastructure bill commits billions of dollars and regulatory changes to accelerate deployment of three in particular: hydrogen, carbon capture and advanced nuclear. The implications were described in more detail in a note this week by David Brown, Wood Mackenzie’s head of markets and transitions for the Americas. It is clear that the supports put in place by the infrastructure bill have some important omissions and drawbacks, including “buy American” provisions that are likely to drive up costs. The proposed Build Back Better Act includes additional mechanisms to reward investment in carbon capture and hydrogen, and those industries really need that kick-start to accelerate growth.

Even so, the measures already passed by Congress in the infrastructure bill will have a significant impact. The prospects for projects including clusters for producing low-carbon hydrogen, pipeline infrastructure for transporting carbon dioxide, and small modular reactors now look much brighter. It is also important that the bill has passed with support from both Democrats and Republicans in both the Senate and the House. Party control of Congress and the White House can be expected to change hands many times before 2050, which is when President Biden hopes the US will be a net-zero economy. Policy measures with bipartisan support stand the best chance of remaining resilient to changes in the political prevailing wind, and hence of offering more predictability to investors.

President Biden under pressure over fuel prices

While President Biden is celebrating the passage of legislation that could have its biggest impact on the US energy system in the 2030s, many Americans have a more immediate concern: the cost of gasoline. At an average of $3.29 for a gallon of Regular, retail gasoline prices are at their highest since 2014. A popular image circulating on social media shows a spoof gas station display with prices for three grades of fuel: Regular, an arm, Plus, a leg, and Super, your soul.

High rates of car ownership in the US mean that for people on low incomes, fuel costs can take a large share of their total spending. In 2019 the lowest-income tenth of US households were spending an average of 15% of their household after-tax income on gasoline, according to JPMorgan. The precise number may be open to debate over data quality issues, but the general point is unarguable: fuel is a very important expenditure for lower-income Americans, and when gasoline prices rise, they suffer.

There are already signs that rising gasoline prices are hurting President Biden politically. A poll for the Associated Press published last week found that just 35% of Americans agreed that they would call the national economy “good”, while 65% said it was “poor”.

In response, President Biden and members of his administration have been attempting to pin the blame on the OPEC+ countries for not increasing crude production more rapidly. They have been urging Saudi Arabia, Russia and other countries to ramp up output faster, so far without any success.

This week a group of Democratic senators, led by Jack Reed from Rhode Island, pitched in, writing a letter to President Biden urging him to “consider all tools available at your disposal to lower US gasoline prices”. Those tools, the senators said, included a release of oil from the Strategic Petroleum Reserve, and a ban on US crude oil exports.

A crude oil export ban has next to no impact on the gasoline price at the pump in the US, if refined products can be freely exported. That was proved as was proved when such a ban was in effect up to the end of 2015. But the mere fact that US senators have mentioned it is a sign that there is mounting pressure on the administration to be seen to be doing something about gasoline prices, however ineffective.

Headlines from COP26’s second week

Week Two of COP26 in Glasgow was always lined up as the time for the hard negotiating, with most of the world leaders gone and media attention diminished. Most of the headline-grabbing international pledges were launched in the first week, and the second week has been more about the detail of implementation.

The most significant announcement was a joint statement from the US and China that was described as “a surprise climate agreement”. The main pledges simply reiterated previously stated goals, but there was more detail on plans for the two countries to co-operate on cutting emissions. For example, the two countries will have a working group on “enhancing climate action in the 2020s,” which will “meet regularly to address the climate crisis… focusing on enhancing concrete actions in this decade”. Specific areas for co-operation included carbon capture, including direct air capture, “circular economy” techniques, and strategies for cutting methane emissions.

Ford, General Motors, Mercedes-Benz and Volvo are among the car manufacturers that signed on to a declaration on accelerating the transition to zero-emissions vehicles. The manufacturers say they will “work towards reaching 100% zero emission new car and van sales in leading markets by 2035 or earlier”. However, four of the world’s five largest manufacturers — Volkswagen, Toyota, the Renault-Nissan alliance, and Hyundai-Kia — did not sign the declaration.

The key outstanding issues include countries’ emissions goals and how they plan to achieve them, and above all the question of how global decarbonisation can be paid for. Next week I will take a look at how those issues were resolved, or weren’t.

In brief

General Electric, the manufacturing conglomerate that is one of the world’s largest suppliers of equipment to the power industry, including gas turbines and wind turbines, is breaking itself up. The company will split into three: a healthcare equipment business, an aero engine business, and a renewables, power and digital company, which chief executive Larry Culp said would be “positioned to lead the energy transition”. Culp has argued that the supposed benefits of synergies between those three divisions were “illusory”, and said the breakup “will allow these businesses to relentlessly prioritise where they can add the most value”.

The Wall Street Journal had an interesting angle on GE’s strategy, suggesting that the decision to split the aero engines division off as a separate standalone business was a bet on a “flying revival”, a prospect that also of course has implications for jet fuel demand.

France will start a programme to build new nuclear power plants “for the first time in decades”, President Emmanuel Macron has pledged. He said the new reactors were needed “to guarantee France's energy independence, to guarantee our country's electricity supply and achieve our objectives, in particular carbon neutrality in 2050.”

Continental Resources has entered the Permian Basin by buying Pioneer Natural Resources’ Delaware Basin assets for US$3.25 billion in cash.

And finally: a piece of industrial history at the end of an era. The break-up of GE will dissolve the long-standing link, rooted in technological similarities, between its gas turbine business and its jet engine business. GE started building the first US jet engine in 1941, using a design from Britain's Sir Frank Whittle, and powered the US Army Air Corps' first operational jet fighter, the Lockheed P-80 Shooting Star, which entered service in 1945.

At around the same time, GE was also developing the first gas turbine used for power generation in the US. With some of the pressure to accelerate progress in aero engines taken off by the end of World War II, GE was able to build a 3.5-megawatt gas turbine for power generation, which entered service in 1949 at the Belle Isle power station in Oklahoma City. That turbine can still be seen at the GE plant in Greenville, South Carolina. While the logic of the breakup may be sound, it is still a poignant moment in US industrial history for that that 70-year relationship between jet engines and gas turbines at GE to be coming to an end.

Other views

Simon Flowers — Africa’s energy challenge

Juzel Lloyd — The costs of mining

Adam Tooze — Ecological Leninism

Kristen Panerali — Why the electric revolution needs to be about much more than cars

Alejandro De La Garza — The engineer who made electric vehicles palatable for the pickup truck set

John Kemp — Seasonal weakness could take some heat out of oil prices

Gillian Tett — What I got wrong about nuclear power

Quote of the week

“To stay below the targets set in the Paris Agreement, and thereby minimise the risks of setting off irreversible chain reactions beyond human control, we need immediate, drastic, annual emission cuts unlike anything the world has ever seen. And as we don’t have the technological solutions that alone will do anything even close to that, that means we will have to fundamentally change our society. And this is the uncomfortable result of our leaders’ repeated failure to address this crisis.” — At a march in Glasgow outside the COP26 climate talks, the Swedish climate activist Greta Thunberg argued that the conference had been “a failure” and a “greenwash festival”, because it had failed to acknowledge the need for radical global social change.

Chart of the week

This comes from recent analysis by Wood Mackenzie’s Michelle Davis and her colleagues on our solar team. It shows projected installations of new solar generation capacity in the US in two scenarios: Wood Mackenzie’s base case forecast (the yellow line), and a scenario assuming an extension of the Investment Tax Credit for solar gets passed into law (the bars). New solar installations have been growing rapidly in the US, but if the tax credit extensions do not pass, we expect the annual rate of capacity additions to level off for a while, before picking up later in the decade. If the extended tax credits are passed by Congress, however, then we would expect continued strong growth through the 2020s, with utility-scale solar in particular benefitting from an investment boom.