Get Ed Crooks' Energy Pulse in your inbox every week

Solar import duties highlight the challenges in building up US manufacturing

Module assembly has boomed in the US. Onshoring solar cell production is harder

8 minute read

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed Crooks

Vice Chair Americas and host of Energy Gang podcast

Ed examines the forces shaping the energy industry globally.

Latest articles by Ed

-

Opinion

A solution to the problem of paying for data centre power?

-

Opinion

The US oil industry is consolidating as growth slows

-

Opinion

Energy storage steps up

-

Opinion

How the US power system coped with the threat from Winter Storm Fern

-

Opinion

International buyers find value in US gas assets

-

Opinion

The Trump administration moves to curb rising US electricity bills

It has been another busy week for US tariffs. Conflicting signals from the Trump administration have left the outlook for tariffs unclear but raised hopes in the financial markets that an all-out trade war can be averted.

The S&P 500 index opened on Friday morning 6% above its close on Monday night, and only 7% below its level at the start of the year.

The US and China have remained at loggerheads, apparently unable to agree even on whether or not trade negotiations have been taking place. A Chinese official said on Thursday: "China and the United States have not held consultations or negotiations on the tariff issue, let alone reached an agreement.” But President Donald Trump said later the same day that there had been a meeting between the two countries that morning, although he declined to specify which officials had been involved.

Amid all this confusion, there was at least one clear statement on tariffs from the US government this week, relating to imports of solar equipment.

The Department of Commerce announced final proposed new duty rates on solar cell imports from Vietnam, Thailand, Malaysia and Cambodia. The duties are intended to offset the effects of government subsidies and dumping by manufacturers based in those countries.

The duty rates vary from company to company, but average about 34% for producers in Malaysia, 375% for Thailand, 396% for Vietnam and 692% for Cambodia.

The US International Trade Commission (ITC), a separate independent non-partisan agency, now has until 2 June to decide whether US solar manufacturers have been harmed by the subsidies and dumping. If it rules that they have, then the proposed duties will come into effect.

The duties result from investigations launched under the Biden administration but align well with President Trump’s tariff strategy.

The Department of Commerce statement made clear that although it is producers in Vietnam, Thailand, Malaysia and Cambodia that will face the duties, the action is really a blow in a proxy trade war against China. The US alleges that companies operating in those other countries have been receiving subsidies from China, giving them an unfair and illegal competitive advantage in the US market.

Howard Lutnick, US Secretary of Commerce, said his department was “holding China accountable for its transnational subsidies through other countries that harm American industry”.

The Wood Mackenzie view

The solar supply chain is an instructive test case that illustrates the challenges of using tariffs to build up US manufacturing capacity. To some degree, it has already been a success story, but going further will be increasingly difficult. And some of the progress that has been made is now at risk.

Thanks to previous rounds of tariffs and the tax credits in the 2022 Inflation Reduction Act (IRA), particularly the 45X credit for domestic manufacturing of components and materials for low-carbon energy, solar module manufacturing capacity has boomed in the US.

Today, the US has capacity to produce about 50 gigawatts of solar modules a year, Wood Mackenzie data show. That would have been enough to supply the entire US market last year and probably again this year.

However, most of that capacity is used to assemble imported cells into modules. The US has the capacity to manufacture only about 2 GW of cells per year.

The implicit objective of the new round of tariffs on imported cells is to support more investment in cell manufacturing in the US. But a domestic solar cell industry cannot be conjured up overnight.

“Making cells is more difficult than making modules,” says Elissa Pierce, Wood Mackenzie’s research analyst for solar module technology and markets. “Permitting is complicated. The process is water- and energy-intensive, and the waste water has to be disposed of carefully. It all needs a lot of expertise.”

Wood Mackenzie is forecasting that US annual cell manufacturing capacity will reach only about 8 GW by the end of the year. That means the majority of cells for the US market will still have to be imported.

While the latest round of new import duties may help encourage investment in US solar cell manufacturing, other features of the policy environment will not. Uncertainty over US tariff rates makes it difficult to form stable views on any investment plan. And the threats to the IRA tax credits make it particularly hard to have clarity on the viability of low-carbon energy projects.

Members of Congress return from recess next week, with negotiations on a tax and spending bill at the top of their agenda. The Republican majority in Congress aims to extend tax cuts that were first passed in 2017, make some additional cuts and increase military spending, while limiting the increase in government borrowing. To do that, they will have to make savings elsewhere, and the IRA tax credits for low-carbon energy are a tempting target.

Speaking at Wood Mackenzie’s Solar and Energy Storage Summit this week, Abby Ross Hopper, chief executive of the Solar Energy Industries Association, said that although she believed that a complete solar supply chain would be built in the US over time, the uncertain outlook for the tax credits was for now an obstacle to investment.

“Obviously, there's more uncertainty now. And the uncertainty is not just the 45X, that advanced manufacturing tax credit. It is also: is there going to be a demand for my product?” she said, in a conversation for Energy Gang podcast that will be published next week. “So the supply and the demand signals both are uncertain.”

In brief

India and Saudi Arabia agreed to deepen their cooperation in energy across a range of sectors, including oil, LPG, refining, renewables and green hydrogen. The announcement of enhanced cooperation came after India’s Prime Minister Narendra Modi met Crown Prince Mohammed bin Salman of Saudi Arabia in Jeddah on Tuesday.

Energy was also high on the agenda when US Vice President JD Vance met Prime Minister Modi in New Delhi this week. Vice President Vance said he believed India would benefit from increased US LNG exports. He also said the US was ready to help India explore its natural resources, including offshore natural gas and critical minerals, and to develop its nuclear power industry.

Prime Minister Modi’s visit to Saudi Arabia was cut short following an attack on tourists in Kashmir that killed 26 people. It was India’s deadliest terrorist violence since 2008. After the attack, India announced that it would suspend the 1960 Indus Waters Treaty with Pakistan until its neighbour “credibly and irrevocably abjures its support for cross-border terrorism". The treaty, which regulates how water from the Indus River is shared between the two countries, is seen as critical for hydro power generation in Pakistan.

Tesla reported a 21% fall in revenue from car sales and a 71% drop in net income for the first quarter of 2025. The company warned that “as a result of rapidly evolving trade policy, uncertainty in the automotive and energy markets continues to increase, posing risks to our global supply chain and cost structure, which could have a meaningfully adverse impact on demand for our products and our profitability”.

Other views

US energy dominance faces long-term challenges

North America gas strategic planning outlook: A glimpse into 2050 – Dulles Wang

Four key carbon policy developments from Q1 2025 – Nuomin Han and Stephen Vogado

US residential solar turbulence persisted through 2024 – Zoë Gaston

Quote of the week

“Since I announced China's goals for carbon peaking and carbon neutrality five years ago, we have built the world's largest and fastest-growing renewable energy system as well as the largest and most complete new energy industrial chain… However the world may change, China will not slow down its climate actions, will not reduce its support for international cooperation, and will not cease its efforts to build a community with a shared future for mankind.”

China’s President Xi Jinping gave his first speech focused on climate and the energy transition for several years. He highlighted China’s progress in developing its low-carbon energy industries, and urged other countries to “do their utmost” to formulate and implement plans for emissions reductions before the COP30 climate talks in Brazil in November.

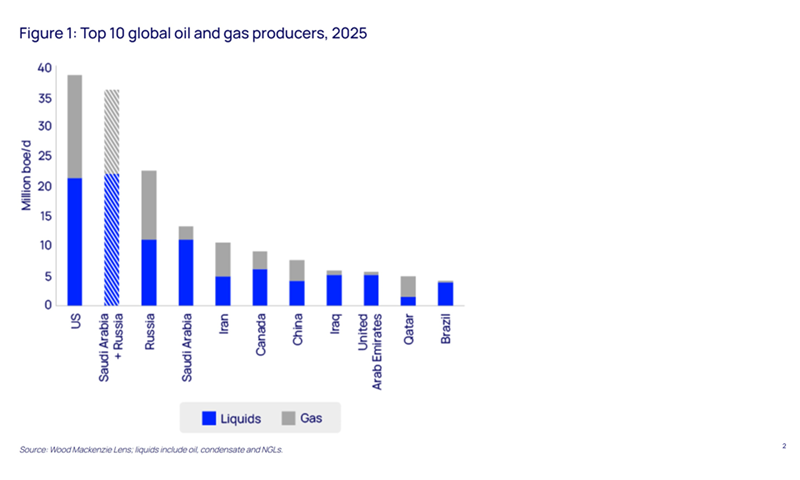

Chart of the week

This comes from a new Horizons report that I co-wrote with Robert Clarke, Wood Mackenzie’s head of US onshore upstream research. The report is about the Trump administration’s often-used buzz-phrase “energy dominance”: we explore what the concept means, how far the US already has it and the prospects for the US maintaining that dominance in the future.

This is a very straightforward chart, but still an eye-opening one. US hydrocarbon production has been so strong – its output of oil, gas and natural gas liquids is now greater than that of Saudi Arabia and Russia combined. For a lot more on what that means, and what it implies for the future of energy worldwide, check out the full report: ‘ Tough at the top: the threats to US energy dominance’.

Get The Inside Track

Ed Crooks’ Energy Pulse is featured in our weekly newsletter, alongside more news and views from our global energy and natural resources experts. Sign up today via the form at the top of the page to ensure you don’t miss a thing.